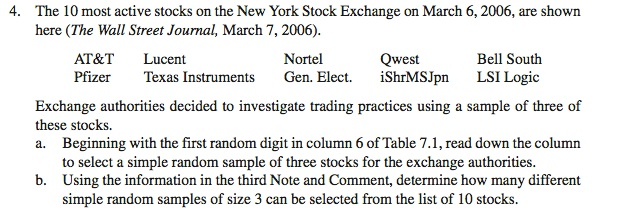

Ally Invest provides wealth management solutions to its customers. Ally Invest includes a variety of trading and investment tools. This includes everything from bonds and stocks to closed-end mutual funds and forex. The platform is simple to use and well designed.

Customers of Ally Invest are not permitted to trade cryptocurrencies. They are however allowed to purchase digital assets via a FINRA-regulated broker. Customers can use their debit cards to buy cryptocurrencies at Coinbase. A customer can also link his Ally Bank account with Coinbase for crypto purchases.

While the primary website works well, it lacks the same functionality as Ally Invest Live. Ally Invest Live has streaming quotes and peer-performance comparisons. You can also access data and a customizable dashboard. It is similar to the Ally Invest homepage in terms of content, but the website is differently organized.

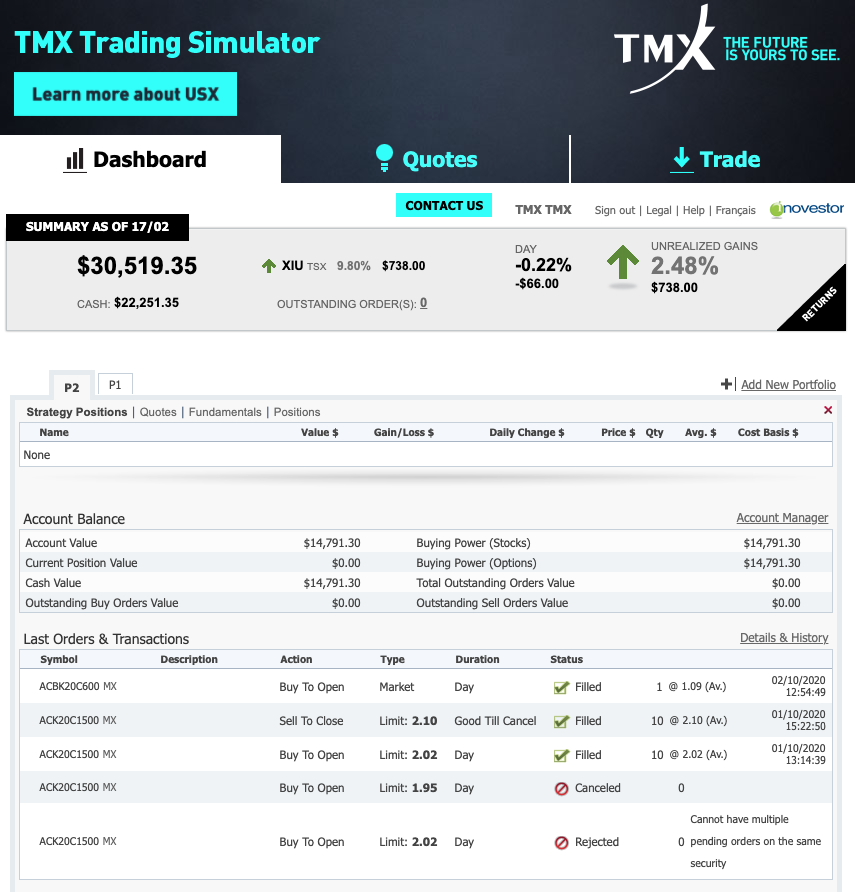

One of the biggest disadvantages of the Ally Invest website is that it does not support all or none orders. Traders that want to add an item to their orders must cancel any existing orders before they can add the new option. It is also difficult to create custom orders. You cannot access a trading simulator. Trailing stops and stop loss are not supported.

On the upside, the Ally Invest website is a well-designed, responsive site with a wide array of educational resources. It has no transaction costs, which is a big advantage over other online brokerages. There is no minimum deposit required to open an online account. Likewise, there is no annual fee to maintain an account. The cash balances are subject to a competitive interest rate.

Another problem is the lack of a practice account. It's also difficult to diversify small portfolios as it doesn’t allow fractional investment. Additionally, it does not support trailing orders, conditional order, or contingent orders.

As a rule of thumb, investors who are just starting out and don't know much about stocks and options may find that they're better served with a platform that offers a fractional share trading service. Ally Invest, however, is a viable option for active options traders.

However, it is not recommended for novice investors who plan to trade large and risky amounts. It is also difficult to calculate a dollar-cost average for a portfolio. It is not a smart idea to invest all your money in penny stocks, even if you're a seasoned investor.

Uphold is another reputable online brokerage that offers cryptocurrency trading. You can choose from hundreds of different crypto assets. They also offer zero commission trading through Ally Bank. And, they are based in the United States, which makes it secure. Furthermore, Uphold's services are regulated. They charge a spread fee for any cryptocurrency trades.

You can begin investing in crypto currencies with a low fee. Before you can buy or sale a currency, you will need transfer your money from another bank account to Ally Bank. To trade crypto assets, you need to use a FINRA registered crypto broker.

FAQ

Do forex traders make money?

Yes, forex traders can make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is crucial to find an educated mentor before you take on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

What are the disadvantages and advantages of online investing?

Online investing is convenient. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing has its limitations. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

When considering investing online, it is also important that you understand the types of investments available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There might be restrictions or a minimum deposit required for certain investments.

Most Frequently Asked Questions

What are the 4 types of investing?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be broken down into common stock or preferred stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Where can I earn daily and invest my money?

Although investing can be a great investment, it's important that you know your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

Real estate is another option. Investing property can bring steady returns as well as long-term appreciation. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which is more safe, crypto or forex

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Can you make it big trading Forex or Cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Trading with money you can afford is a good way to reduce your risk.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Is it safe to store my investment assets online, or should I consider other options?

While money can be confusing, the decision to where it should be stored can be just as complex. You have several options when it comes to protecting your valuable assets.

Online storage of investment assets is easy and convenient. You can access them easily from any device. There are some risks associated with using a digital option as electronic breaches could occur.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

Another option is to keep your investments in traditional banking and investing accounts. You also have the option of self-storage facilities, which allow you to store valuables such as gold, silver or other precious metals safely outside your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

The final decision is up to you. What works for you? What provides the safety and security necessary to protect your investment assets?