There are many aspects to consider when choosing a futures brokers. Choose a platform that offers a wide range of assets and provides accurate price updates. In addition, you should also be sure to check whether the platform is regulated. This will ensure you are able to trade safely and securely.

Many traders will have no interest in products offered by a broker. However, choosing a good broker is crucial for any trader. A broker should offer a broad range of securities and trading platforms. They also need to have a customer service team that is knowledgeable. Even if your experience is minimal, a broker can help you get the best out of your investment.

If you are just starting out in the world of trading, it is important to find a broker that has a great selection of markets and a quality platform. They also need to have a reliable and secure website. Also, you should consider any fees associated with trading. You should also consider any trading fees.

Many top futures brokerages offer multiple features. One example is a free virtual trading platform that allows you practice with fake money prior to opening a trading account. A few brokers allow you to download a free demo of their platform before you commit.

You can also trade on precious metals and foodstuffs. You can trade on a variety of assets with brokers like XTB and Optimus Futures. All of them offer excellent trading platforms and some even provide a demo account. You can also use their apps to help you keep track of your trades.

It is difficult to find a good futures brokerage, especially if it is your first time on the market. It is important to review the terms of your service contract before you make any decisions. Also, you should be aware that there are a variety of different fees associated with trading futures, including commissions, exchange fees, and non-trading fees. The smallest of these fees is the National Futures Association fee. The National Futures Association fee will generally be charged through your trading account. Please refer to the pricing schedule.

In conclusion, you'll be better off choosing a regulated futures broker if you're a serious trader. The regulations and standards that are required by regulated companies ensure that your investments remain safe and secure. Non-regulated brokers, on the other hand will not be held to the same high standards.

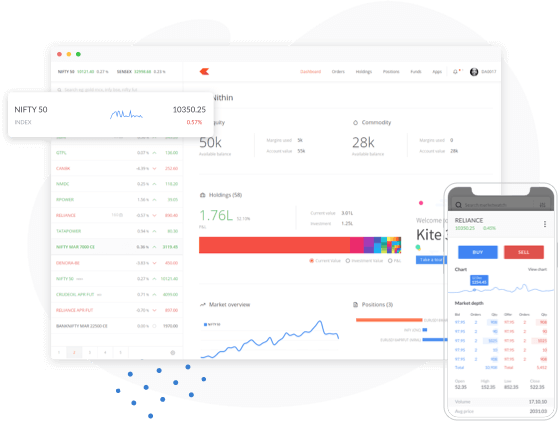

A trading platform is one of many highlights of a professional futures broker. Depending on the size and type of your account you will have access multiple platforms. To find a platform that suits your needs, you'll want to look for a platform that includes a free demo account and offers a large number of features. An integrated platform will offer tools to help you understand and research your trades. This includes price alerts and research tools.

FAQ

Forex traders can make money

Yes, forex traders are able to make money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which trading site is best for beginners?

It all depends on how comfortable you are with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many offer interactive tools to help you understand how trades work.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

What are the benefits and drawbacks of investing online?

Online investing offers convenience as its main benefit. You can access your investments online from any location with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing comes with its own set of disadvantages. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

You should also be aware of the different investment options available to you when investing online. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment comes with its own risks. You should research all options before you decide on the right one. Some investments may also require a minimum investment or other restrictions.

Which is best forex trading or crypto trading?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases, it's important to do your research before making any investments. With any type or trading, it is important to manage your risk with proper diversification.

Understanding the various trading strategies for different types of trading is important. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Where can I invest and earn daily?

Although investing can be a great investment, it's important that you know your options. There are other ways to make money than investing in the stock market.

One option is to buy real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Trading forex or Cryptocurrencies can make you rich.

If you have a strategy, it is possible to make a lot of money trading forex and crypto. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I ensure the security of my online investment account?

Online investment accounts must be secure. It's vital that you protect your data, assets and information from unwelcome intrusion.

You must first ensure that the platform you're using has security. Look for encryption technology, two-factor authentication, and other security measures that will provide maximum protection against potential hackers or malicious actors. There should also be a policy that outlines how any personal information you have shared with them will be regulated and monitored.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. Finally, review your account activities periodically so that you are aware of any changes or irregularities in order to detect potential threats quickly and take immediate action if necessary.

It is important to be familiar with the terms and conditions of any online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. Review and rate the platform and see what other users think. Finally, you should be aware of tax implications for investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.