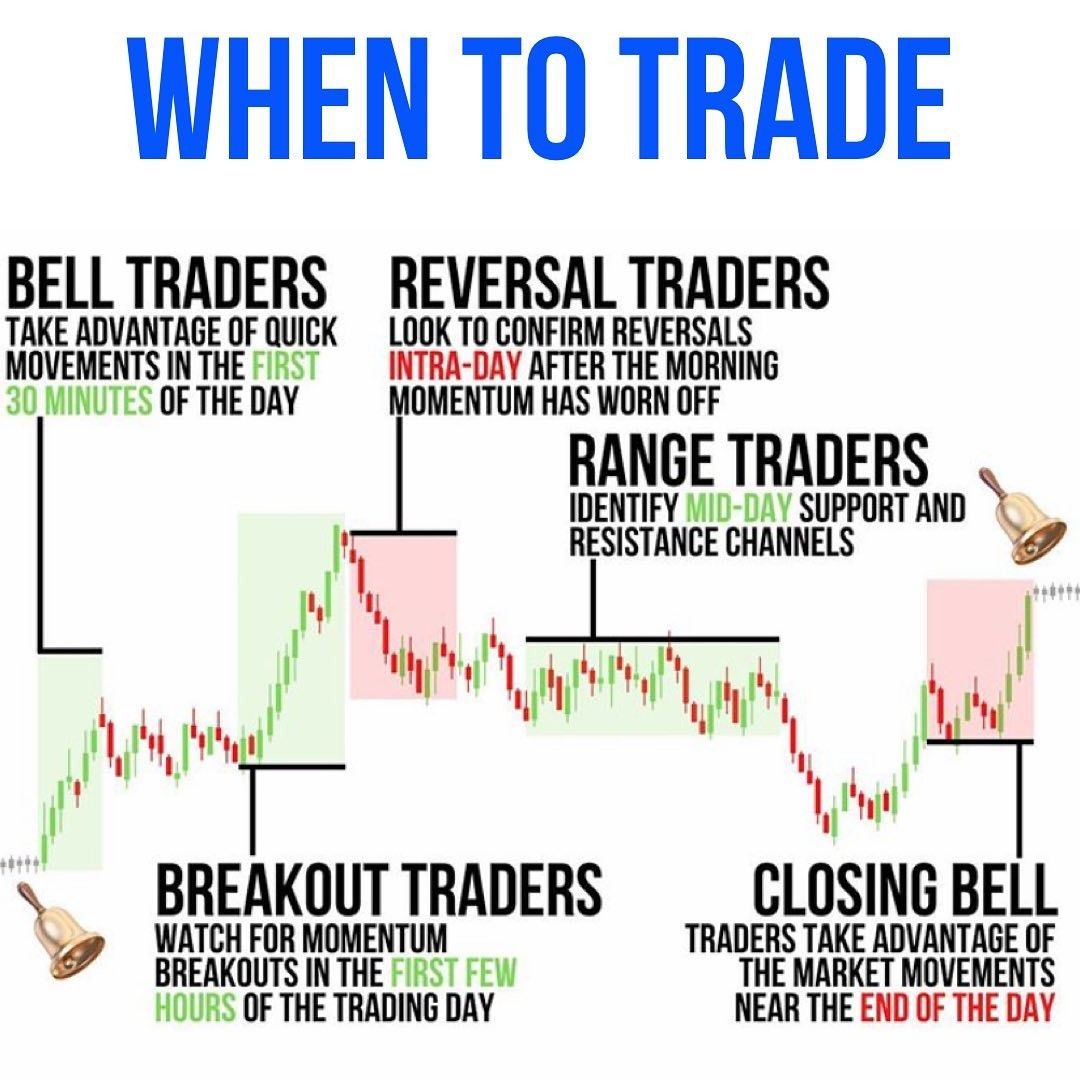

Forex trading is very active and dynamic. It moves in accordance with the laws and demands of supply and demand. This makes it attractive to traders who seek to take advantage of fluctuations in forex rates. Forex trading can be very profitable if you are able to recognize trends and reversals.

Forex indicators are an invaluable resource for professional and novice traders. They are useful for helping to determine key limit points, identify trends, and forecast reversals. However, they do not guarantee success in trading. They can, however, cause serious losses. However, indicators can help you decide when it is the right time to trade. It is best to rely more on fundamental analysis and patience.

The RSI is one of the most widely used forex indicators. It uses a 100 point scale in order to measure buying and selling trends. It's a sign that there is a change in trend if it is over 30. It is more likely that the trend will reverse if it falls below 30. It bounces above 30 to indicate that the trend remains intact.

Another useful forex indicator is the Bollinger Bands. These bands have an upper and lower range based on the standard deviation from the moving average. The bands are useful in determining whether an asset is priced fairly by analysing the market volatility.

Support and resistance are two of the most important elements in technical analysis. These levels are where a trend can break through and raise or lower the price. A decline in value may also lead to more sellers than buyers.

There are other popular indicators that can be used to evaluate a market's current state. These include OBV (On Balance Volume) and RSI. OBV (On Balance Volume) and RSI are both tools that can confirm a trend. However, RSI may also indicate potential reversals.

There are many other types of Forex indicators. Some are visual representations of average price movements while others give an overview of the market. Many of these indicators may be free to use. Others require a minimal cost and provide more functionality.

These tools are not the only ones that have been created. There are also automated Forex trading systems. They can analyze multiple charts and then send alerts by email to traders. Most of them are easy to use and do not require any advanced knowledge of the forex market.

Forex Trendy is an excellent choice if you're interested in automating your trading. Trade alerts can be sent based upon patterns and you can scan upto thirty-four currency pairs. While it is not intended for trading strategies, it has been very effective for many people.

Regardless of which Forex trading program you choose, you should be aware that there are no guarantees of future success. It is vital to be patient and understand that markets can move in any direction.

FAQ

Frequently Asked questions

What are the 4 types?

Investing is a way to grow your finances while potentially earning money over the long term. There are four main types of investing: stocks, bonds and mutual funds.

There are two kinds of stock: common stock and preferred stocks. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Which trading site is best for beginners?

Your level of experience with online trading will determine your ability to trade. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which is harder crypto or forex?

Each currency and crypto are different in their difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

What are the advantages and disadvantages of online investing?

Online investing has one major advantage: convenience. With online investing, you can manage your investments from anywhere in the world with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

You should also be aware of the different investment options available to you when investing online. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment type has its own risks, rewards, and it is important to fully research each option before making a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Can forex traders make any money?

Yes, forex traders can earn money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Where can i invest and earn daily?

Although investing can be a great investment, it's important that you know your options. There are many options.

One option is to invest in real property. Investing property can bring steady returns as well as long-term appreciation. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

Is it safe to store my investment assets online, or should I consider other options?

Money can be complex but so can the decisions about how to store it. A strong security system is essential for your valuable assets. There are several options.

Online storage of investment assets is easy and convenient. You can access them easily from any device. There are some risks associated with using a digital option as electronic breaches could occur.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

Another option is to keep your investments in traditional banking and investing accounts. You also have the option of self-storage facilities, which allow you to store valuables such as gold, silver or other precious metals safely outside your home.

You might also consider looking into specialist investment firms that provide secure custody services, specifically tailored to protect large asset portfolios.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.