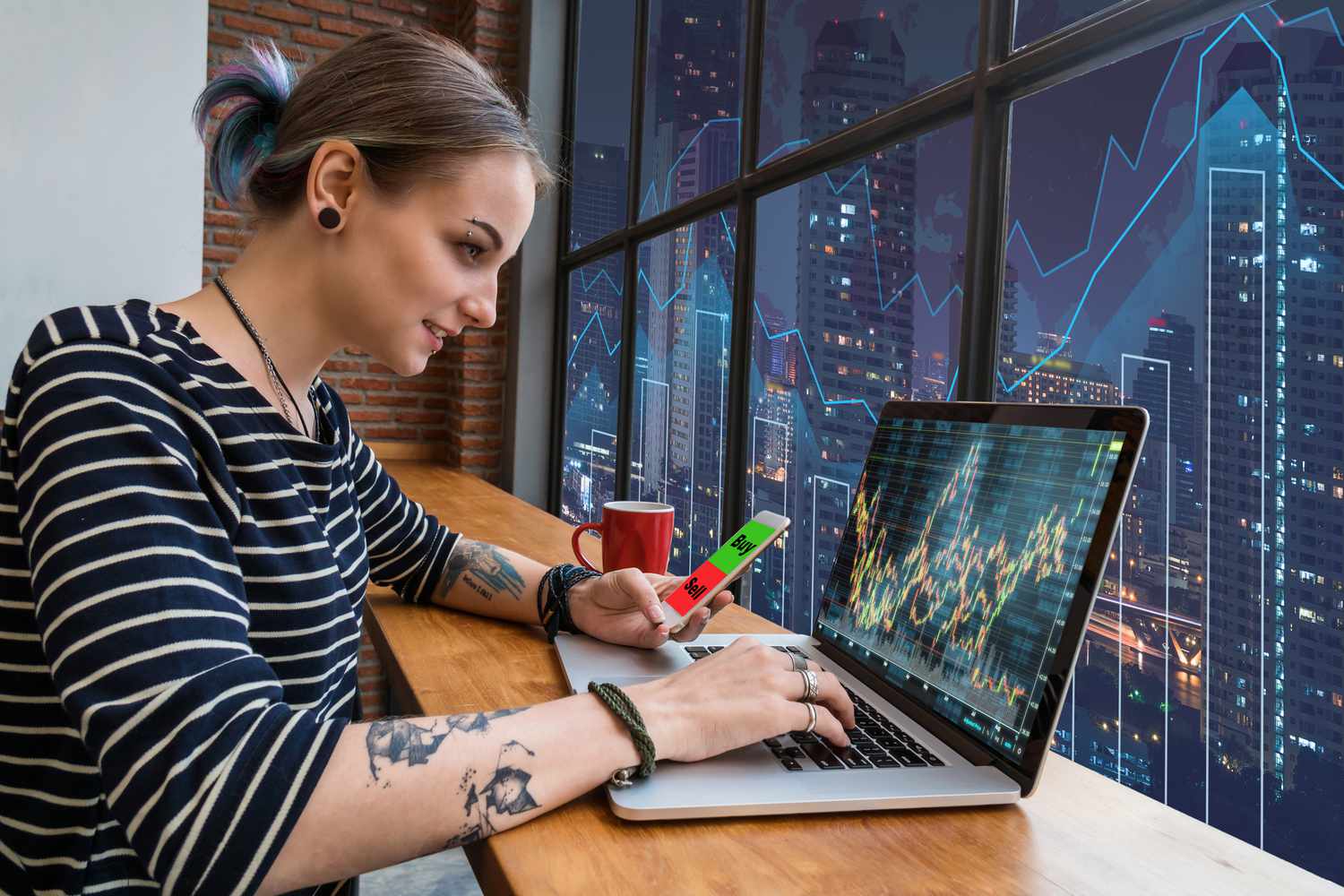

Options trading can be a great way diversify your portfolio. It can be less expensive than buying stocks outright. However, options carry a number of risks. A simulator for options trading is a good option to learn the market and get comfortable before you invest real money.

There are several different types of options trading simulators. Some are free while some are paid. Each has its own benefits and drawbacks. For beginners learning about the options, a free version is ideal. The paid versions include more options and advanced features.

Several brokerage firms offer their own version of an options trading simulator. CBOE offers a simple set-up, while OptionsXpress and Charles Schwab offer more sophisticated tools.

ETNA Software's options trading simulator is one of the best. ETNA Software offers an authentic option execution experience that allows users to create customizable trading dashboards and place multi-leg order. The software is mobile-friendly.

An option trading simulator can also serve as a teaching tool. This type of program is being taught at many colleges and universities. These programs allow students to get the basics down before going live.

Virtual commissions and standard fees are included in many options trading simulators to allow traders to see how real trading works. This allows them to see how their performance will impact their investment strategy. Real-time stock prices and data are also available. The simulator may allow users to practice various strategies such as option chains and conditional orders.

Virtual Trade is a popular trading option. Virtual Trade features a range of interactive tools. These include charts that show real time price quotes, training centers, and virtual money valued at $25,000 Invite other players to play and compete for the highest weekly returns.

Wall Street Survivor, another option, uses a virtual options simulation to show investors the benefits and risks of trading options. While the desktop platform is focused on basics of options trading the mobile app has robust trading guides, quizzes and a contest. You can also choose to receive actual cash for price payouts.

Many options trading simulators come with a free brokerage accounts. This gives you the opportunity to test with real options chains and options contracts. They can be useful tools for both beginners and more experienced traders. The best option simulator for you is essential. Make sure you consider all the benefits and features before making your final decision.

Also, you should consider whether an options trading simulator can be used with your trading platform. Some simulators may require personal information. This will ensure your simulator is compatible and works with your chosen broker. Without this information, you may lose money or gain only a fraction of your cash.

FAQ

Which trading site for beginners is the best?

It all depends upon your comfort level in online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Which trading platform is the best?

Many traders can find choosing the best trading platform difficult. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This information will help you narrow down your search and find the best trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Frequently Asked Questions

What are the different types of investing you can do?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Where can I find ways to earn daily, and invest?

Although investing can be a great investment, it's important that you know your options. There are many other investment options available.

One option is to buy real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Is Cryptocurrency Good for Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

What are the advantages and drawbacks to online investing?

The main advantage of online investing is convenience. You can manage your investments online, from anywhere you have an internet connection. Access real-time market data, and make trades online without leaving your office or home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing has its limitations. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There may be restrictions on investments such as minimum deposits or other requirements.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

When investing online, research is essential. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Learn about the investment's risk profile and review the terms and condition. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.