S corporations can be described as domestic businesses that are owned by US citizens. They must fulfill a number requirements. They must not have more than one hundred owners, be restricted in their ownership to trusts and LLCs, and be registered in the United States.

They have many advantages that LLCs do not, but they also have their disadvantages. S corps have one major disadvantage. They are not treated in a similar way by state governments. Additionally, the IRS may audit a business owner who claims all income from distributions to shareholders. There is also a chance that the IRS will reclassify some of the distributions as salary. This practice is discouraged by the IRS.

S corporations also allow their owners to be paid as employees. This is possible because they have an elective status. If the owner of the company is considered an employee, the payroll taxes will be paid by the S corporation. However, the S corporation will pay the employer's payroll taxes. The owner will report income on his personal income tax return. An S-corp owner can also deduct auto mileage expense and home office taxes.

An S corp must keep accurate records and inform the IRS about its income and loss. Its board and officers supervise the daily operations of its corporation. An S corp, unlike an LLC, must hold shareholder meetings. These meetings are typically held to discuss major decisions, like the purchase and hiring of executive directors.

S corporations have fewer operating requirements than other organizations but must still comply with the laws of their home state. They must also keep a corporate record, and the minutes of corporate meetings. Based on the corporate structure, permits, licenses, registrations must be applied for and received.

The Internal Revenue Service pays special attention S corps. The IRS requires that all corporations file a Form 2553. This information can be used to calculate both the federal and state tax due on the corporation's earnings. Aside from the information required by the IRS, a corporation must also make an election to receive S corp tax treatment.

If an S Corporation is profitable, it may be possible to distribute some of its earnings to shareholders by way of dividends. Shareholders will be subject to personal income tax on any dividends received. An S corporation, unlike an LLC can only issue common stock. This can make it difficult to raise capital.

As a result, S corps are generally categorized as pass-through entities. S corporations have income and losses that are reported on the individual's tax return. Therefore, every corporation should have a solid system for payroll. ADP is a reliable service that can manage small businesses' payroll.

The 60/40 rule, an informal rule, divides a corporation’s income into 60% of its salary (and 40% of its shareholder distributions). While it is not approved by IRS, the 60/40 rule helps an S corporation owner determine a reasonable income.

FAQ

Forex traders can make money

Yes, forex traders can earn money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which trading website is best for beginners

It all depends on your level of comfort with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers provide interactive tools to show you how trades function without risking any money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Frequently Asked Questions

What are the different types of investing you can do?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. It is important to trade only with money you can afford to lose.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

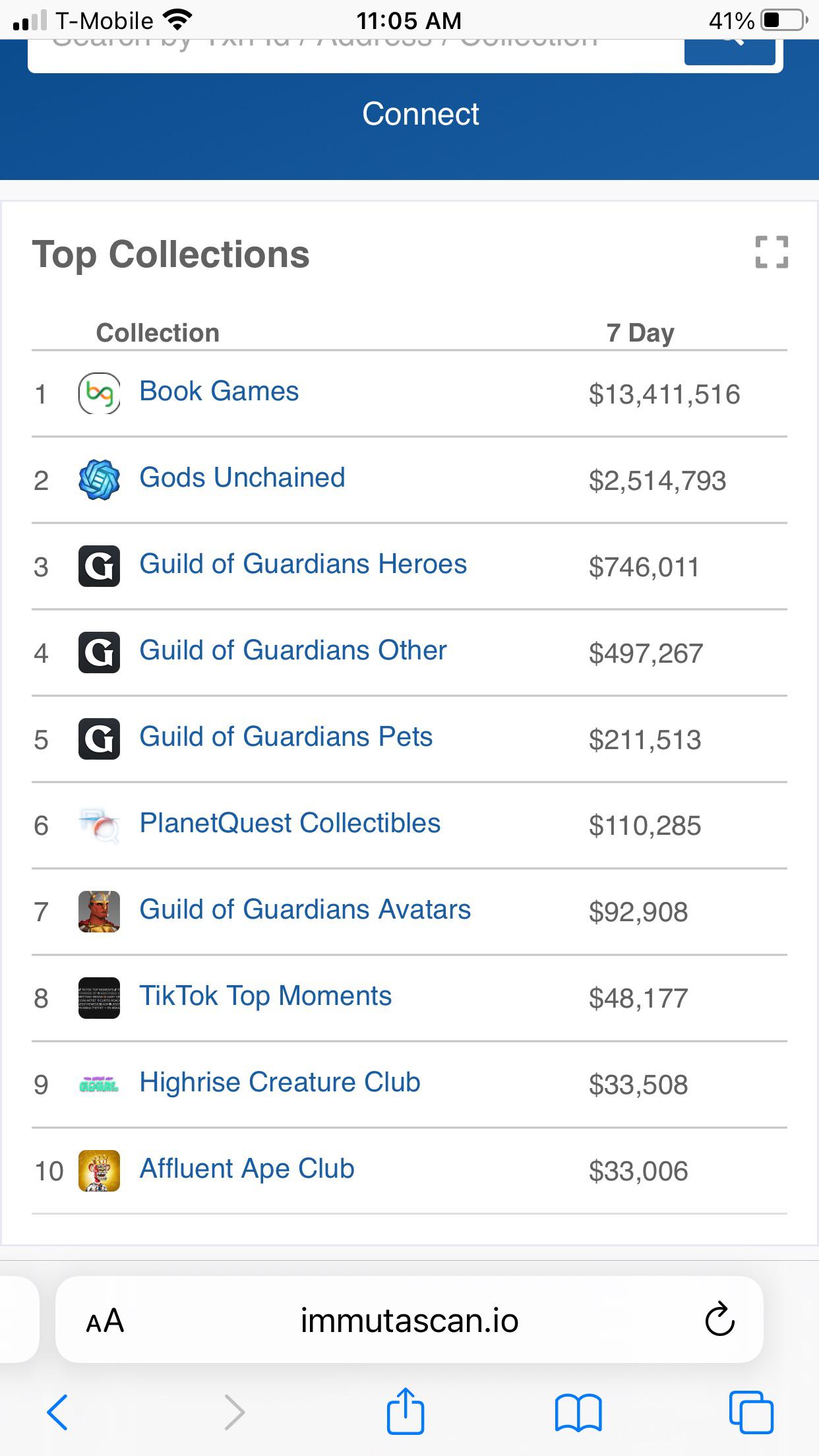

Is Cryptocurrency Good for Investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

Online investing requires research. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. You should also be alert for industry restrictions and regulations that might apply to your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. Ask yourself if it's too good to be true and beware of claims that imply a guarantee of future results or substantial returns.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Do your due diligence and make sure you get what you pay for. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.