Wall Street is a financial epicenter where some of the most powerful institutions in the world trade. There are many ways to make money, from stocks and commodities to real property and weather. The Wall Street people are responsible for fueling the American economy.

Wall Street traders may be a good choice if your career goals include investment management and finance. The job is lucrative and comes with numerous benefits, such as a 401K or health insurance. Plus, the market is constantly moving, making it an exciting, high-paced, and rewarding profession.

You must have a basic understanding about the stock exchange to be able to trade. Although this knowledge is essential, it will not be sufficient. You also need to know the basics of economics and math. Although traders usually have a degree, some trades can be taught by themselves. It is important to do your research thoroughly before you rush to make a decision.

You must be willing to work at minimum 50 hours per week in order to pursue a career as Wall Street traders. It is also necessary to meet sales quotas regularly. Your earnings will be a combination of your salary and the value of your company's stocks and other investments.

There are many reasons to trade Wall Street, but the main reason is to make money. An investor might ask that you purchase 500 shares of a specific stock at $35 per piece. If you make impulse purchases, it is easy to blow your account. However, a good trader will have a strategy for minimizing this risk.

A Wall Street floor broker is one of the most rewarding jobs in the financial sector. While the job can be difficult, it is also rewarding. These people read the newspaper, answer the phones and use the Bloomberg terminal.

There are many other career options on Wall Street. Many Wall Street mover and shakers work in brokerage offices, where they act as intermediaries between clients or floor brokers. Their primary function is to relay orders from clients to floor brokers. A floor broker is responsible for completing an order when a client calls.

A Wall Street trader may also have to make sales recommendations and meet with clients. They might also need to analyze the financial markets. A great thing about working on the trading floors is the possibility of having minority employees.

Wall Street traders are well-known for their longstanding existence. They are skilled at trading a variety of techniques. The most popular is the "look" request. This basically means that you can find the current stock price. This information can be used by the floor trader for buying or selling shares.

FAQ

Where can i invest and earn daily?

Although investing can be a great investment, it's important that you know your options. There are many options.

One option is to invest in real property. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which is better, safe crypto or Forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Is Cryptocurrency an Investment Worth It?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which trading platform is best?

Choosing the best trading platform can be a daunting task for many traders. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. These factors will help you narrow down your search to find the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Frequently Asked Question

What are the different types of investing you can do?

Investing can help you grow your wealth and make money long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be broken down into common stock or preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Can one get rich trading Cryptocurrencies or forex?

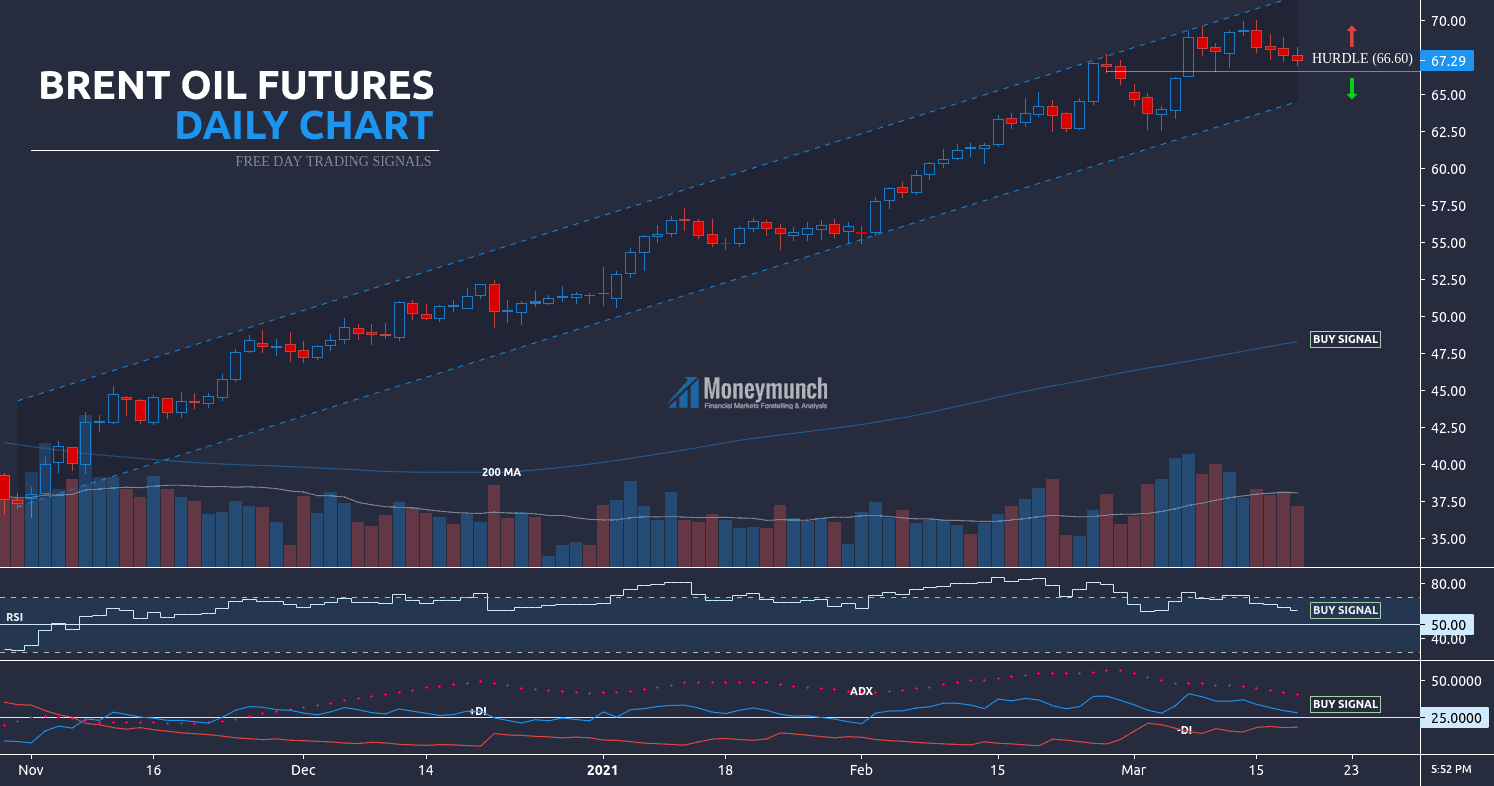

Trading forex and crypto can be lucrative if you are strategic. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Knowing how to spot price patterns can help you predict where the market will go. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

Online investing requires research. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Also, be aware of any restrictions or industry regulations that may apply to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Know the risks associated with your investment and the terms and conditions. Before you open an account, check what fees and commissions might be taxed. Do your due diligence and make sure you get what you pay for. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.