Moomoo has a brokerage firm that specializes only in stock trading. It offers a number of features to make it easy to invest. The company offers US stock trading without commission and extended trading hours. A mobile app is available for the platform, which allows you to trade stocks from your smartphone. In addition, the app provides live market data and financial news.

Moomoo, a member of Securities Investor Protection Corporation is insuring customer funds upto $500,000. Moomoo is a registered brokerage-dealer with FINRA and the United States Securities and Exchange Commission. It takes just five minutes to open a new account. For registration, you will need to provide your Social Security numbers, a valid email address, as well as a password.

Moomoo offers a wide variety of services, including realtime trading, a mobile application, and advanced charting. Access to Shanghai Stock Exchange, Shenzhen Stock Exchange, Hong Kong Stock Exchange are all available through Moomoo. This platform is an excellent option for investors who don't have the time or desire to monitor the markets.

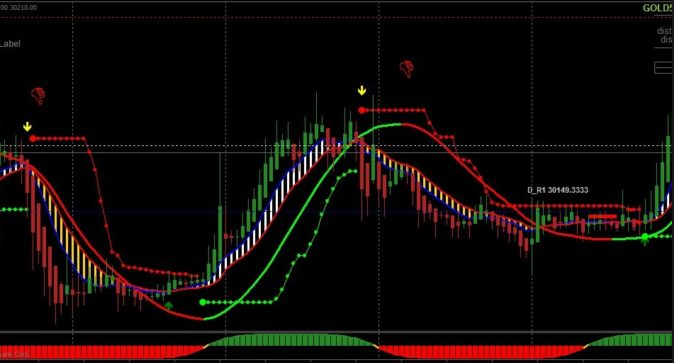

Moomoo offers individual margin accounts in addition to its comprehensive charting service. Customers can purchase and sell stocks and ADRs as well as REITs. Customers can place up to 40 orders simultaneously. A market monitor powered by AI provides regular updates to users on prices. Using a variety of technical indicators, Moomoo lets its users watch the markets in real-time, which means they'll be able to spot price fluctuations before they happen.

Moomoo provides a broad range of services as well as competitively priced fees. There is no minimum balance required or monthly fee. Moomoo also offers a 180-day commission free trade promotion. In addition, the brokerage charges only 6.8% on all debit levels for U.S. stocks, and 2.2% for China A.shares.

Users also have unlimited access and can set up custom alerts. The app can be used to track prices, receive updates and communicate with traders. You can also find investing tips on the company's blog.

Moomoo is a reliable and legitimate brokerage. Its trading platform has been designed to accommodate investors of all levels. It is the preferred choice of many investors worldwide. But, it's important to keep in mind that any type of investment has the risk of loss. Before you invest, do your research.

Moomoo's terms and condition are essential if you wish to trade with it. This will allow you to determine which option is best for your needs. Keep in mind that you cannot foresee the market's direction and that trading is always risky.

Moomoo has a live chat available 24 hours a days if you need assistance. It is also available via email during US trading times.

FAQ

Can forex traders make any money?

Forex traders can make good money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Which is safer, cryptography or forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Where can I earn daily and invest my money?

Although investing can be a great investment, it's important that you know your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is investing in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

What is the best forex trading system or crypto trading system?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. Forex trading is easier than investing in foreign currencies upfront.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both instances, it is crucial to do your research prior to making any investments. Any type of trading can be managed by diversifying your assets.

Understanding the various trading strategies for different types of trading is important. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. To help manage their investments, traders may use automated trading systems or bots. Before you invest, make sure to understand the risks associated with each strategy.

How Can I Invest in Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need is the right knowledge and tools to get started.

The first thing to understand is that there are different ways of investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. Keep an eye on market developments and news to stay current with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

What are the benefits and drawbacks of investing online?

Online investing has the main advantage of being convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, there are some drawbacks to online investing. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

It is also important for online investors to be aware of all the investment options. Investors have many choices: stocks, bonds or mutual funds. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There may be restrictions on investments such as minimum deposits or other requirements.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I protect my financial and personal information when I invest online?

Online investments require security. Protecting your financial and personal information online is essential.

Be mindful of whom you are dealing with when using any investment app. Be sure to choose a reputable company with good ratings and customer reviews. Before you transfer funds to them or give out personal information, do your research.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. To ensure your account security, disable auto-login on all devices. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. To prevent a breach of one account, it's smart to have different passwords for each account. Last but not least, make sure to use VPNs when investing online. They're often free and easy!