Options trading is another option to be exposed to the stock markets. You can buy and sell an option contract, which is based upon a security like a stock or index, at a certain price for a particular period. The contract outlines the essential terms of the trade, including details such as the strike price and expiration date.

What is an Options Contract?

A written option contract between a seller or buyer gives the buyer the right, at a predetermined price, the strike price, to purchase or sell an underlying asset until a date known as the expiration. The strike price is a fixed sum, which is often less than current market prices for the underlying asset.

How does an option contract work?

A call is the most basic option. It gives the buyer the right of buying the underlying asset at the agreed strike price. The strike price for the underlying asset can be set in advance. A premium is paid upfront by the call buyer.

The call buyer will make a profit when the strike price for the underlying security exceeds the expiration date. This is calculated by dividing the difference between the market price of the underlying asset and the option strike price, divided by the premium paid for the option.

A put option gives the buyer the right to sell the underlying asset at the strike price, but not the obligation to do so. The buyer of a put option loses all his investment if the strike value of the underlying assets falls below that price. The premium paid to purchase the option will limit the buyer's losses.

How much does an option contract cost?

A call option costs $2 per contract, which includes the strike price and the expiration date. The investor also pays a cash premium for the right to buy the underlying securities at the specified strike price until the option expires.

An investor can purchase one, two or more contracts with different prices and expiration dates. Investors are more likely to lose money if they buy more contracts.

What are the Benefits of an Option Contract?

Option contracts are often used as leverage by investors. This leverage allows investors to multiply their gains by borrowing against their position, rather than having to pay full price for the underlying assets. It can also cause bigger losses than you expected.

How can an Options contract make me a profit?

The biggest advantage of options is that you can use leverage to increase your profits. Option contracts can also serve as insurance against market movements, which you do not control.

Options are often used by traders to hedge against risks. Options can be used as a hedge against risk, protecting traders from losing their investment in case of an unanticipated event, such an earthquake, or simply because markets are volatile. In addition, they offer a potential to earn an additional income through dividends or capital gains taxes.

FAQ

Which forex trading platform or crypto trading platform is the best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading is easier than investing in foreign currencies upfront.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

