A strategy is essential to your success as a forex trader. There are many strategies that you can use, but it is crucial to understand which strategies are most effective for your situation. You should know the basics of fundamental analysis and market manipulation. Simple strategies can be used to apply capital management knowledge.

It is important to identify the dominant players in the forex market before you can develop a strategy for forex bank trading. This will help you determine the likely price levels. Analyzing the market's sentiment is the next step. Once a trader has a good understanding of how the market is moving, he/she will be able sell or buy.

Next, you'll need to identify currencies most likely to be undervalued. If you're not sure, the Federal Reserve offers basic information through its Economic Data Database. Those who are more experienced can use technical analysis to find out what is behind the price movements.

Once you've identified the currencies with high prices, you can start to look for ways to profit from them. Portfolio trading and hedging are two of the most common methods. Portfolio trading involves investing in multiple currencies. While hedging is where a trader buys one currency and then sells another, portfolio trading is when a trader invests in several currencies.

Using a strategy such as this one, you will be able to avoid losing money in the market. Key data on both currencies will be important. Traders should be careful about geopolitical events, which can add uncertainty and make unprotected portfolios susceptible to losses.

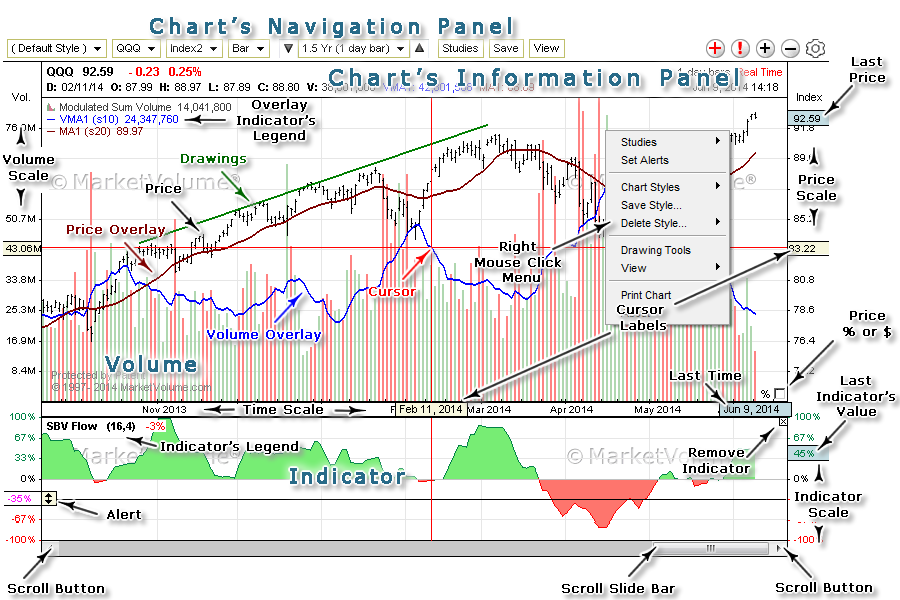

The Dow theory is the cornerstone of a bank's strategy. It employs 80% of the fundamental analysis and 20% of the technical analysis. It is based in the assumption that trends can be confirmed by volume.

Another important factor to consider is market size. It is vital to know the market size before major moves take place. Larger markets are more likely than smaller ones to follow the trend. Smaller markets, however, will be more volatile.

Depending upon your trading time, you might want to use a variety trade styles. These styles include swing trading, portfolio trading, carry trade, and day trading. These trading styles are typically carried out on weekly or daily charts.

Banks are the largest players in the exchange trade. They have the largest positions and can generate liquidity. They are able to trade, and also rebalance each month.

Because banks are so powerful, they can have three types of influence on the market. One of these is called a false break. It occurs when the prices breaks out from a support or resistance zone. A price that breaks out of a support/resistance area means that a large part of the market has fled. During this phase, smart money (banks) enter the market.

FAQ

Is Cryptocurrency a Good Investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

You can also make a profit if your risk is taken and you do your research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Can forex traders make any money?

Forex traders can make a lot of money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

How can I invest in Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need is the right knowledge and tools to get started.

It is important to realize that there are several ways to invest. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Frequently Asked Question

What are the four types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be broken down into common stock or preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Where can I find ways to earn daily, and invest?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

Real estate is another option. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. If you're comfortable taking the risks, you can also trade online with day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which trading site is best for beginners?

It all depends on how comfortable you are with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many offer interactive tools to help you understand how trades work.

You can also trade independently if your knowledge is good enough. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

When investing online, research is essential. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. Ask yourself if it's too good to be true and beware of claims that imply a guarantee of future results or substantial returns.

Know the risks associated with your investment and the terms and conditions. Before you open an account, check what fees and commissions might be taxed. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.