Binance Futures Signals, a service designed to help traders trade in crypto markets, is now available. This team provides technical analysis and signals that provide insight into the market's behavior. They can also help users determine the best time to sell or buy the assets.

This service features a variety of features to make cryptocurrency trading fun and rewarding. In addition to the signals, traders can also access educational content and leverage to increase profits. Traders can opt to pay a one-time fee, or subscribe to a monthly, quarterly, or yearly subscription.

The binance team's futures signals team offers signals which can be used to assist traders in deciding when to enter a long or short position. These signals are reliable at different levels. Signals should be followed carefully by traders. For example, it is important to avoid investing too much capital on a single trade. Traders should use stop-loss measures to protect themselves from losses.

There are many services and features offered by signal providers, but not all are the same. When searching for a signal provider, it is important to consider the frequency of the signal, the number and price of the subscription. It is a good idea to find a service provider that offers reliable customer support.

Although there are no guarantees, there's a way to pick a reliable crypto signal provider. You should look out for a large number of signal providers, reliable support systems, and the ability of trading on paper before you actually move forward with a live account. You can also get discounts from signal providers for an annual subscription.

Binance Futures Signals special subscriptions, for example, include the signals of ten top signal team members. Each team has its own expertise and a combination of these signals can provide you with a comprehensive package. You can also choose to work with a specific algorithm or team. You will get the most out of your investment, regardless of its specifics. If you are able to understand how it works, you will be able to maximize its value.

Depending on how much capital is available, you may choose to invest in a single or multiple coins. Binance's futures platform supports many coins and tokens, including Litecoin (ETH), Chainlink, USDT, USDT, and Bitcoin Cash. Using Binance futures signals can help you make informed decisions about which coins to invest in.

Your trading plan can be made or broken by choosing the right crypto trading signal. You need to choose a signal that is reliable, consistent, provides high-quality information, and is reliable throughout the day. Moreover, you should look for a provider that offers a reasonable price, multiple subscription options, and is well-organized.

It all depends on the market and your risk tolerance. Generally, the average number of signals per month can range from about five to thirty. You will get at most one signal per day from a top-notch provider.

FAQ

Trading forex or Cryptocurrencies can make you rich.

Trading forex and crypto can be lucrative if you are strategic. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which trading platform is the best for beginners?

It all depends on your level of comfort with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many offer interactive tools to help you understand how trades work.

You can also trade independently if your knowledge is good enough. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which is more difficult forex or crypto currency?

Forex and crypto both have unique levels of complexity. Crypto is more complex because it is newer and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Where can i invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. There are many other investment options available.

One option is to invest in real property. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

What are the disadvantages and advantages of online investing?

Online investing is convenient. You can manage your investments online, from anywhere you have an internet connection. Access real-time market data, and make trades online without leaving your office or home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing is not without its challenges. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important for online investors to be aware of all the investment options. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Statistics

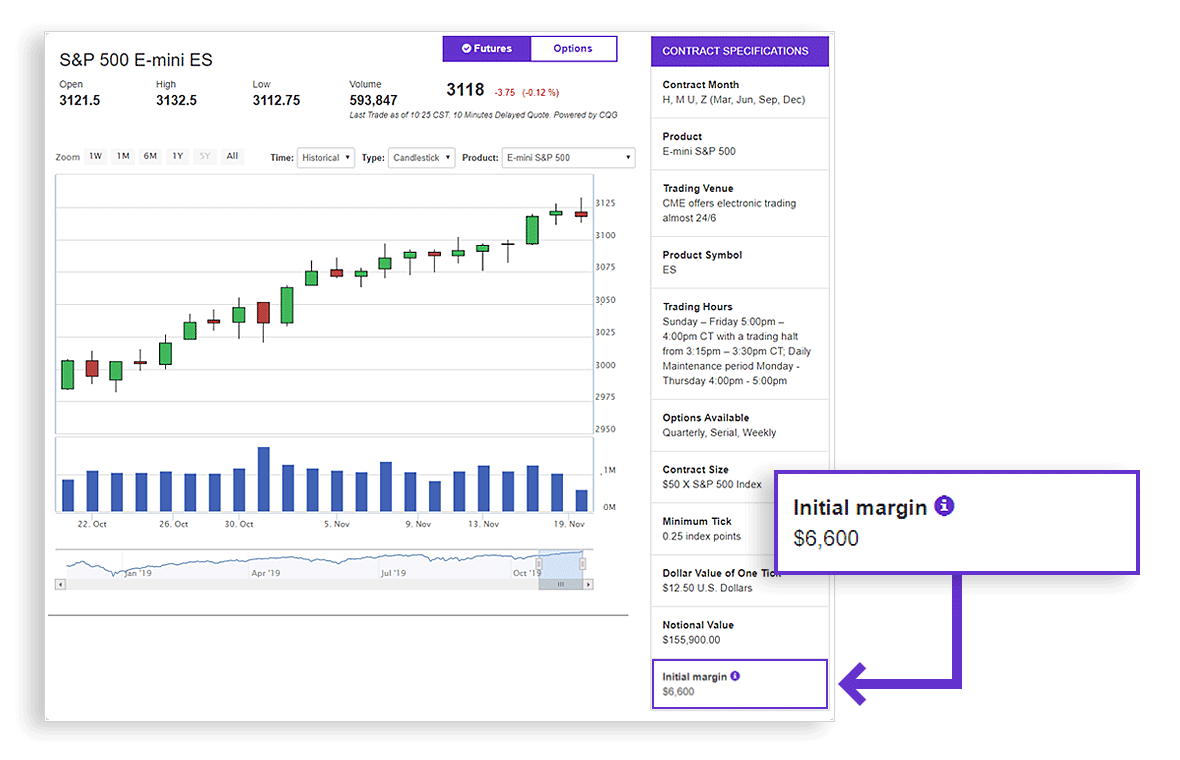

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I protect my personal and financial information when investing online?

Online investing is a risky venture. Protecting your financial and personal information online is essential.

You must be mindful of who your investment platform or app is dealing with. You want to work with a company that has positive customer reviews and ratings. Before you transfer funds or provide any personal information, it is important to check the background of each company or individual that you are considering.

Strong passwords and two factor authentication are recommended for all accounts. Regularly scan your devices for viruses. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. Avoid phishing attacks by not clicking on links from unknown senders and never downloading attachments unless they are familiar to you. Also, ensure that you double-check the website's security certificate before you submit any personal information.

To ensure only trustworthy individuals have access to your finances, delete all bank applications from outdated devices. Also, change passwords every few months. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. Last but not least, make sure to use VPNs when investing online. They're often free and easy!