The Best Blockchain Stocks to Buy Now

There's plenty of opportunity for investors in a world that is increasingly embracing blockchain technology. However, before you put your hard-earned cash into any new investment, it's important to understand exactly what you're purchasing.

The best blockchain stocks include companies that have a solid business model and use blockchain technology to drive growth. While some companies in this sector are well-established, they are best positioned to reap the long-term boom. Others will struggle to make it big.

International Business Machines - NYSE:IBM

IBM is an iconic name in the computing industry, and its blockchain enterprise is a great place to start if you're looking for a company that's already tapped into the potential of the new technology. The company has been working with clients to develop blockchain applications such as supply chain management or health care records.

Mastercard Incorporated

One of the leading companies in the blockchain space, Mastercard Incorporated offers a platform that helps companies secure and streamline their business-to-business transactions and trade finance. The company also has a robust blockchain API that lets you easily integrate your business processes into a blockchain system.

Taiwan Semiconductor Corporation

This semiconductor manufacturer is a leading player in high-performance chips. It also has many applications for blockchain technology. Its chips are efficient and highly scalable. ASICs are a popular choice for miners who need chips that are more powerful and reliable than their competition.

Coinbase Global, Inc

Coinbase, a cryptocurrency trading and storage company, is one of today's most sought-after stocks. Although the stock suffered a bit recently as digital asset prices have plummeted in recent times, the firm should experience strong gains if there is a recovery in the blockchain market.

With a user base close to 90 million, it is a major player on the cryptocurrency market. Coinbase Exchange is home to over 10,000 cryptocurrencies.

Robinhood Markets, Inc

Robinhood Markets provides a popular stock trading platform. However, Robinhood Markets also offers trading for cryptocurrencies and digital currencies. The company is growing rapidly in the crypto space and its user base has increased significantly over the last few months.

eToro, LLC

eToro, the largest online brokerage that specializes in crypto and forex, is a great place to invest in cryptocurrency without having to pay commission fees. It's also a safe and secure place to store your cryptocurrency wealth, and you can build an eToro Money Crypto Wallet for free.

Metacade

Metacade token offers a game-based rewards program and is uniquely positioned to bring you big benefits. This token is a relatively recent launch. It has not yet experienced the law that diminishes returns. This means it has huge upside potential.

Riot Blockchain

Riot Blockchain (Nasdaq : RIOT) is a company that offers bitcoin mining. This company is focusing on mining and intends to be the largest and lowest-cost producer of the cryptocurrency in the United States. It has a solid reputation in the industry, and a highly regarded management team.

