Stock charts can be an invaluable tool for traders. They provide an abundance of information about the market, including peak levels and key entry and departure points. These charts can also be used to help you decide when to sell or buy. You need reliable stock charting software to help you analyze your stocks, and trade them effectively. Read on to learn about some of the top options available.

Sierra Chart provides a wide range of analysis and charting tools. It's a versatile piece of software that can generate a wide variety of visualizations. From simple OHLC charts to complicated mountain and candlestick maps, it is very flexible. Sierra Chart has the ability to detect trendlines, Fibonacci patterns, as well as automated indicators. The company also provides a variety of chart overlays, including charts on DOM execution windows, and it can be used in a variety of chart layouts.

The Market Screener is another software tool that can be used to help with trading. This feature allows you to set up a screening strategy with a number of templates, from a basic screen to a more sophisticated method. You can even customize your view to highlight certain securities. But the true strength of this software is its ability scanning the entire stock market to display crucial trading information in a simplified and user-friendly manner.

ChartNexus also provides a useful tool, automatically plotting key price levels for your stock. You can also set up your own templates, and download up five years worth of historical data.

A Trading Magnet, an automated indicator is also available on this platform. This indicator will help you identify potential buy and sell signals. The indicator can scan through many symbols to identify the most suitable price triggers.

You will also find an advanced scouting system and a customizable interface. If you are looking for a robust charting solution with premium features, DXcharts is a good option.

Interactive Brokers also offers the Multichart trading platform. You can choose from 15 layouts to best suit your style of trading. You can, for example, display four charts simultaneously, synchronize crosshairs, and synchronize intervals or drawings. You will need the appropriate symbols to use this feature.

Finally, the YChart tool is a comprehensive and complete tool for communicating your investment strategy. It can also help your clients understand what your investment plans are. This software will allow you to generate visuals and market analysis, as well as educate your prospects. Its powerful tools and customizable options allow you to make informed investment decisions and build a strong portfolio.

You must ultimately decide which stock charts software you want. Your needs as well as your budget will influence the best stock charting software for you.

FAQ

How can I invest Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You just need the right knowledge, tools, and resources to get started.

The first thing to understand is that there are different ways of investing. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. Keep an eye on market developments and news to stay current with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Can forex traders make any money?

Forex traders can make good money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading is not an easy task, but it can be done with the right knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Which is safe crypto or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

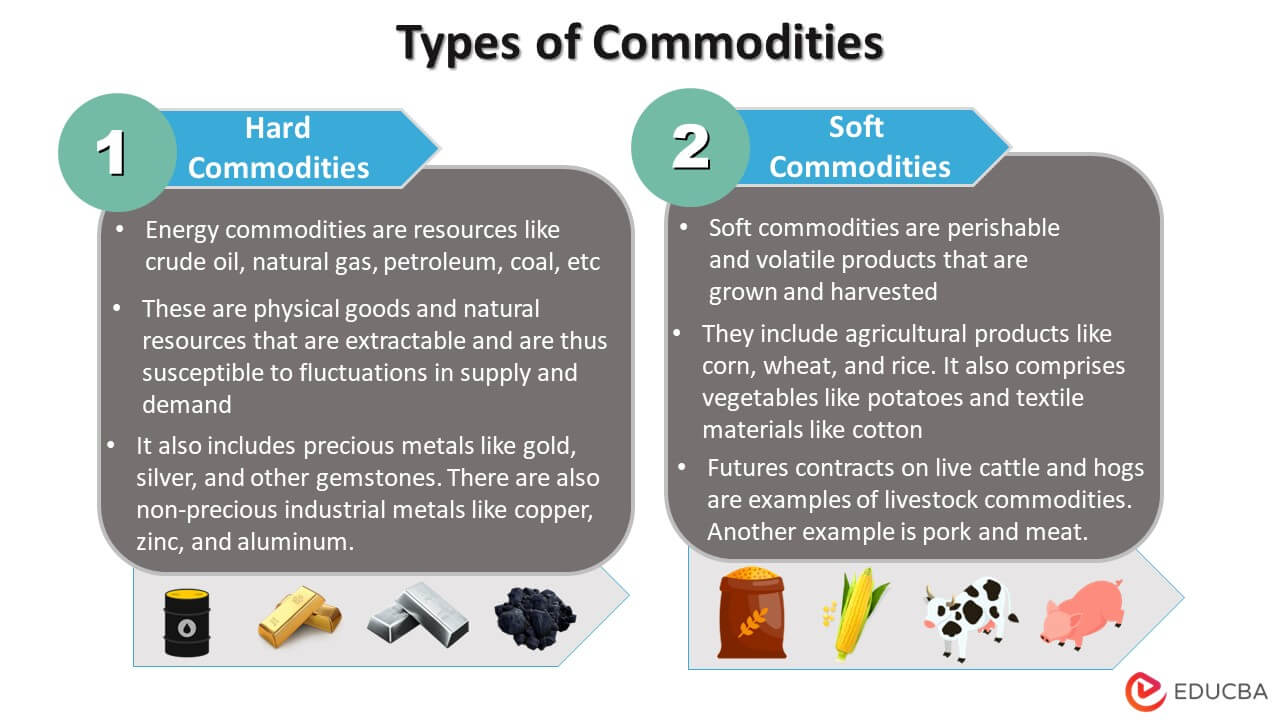

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Which trading site for beginners is the best?

It all depends upon your comfort level in online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Which is more difficult, forex or crypto?

Forex and crypto both have unique levels of complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Where can you invest and make daily income?

However, investing can be an excellent way to make money. It's important to know all of your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

You can also invest in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

What precautions can I take to avoid investment scams online?

Protection starts with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Do not answer unsolicited emails and phone calls. Fraudsters are known to use fake names. Do not respond to unsolicited emails or phone calls. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Lastly, always remember "Scammers will try anything to get your personal information". Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

It's also important to use secure online investment platforms. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Secure Socket Layer (SSL) encryption technology is recommended to protect your data over the internet. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.