Before you start trading NFTs, make sure you verify the security at your chosen trading site. This is especially important if you are looking to purchase collectibles. If you are buying from a trustworthy company, you can expect to receive NFT that is safe, secure and of high quality. Even the best NFT trading site can be scammed.

A private crypto wallet is one of the best ways to protect your NFTs. A good idea is to keep your tokens on a device like Ledger. You can be sure that your tokens are safe from the public.

Another option to purchase NFTs is to do so on a curated platform. These types of markets will pre-screen the projects and artists that are involved. Many of these websites provide a platform for artists and traders. You can buy and sell NFTs. Additionally, you can also support one another's work and collaborate on projects.

SuperRare and Rarible are two examples of curated NFT markets. They offer a variety of high-quality digital collectibles. You can search through thousands to find the perfect one. They aren't as well-known as other curated shops, but they do charge a small amount.

NFT markets often require you set up a profile that includes KYC information before making a purchase. This can be a red flag for some users. You might need to place a bid if you want to purchase an NFT from a celebrity. NFT sites usually allow buyers and sellers to accept bids, but it's possible to also list a collectible with a fixed price.

The NFT market is growing in popularity. Some of the biggest companies in the centralized crypto trading industry are developing their own NFT trading platforms. Binance is a major player in the market for NFTs. GameStop and other companies are also interested in NFTs.

You can also search for specific NFT traits, such as fashion or sports memorabilia. You can filter NFTs by style or gold fur on some sites. Additionally, some NFT marketplaces will let you buy NFTs using your credit card or Apple Pay.

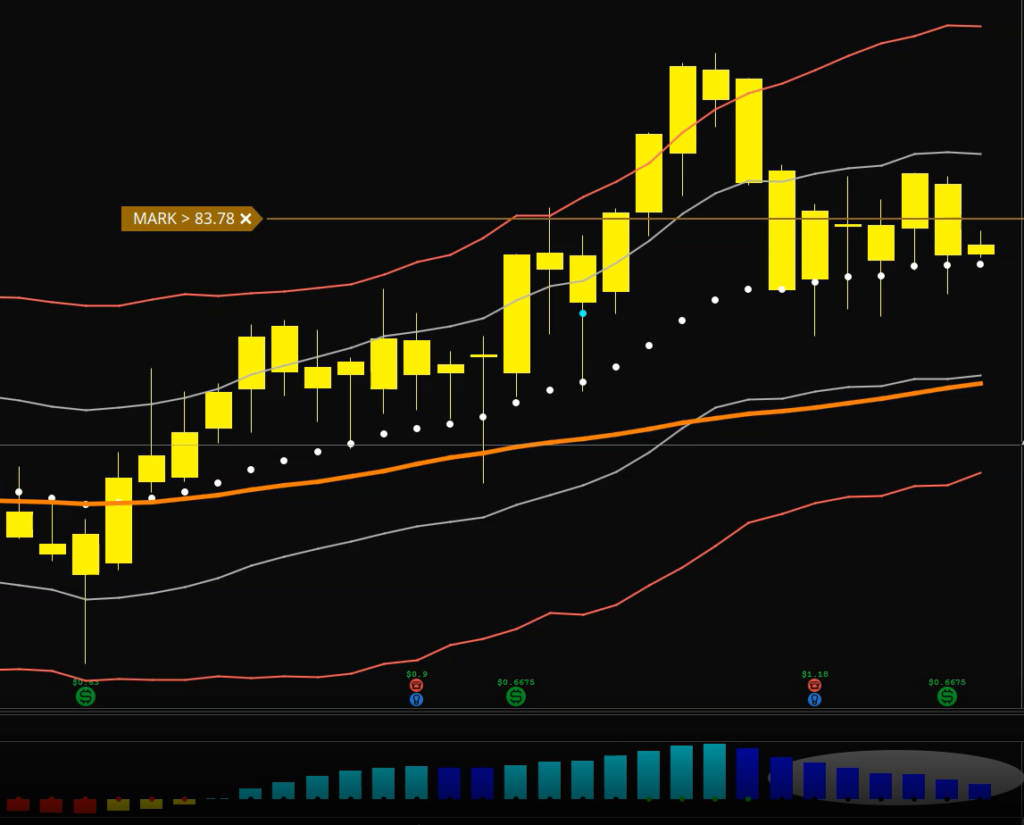

The trading volume is another important aspect to consider when designing your trading website. A high trading volume is a sign that there are many people selling and buying on the site. Also, a low volume of trading indicates that the website isn't very active. You should be able to see the trading volume graphed. It is also an indicator of a site's reputation that its daily trading volume.

Another thing to consider is how easy it is to use. Customers are required to register KYC information and connect their crypto wallets on most NFT sites. Most of these sites will also ask for contact information to assist customers. Be sure to contact customer care if you experience difficulties with your account.

FAQ

Cryptocurrency: Is it a good investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Which is harder, forex or crypto.

Different levels of difficulty and complexity exist for forex and crypto. Crypto is more complex because it is newer and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

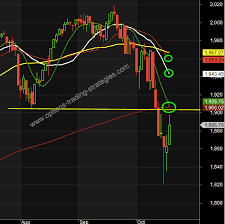

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

What are the disadvantages and advantages of online investing?

The main advantage of online investing is convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, there are some drawbacks to online investing. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

When considering investing online, it is also important that you understand the types of investments available. Investors have many choices: stocks, bonds or mutual funds. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Forex traders can make money

Forex traders can make a lot of money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

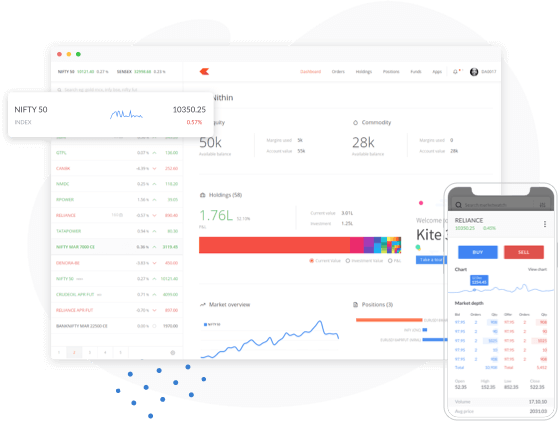

Which trading site is best for beginners?

It all depends on how comfortable you are with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many offer interactive tools to help you understand how trades work.

You can also trade independently if your knowledge is good enough. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I protect my personal and financial information when investing online?

Online investments require security. Online investments can be dangerous. You need to know the risks and how to mitigate them.

Start by being mindful of who you're dealing with on any investment app or platform. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. You can protect yourself against phishing by not clicking on emails from unknown senders, never downloading attachments, and always checking the security certificate of a website before entering any private information.

It is important to ensure that only trustworthy people have financial access to your accounts. Make sure you delete old bank apps from all devices, and change passwords every few weeks if necessary. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. To prevent a breach of one account, it's smart to have different passwords for each account. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!