FAQ

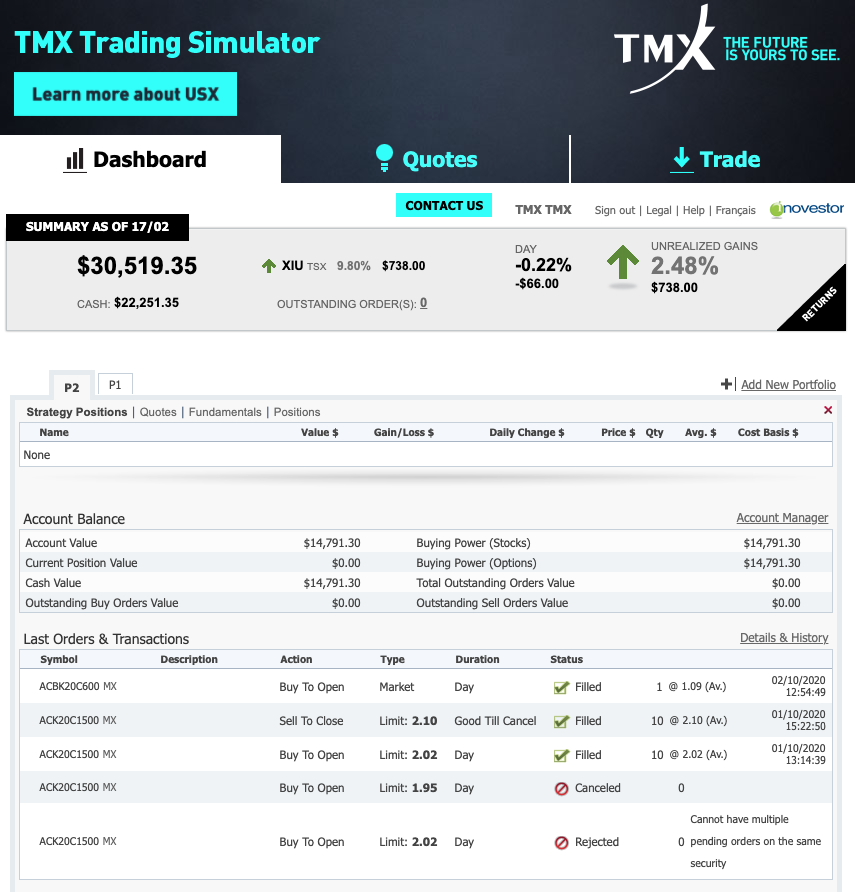

Which trading website is best for beginners

It all depends on your level of comfort with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Which is harder forex or crypto?

Both forex and crypto have their own levels of complexity and difficulty. Crypto is more complex because it is newer and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

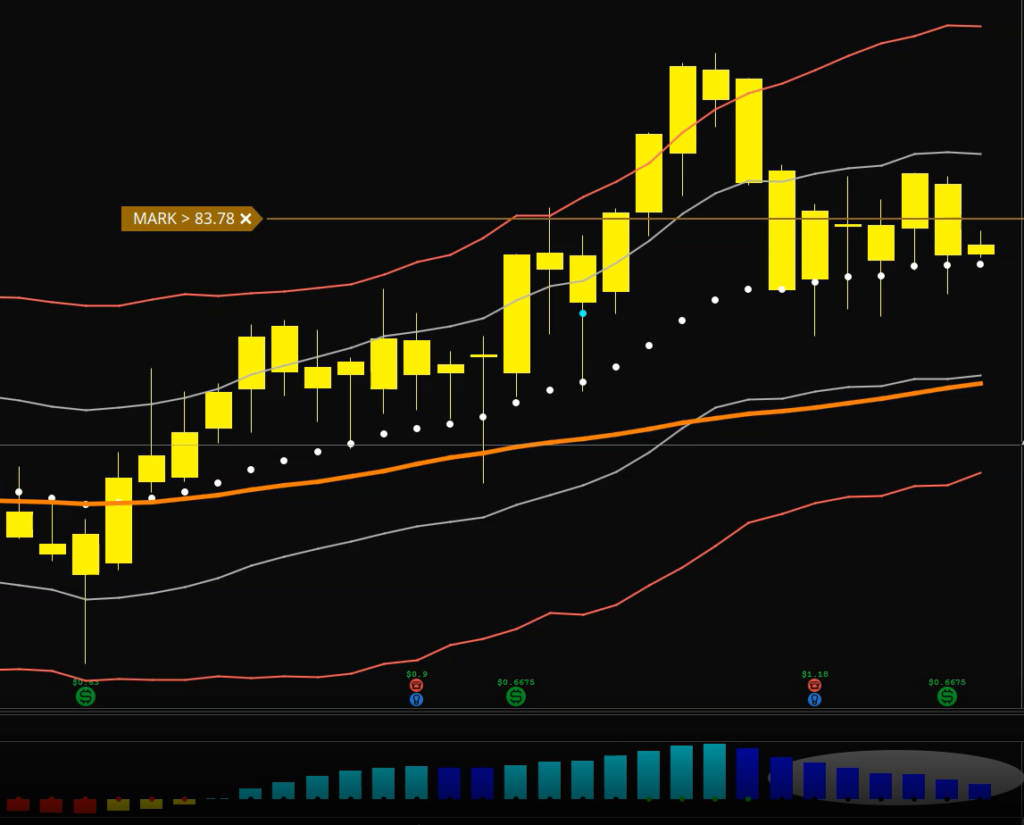

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

What is the best forex trading system or crypto trading system?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases it's crucial to do your research before making any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important that you understand the different trading strategies available for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

How can I invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You just need the right knowledge, tools, and resources to get started.

It is important to realize that there are several ways to invest. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Which is safer, cryptography or forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Where can I find ways to earn daily, and invest?

However, investing can be an excellent way to make money. It's important to know all of your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

Real estate is another option. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

When you invest online, it is crucial to do your homework. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Know the risks associated with your investment and the terms and conditions. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.