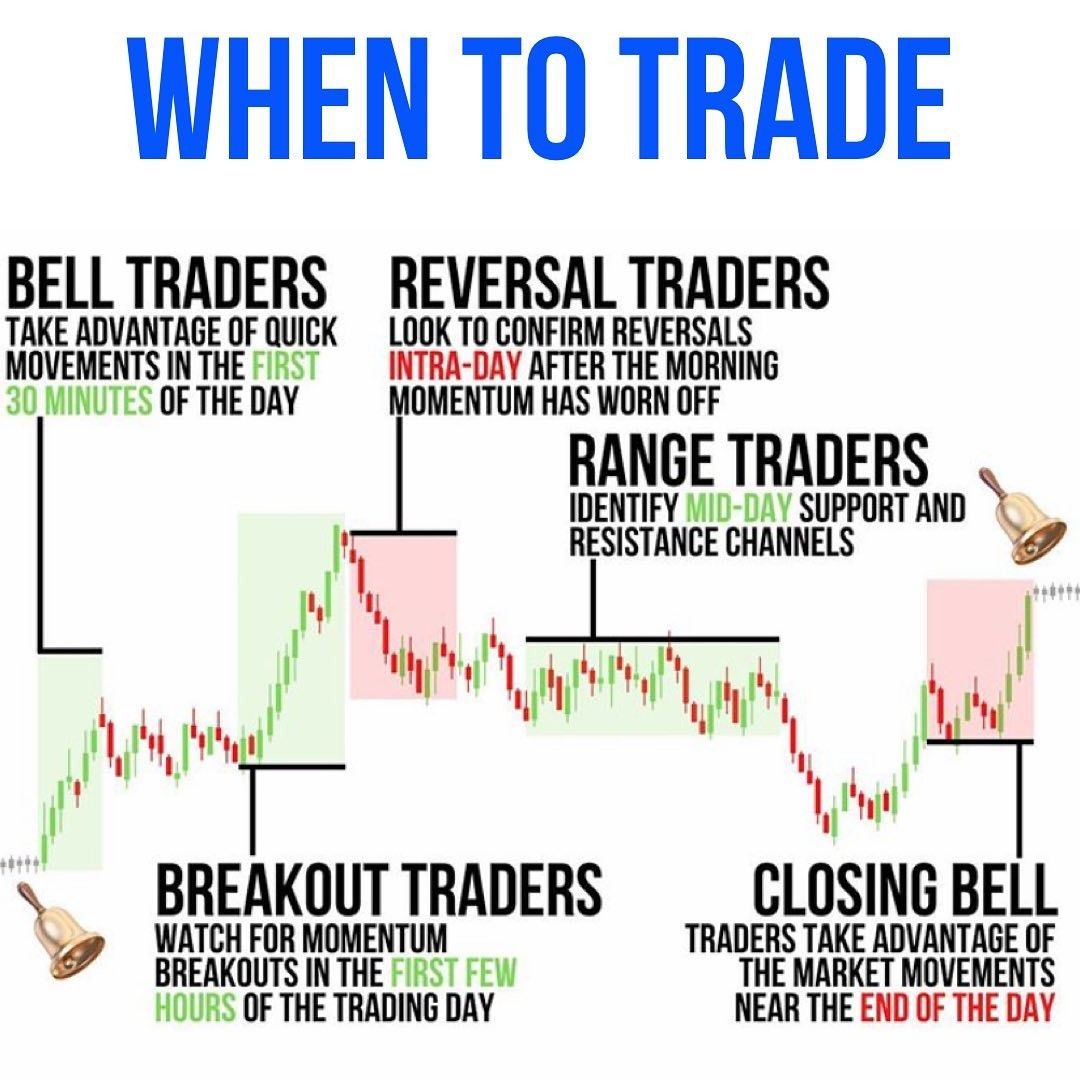

It is important to be familiar with the various types of trading strategies that are available for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Where can I find ways to earn daily, and invest?

Although investing can be a great investment, it's important that you know your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

Real estate is another option. Investing in property can provide steady returns with long-term appreciation and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

What are the benefits and drawbacks of investing online?

Online investing has the main advantage of being convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing is not without its challenges. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many choices: stocks, bonds or mutual funds. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Is Cryptocurrency a Good Investment?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

How do I invest in Bitcoin

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You only need the right information and tools to get started.

First, you need to know that there are many ways to invest. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

Next, gather any additional information to help you feel confident about your investment decision. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Which is harder forex or crypto?

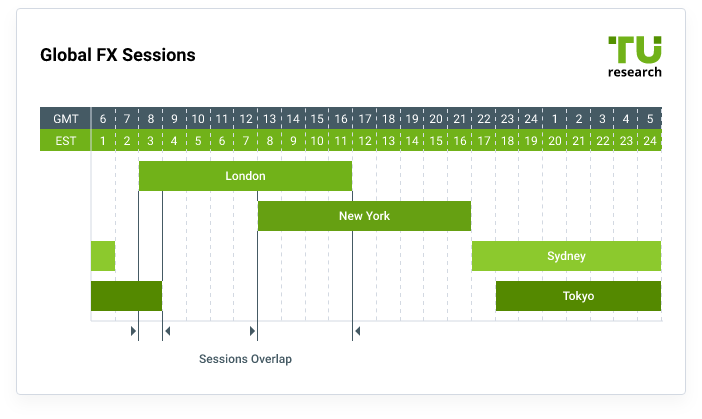

Each currency and crypto are different in their difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

Is it safe to store my investment assets online, or should I consider other options?

While money can be confusing, the decision to where it should be stored can be just as complex. You have several options when it comes to protecting your valuable assets.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

You can also keep your investments in traditional bank or investing accounts. There are also self-storage options that allow you safe storage of gold, silver, and other valuables, outside your home.

You may also want to consider specialized investment firms offering secure custody services that are specifically designed to protect large asset portfolios.

Ultimately the decision is yours--what works best for you and provides the security and safety necessary to protect your investments?