In the foreign exchange market, there are many players that affect the exchange rate. The liquidity level is the main factor that influences the forex spread. Liquidity is the number of traders that are trading a particular financial instrument. The gap between the ask and bid prices will be greater if there are fewer traders. This will lead to a higher cost for the trader to buy or to sell a currency.

The three main trading periods on the foreign market are: morning, mid-afternoon and late evening. There are three main trading periods: early morning, mid-afternoon, or late evening. These are the most active trading hours. This is when the forex market tends to be more active and traders should be prepared.

Broker spreads can vary widely between brokers. This is something traders should be aware of. They can offer either fixed spreads or variable spreads. Fixed spreads can be more beneficial for traders. However, they also pose more risk. Whenever the market moves in a significant way, the broker may be forced to adjust its spreads. Therefore, it can be difficult to maintain an even spread.

A narrow spread is an indication of a smaller gap between the offer price and the bid price. A low spread also indicates high liquidity. But, a low spread can be misleading. Sometimes traders may end up paying different prices for the same currency pair. Some of these hidden costs include fees, margins, and inactivity fees.

A market maker is a broker that acts as a counterparty. Typically, these brokers provide fixed spreads. A market maker can notify a trader when a specific price is not suitable to trade.

Spreads offered by forex brokers are usually two-fold. Variable spreads refer to the chili pepper to fixed spreads. ECN brokers enable you to trade on different currency markets. They offer spreads which can change depending on the demand and supply of currencies.

Many forex brokers offering variable spreads are not dealing desk brokers. These brokers get pricing information from different liquidity sources and pass it on to their customers. The spread can affect the cost to execute a trade so it's important that you choose the right forex broker.

The economic conditions, volatility and risk are all factors that can influence the spread. Forex brokers that offer a greater spread are likely to charge more than those with a fixed spread. Spreads are likely to be higher if the trader books euro transactions during the Asian trading sessions.

It is important to understand forex spreads when it comes down to commissions. Many brokers will charge fees for opening oppositions. Brokers will charge a fee for opening an opposition. The fees and commissions are not very high, but they can still be quite significant if the trade involves large amounts of currency. Before placing any trades, make sure you visit the website of your broker.

FAQ

Frequently Asked Question

What are the 4 types?

Investing can be a great way to build your finances and earn long-term income. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be broken down into common stock or preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Trading forex or Cryptocurrencies can make you rich.

Yes, you can get rich trading crypto and forex if you use a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. You should also trade with only the money you have the ability to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Which trading website is best for beginners

