DappRadar allows users to track and explore decentralized apps around the world. It offers a number of useful functions such as portfolio management, payment options, and staking. The company claims to have around four million unique users a year and supports over 8,000 dapps.

DappRadar intends to launch a native currency called RADAR. The RADAR token, which is based on Ethereum blockchain, will be used to pay for the service. RADAR token holders will have access to DappRadar's PRO section. This section offers exclusive analysis, new collections, and early access. RADAR owners can participate in the staking scheme and claim rewards as a bonus.

Although RADAR's primary purpose is to reward users with tokens, it will also be used to encourage DappRadar users to make contributions. This includes voting, staking, and suggesting recommendations. The RADAR holders are able to help with product decisions.

As a staker, RADAR can help to increase the number of dapps available on the Ethereum network. Likewise, holders of RADAR can vote on initiatives and take part in the DappRadar Community. It will also serve as a governance token to the DappRadar DAO. RADAR will enable the platform to offer better portfolio tools and expand its coverage.

DappRadar can be used as an open-source project. It has partnered to the LayerZero protocol to enable smart contract communication across chains. Through this protocol, DappRadar can eliminate the need for gas fees on the Ethereum blockchain.

According to the recent DappRadar industry report, the total number of dapps on the platform has increased 396% from the first quarter of 2021. Dapps are being used daily to interact with 2.4 millions of unique wallets. For this reason, the company believes that the multichain blockchain industry is the future. It aims to create an ecosystem that benefits developers and users.

Currently, the total supply of the RADAR token is 10 billion. DappRadar has plans to expand the token’s use and is currently developing a second phase. RADAR can also easily be traded over the Web3 network.

In addition, DappRadar offers four utility tokens for its platform. These include Contribute2Earn, Boosts, Portfolio, and Polygon. These services can be purchased on the market or acquired through an airdrop.

DappRadar's newly announced cross-chain token stake mechanism is a breakthrough innovation. This eliminates the need for bridge assets and drastically reduces staking fees. A smooth user experience is guaranteed on all chains by the protocol.

DappRadar is a pioneer in the multichain blockchain sector. DappRadar aims to be the leading platform that allows users to find and analyze decentralized apps. Therefore, the company is committed to providing the most comprehensive app store in the world.

DappRadar continues to work on a full-scale dapp shop. Dapps with a strong community can unlock many possibilities and gain more power.

FAQ

Which is more difficult forex or crypto currency?

Different levels of difficulty and complexity exist for forex and crypto. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

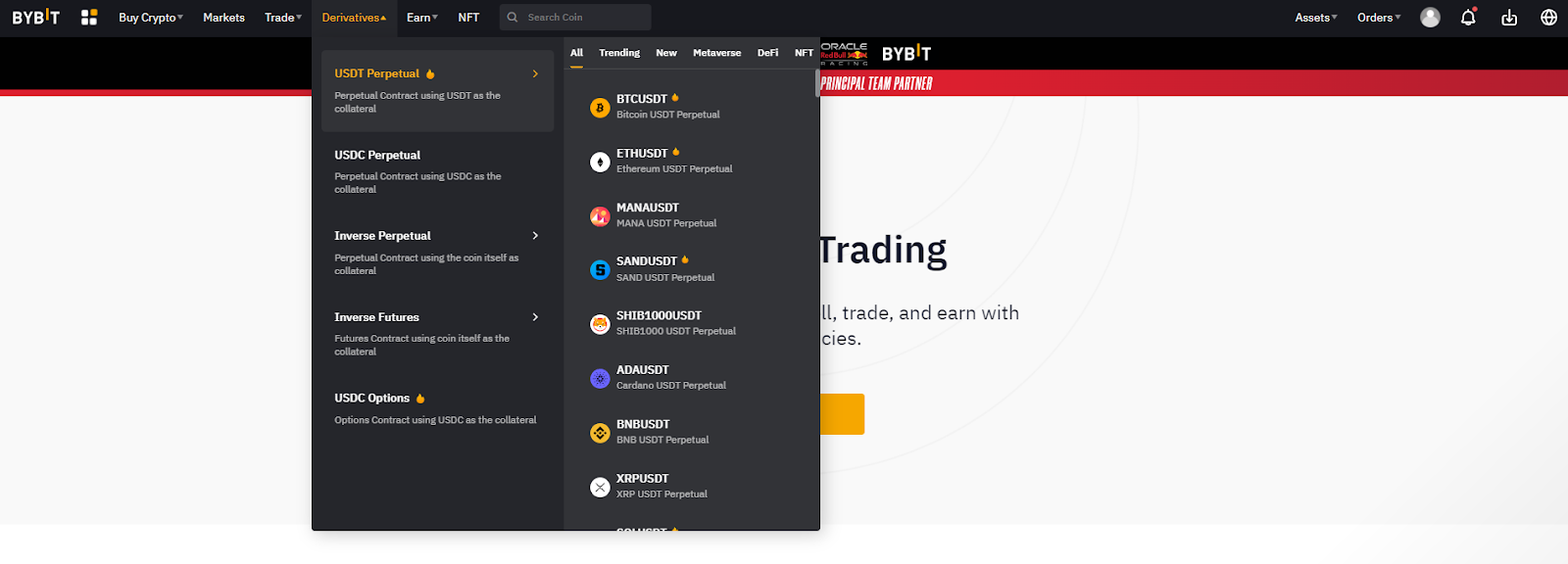

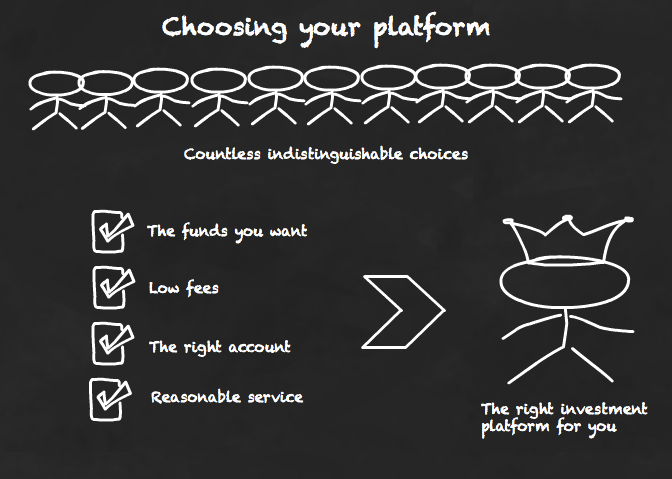

Which trading platform is best?

Many traders can find choosing the best trading platform difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It must also be easy to use and intuitive.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. These factors will help you narrow down the search for the right platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Can forex traders make any money?

Yes, forex traders can earn money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Which is better forex trading or crypto trading.

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both instances, it is crucial to do your research prior to making any investments. With any type or trading, it is important to manage your risk with proper diversification.

It is important to know the types of trading strategies you can use for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Where can you invest and make daily income?

While investing can be a great way of making money, it is important to understand your options. There are many other investment options available.

One option is to buy real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can you protect your financial and personal information while investing online?

Online investments require security. Online investments pose risks to your financial and personal data. Take steps to reduce them.

Start by being mindful of who you're dealing with on any investment app or platform. You want to work with a company that has positive customer reviews and ratings. Research the background of any companies or individuals you work with before transferring funds or providing any personal data.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

Make sure that only trustworthy people have access to your finances by deleting all bank applications from old devices when getting rid of them and changing passwords every few months if possible. Track any account changes that could alert an ID thief, such as account closing notifications or unexpected emails asking you for additional information. Also, you should use different passwords on each account to ensure that any breach in one doesn't cause others to be compromised. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!