Ally Invest is a robo advisor that offers a wide range of wealth management tools to its customers. Ally Invest provides a complete suite of investing and trading tools. These include forex, stocks, bonds, closed-end funds, and closed-end funds. The platform is well designed and easy to use.

Customers of Ally Invest are not permitted to trade cryptocurrencies. However, they are allowed to buy digital assets through a FINRA-regulated crypto broker. Customers can also use debit cards to buy cryptocurrency on Coinbase. A customer can also link their Ally Bank account with Coinbase to make crypto purchases.

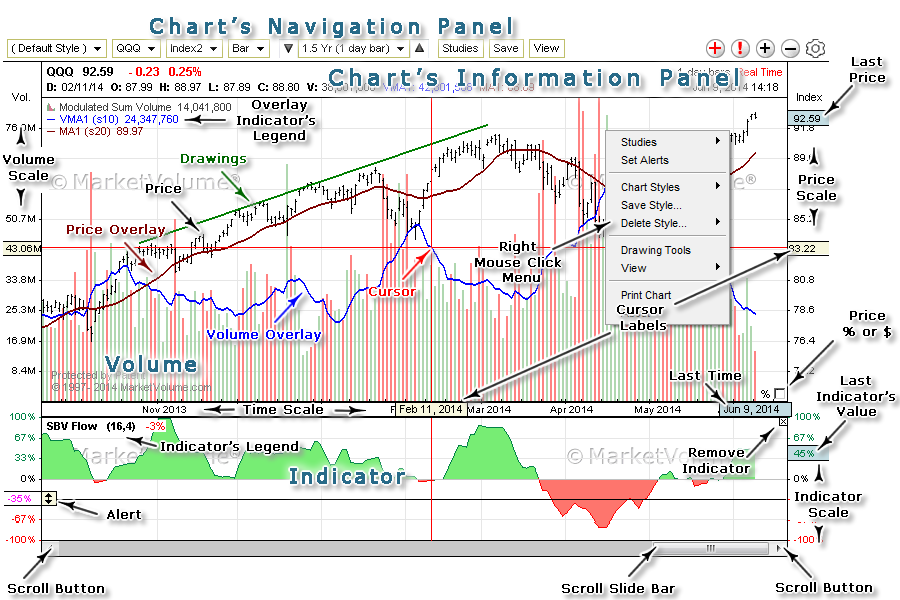

The primary website works very well but does not have the same functionality of the Ally Invest Live platform. Ally Invest Live has streaming quotes and peer-performance comparisons. You can also access data and a customizable dashboard. Although the content is identical to the main Ally Invest website, the site is different.

The website Ally Invest has one major drawback. It does not support any orders. Traders that want to add an item to their orders must cancel any existing orders before they can add the new option. It's also hard to create customized orders. A trading simulator is not accessible. Additionally, trailing stops cannot be supported.

The Ally Invest website has a lot of positive aspects. It is responsive and well-designed. There are no transaction fees unlike other online brokerages. You don't need to deposit a minimum amount to open an account. The account is free to open and maintain, with no annual fees. Additionally, the cash balances have a competitively charged interest rate.

The lack of a practice accounts is another problem. Because it doesn't allow fractional shares investments, it is difficult to diversify small portfolios. It doesn't allow trailing stops, conditional or contingent orders.

A rule of thumb is that investors who are just starting out in investing and don’t have any knowledge about stocks or options might be better served by a platform that offers fractional trading. Ally Invest, however, is a viable option for active options traders.

However, it is not recommended for novice investors who plan to trade large and risky amounts. For example, it is difficult to dollar-cost average into a portfolio. It is not a smart idea to invest all your money in penny stocks, even if you're a seasoned investor.

Uphold, another trusted online brokerage, offers cryptocurrency trading. It offers hundreds upon hundreds of crypto assets. They also offer zero commission trading on Ally Bank. Their headquarters are in the United States, making it more secure. Uphold's services also are regulated. Uphold charges a spread charge for cryptocurrency trades.

You can begin investing in crypto currencies with a low fee. However, you'll need to transfer your money to an Ally Bank account before you can buy or sell a currency. Plus, if you want to trade a crypto asset, you must use a FINRA-regulated crypto broker.

FAQ

Which is harder crypto or forex?

Different levels of difficulty and complexity exist for forex and crypto. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Where can i invest and earn daily?

It can be a great method to make money but it's important you understand all your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is to invest in real property. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you're comfortable taking the risks, you can also trade online with day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Frequently Asked Questions

What are the 4 types?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into preferred and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Which trading site is best suited for beginners?

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers provide interactive tools to show you how trades function without risking any money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Forex traders can make money

Yes, forex traders are able to make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

How can I invest bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. To get started, you only need to have the right knowledge and tools.

You need to be aware that there are many investment options. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

Next, research any additional information you may need to feel confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

When investing online, research is essential. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.