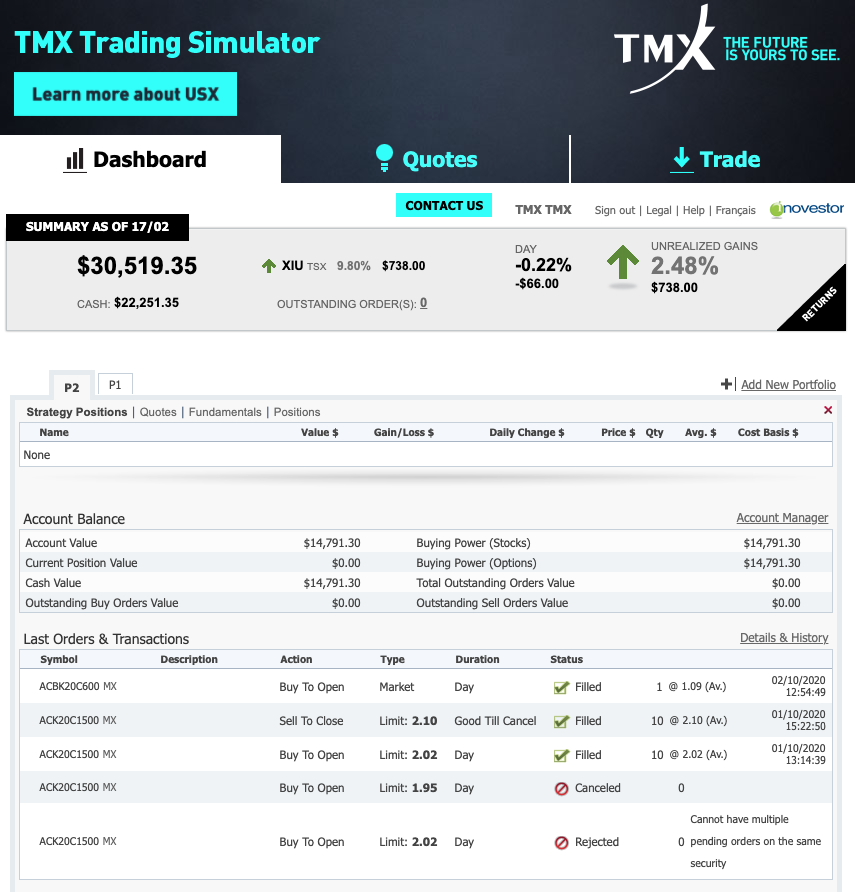

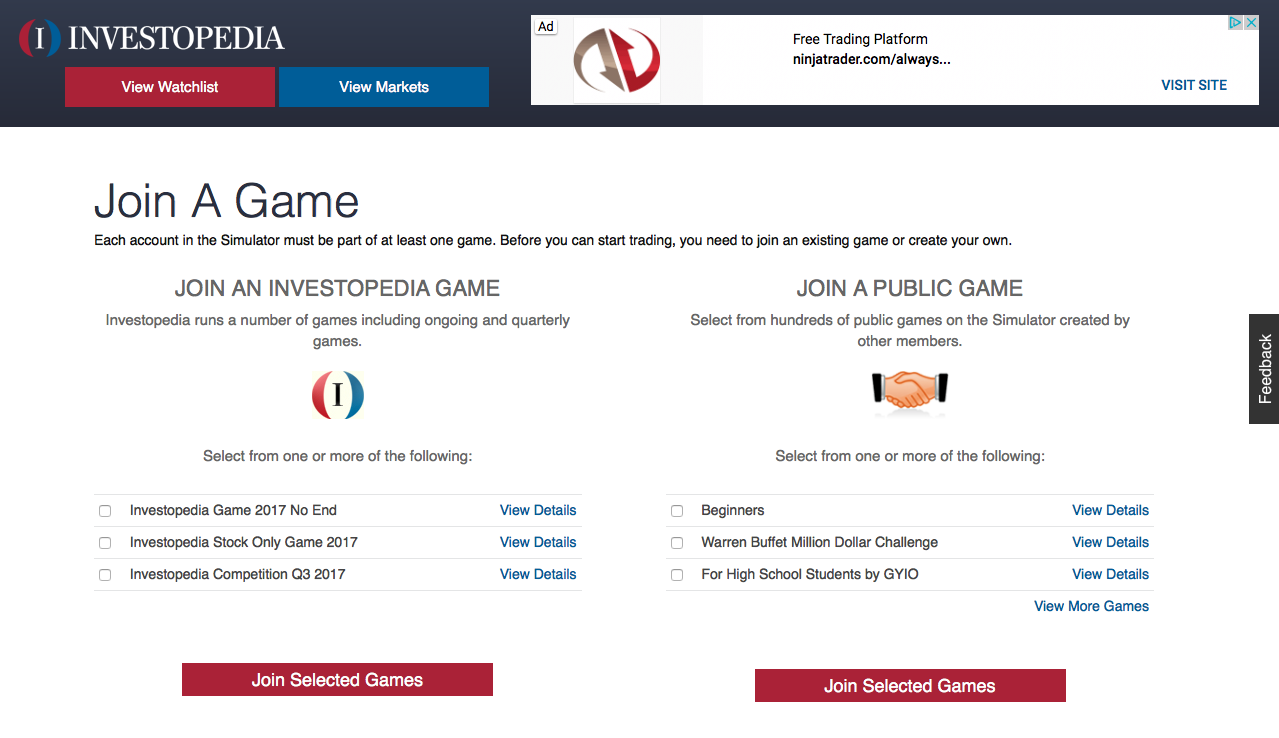

It all depends on how comfortable you are with online trading. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

However, crypto trading can offer a very immediate return due to the volatility of prices. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both instances, it is crucial to do your research prior to making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

Understanding the various trading strategies for different types of trading is important. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it is important that you understand the risks as well as the rewards.

How do forex traders make their money?

Forex traders can make a lot of money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading is not an easy task, but it can be done with the right knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Is Cryptocurrency a Good Investing Option?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can I ensure security for my online investment accounts?

Safety is a must when it comes to online investment accounts. It is crucial to safeguard your data and assets against unwelcome intrusions.

You want to ensure that the platform you use is secure. Two-factor authentication and encryption technology are some of the best security options to protect against malicious hackers. You should also have a policy that describes how your personal information will be monitored and controlled.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. Check your account activities regularly to be alert of any unusual activity.

Thirdly, make sure you understand your investment platform's terms and conditions. You must be familiar with the fees associated to investing as well any restrictions or limitations that may apply to how you use your account.

Fourth, make sure you do thorough research about the company before investing. You can read user reviews and ratings about the platform to see how it works and what users have said about it. Finally, make sure you are aware of any tax implications associated with investing online.

Follow these steps to ensure your online account is protected from potential threats.