If you want to trade in the forex market successfully, you need to have a strategy. There are many strategies, but it's important to know which one is most effective for you. For instance, you should be aware of the basic concepts of market manipulation and fundamental analysis. Simple strategies can be used to apply capital management knowledge.

It is important to identify the dominant players in the forex market before you can develop a strategy for forex bank trading. This will allow you to determine where the price levels are likely to go. The next step in the process involves analyzing the markets' sentiment. A trader will be able buy or sell if he or she has an accurate sense of the market's movements.

Next, you'll need to identify currencies most likely to be undervalued. If you're not sure, the Federal Reserve offers basic information through its Economic Data Database. Technical analysis can be used by those who have more experience to identify the cause of price movements.

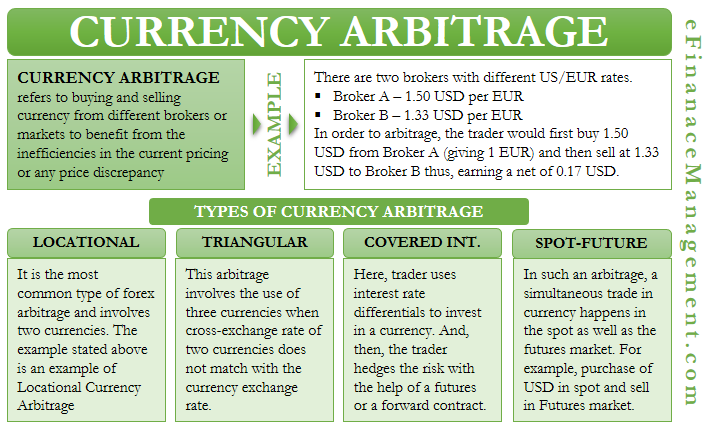

Once you've identified the currencies with high prices, you can start to look for ways to profit from them. Some of the most popular methods include hedging and portfolio trading. Portfolio trading involves investing in multiple currencies. While hedging is where a trader buys one currency and then sells another, portfolio trading is when a trader invests in several currencies.

This strategy will ensure that you don't lose money on the market. Key data on both currencies will be important. Traders should be careful about geopolitical events, which can add uncertainty and make unprotected portfolios susceptible to losses.

The Dow theory forms the basis of bank strategy. It employs 80% of the fundamental analysis and 20% of the technical analysis. It's based on the belief that volume confirms trends.

Another important thing to take into account is the market's size. It is vital to know the market size before major moves take place. Markets that are larger than others will tend to follow the trend's direction, while smaller ones will be more volatile.

Depending on how much time you have, there are a number of trading styles you might consider. There are four types: day trading, swing trading portfolio trading and carry trade. These styles of trading are generally done on daily or weekly charts.

Banks are the biggest players in the exchange trading. They hold the largest positions, and are able create liquidity. This allows them to make trades and rebalance positions every month.

Because banks are so powerful, they can have three types of influence on the market. False break is one such. It occurs when the price breaches a resistance or support area. It means that the majority of the market has been wiped out when a price breaks away from a support or resistance area. This phase is where smart money (banks and other investors) enters the market.

FAQ

Frequently Asked Question

What are the four types of investing?

Investing is a way for you to grow your money and possibly make more long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Where can I invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. There are other ways to make money than investing in the stock market.

One option is to invest in real property. Investing property can bring steady returns as well as long-term appreciation. Diversifying your portfolio might be a good idea.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which platform is the best for trading?

Many traders may find it challenging to choose the best trading platform. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

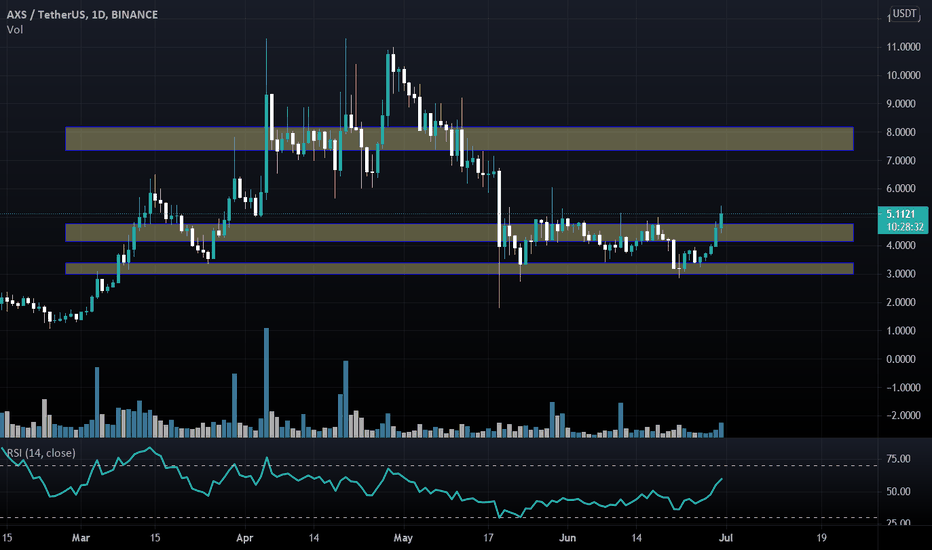

Which is harder forex or crypto?

Both forex and crypto have their own levels of complexity and difficulty. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. A good understanding of technical indicators is essential to identify buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

What are the pros and cons of investing online?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing comes with its own set of disadvantages. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Some investments may also require a minimum investment or other restrictions.

Can you make it big trading Forex or Cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. It is important to trade only with money you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. A solid knowledge of the conditions that affect different currencies is essential.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What are the best options for storing my investment assets online?

Money can be complex but so can the decisions about how to store it. You have several options when it comes to protecting your valuable assets.

Online storage of your investment assets allows you to access them from anywhere and can be accessed quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

You can also keep your investments in traditional bank or investing accounts. There are also self-storage options that allow you safe storage of gold, silver, and other valuables, outside your home.

Finally, you may consider looking into specialized investment firms that offer secure custody services specifically designed for protecting sizeable asset portfolios.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?