Bitcoin is a distributed digital currency that does not have any central backing, such as a central bank, government, or financial institution. It is instead based on a highly secure public blockchain that is maintained by many people. This makes it hard to reverse transactions and also makes them difficult to fake. It is decentralized and serves as a reliable accounting system for all transactions. It also prevents the use of coins that were already spent.

To make a transaction, simply transfer the amount from your digital wallet into another person's wallet. The transaction will then be broadcast to the entire network. If you are using an online platform, such as a centralized exchange, your transaction will be instantly completed. However, transactions made using peer-to-peer services will take some time to record.

The price of a single bitcoin is currently around $30,200. However, the price of a single bitcoin can fluctuate dramatically, especially during volatile markets. That means you may want to look for a platform that allows you to place limit orders on your purchase. These platforms require that you provide an ID number or social security number, as well as a bank account and source of income. Some of these platforms allow you to leave your investment in the account until you are ready to sell.

Transactions are possible in person as well as over any communication platform. Bitcoin transactions are more secure than any other digital currency. Because of this, it is recommended that you store your crypto safely. Keep your private key safe from any other information. Multiplying your passwords will protect you account.

Although cryptocurrency is volatile, some investors still believe in its long-term growth. Although crypto can have many benefits, it also has potential dangers. Some experts fear that it could be used in criminal activity. Others cryptocurrencies have been linked with fraud and illegal activity. Some companies worry that cryptocurrency will be more popular among criminals.

Some experts say that holding and buying a cryptocurrency should be part of a diversified portfolio because of its volatility. While there are some risks involved, investing in a crypto is a more cost-effective option than a traditional asset. Large investors have turned to the alternative as a hedge against inflation.

Unlike traditional investments, there is no physical means to withdraw your crypto, and its volatility can lead to high risk. However, if you're just beginning to invest in crypto, it can be a smart decision. You should understand the basics of crypto before making any purchase.

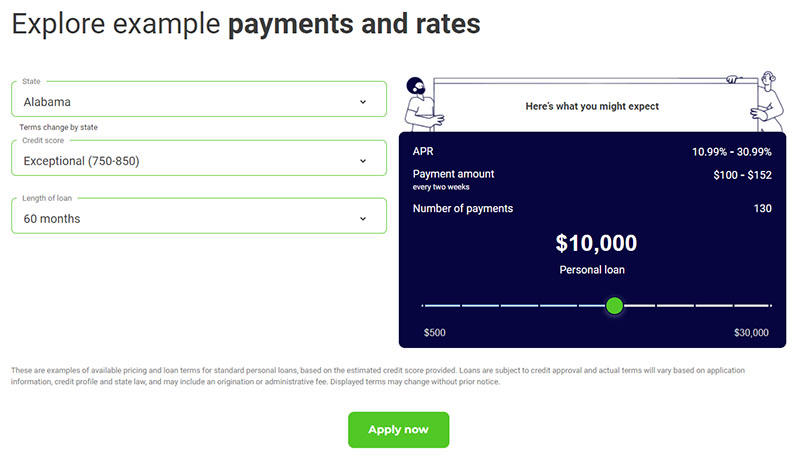

Bitcoin is an excellent place to start if you're looking to invest in a crypto. Although the market is growing, there is still plenty to be volatile. Before buying crypto, it is important to ensure that beginners find a platform that makes it easy to calculate the current rate.

FAQ

Which is harder crypto or forex?

Each currency and crypto are different in their difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Do forex traders make money?

Forex traders can make good money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which is safe crypto or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

How Can I Invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You just need the right knowledge, tools, and resources to get started.

It is important to realize that there are several ways to invest. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, you should research any additional information necessary to feel confident in your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. Keep an eye on market developments and news to stay current with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Is it possible to make a lot of money trading forex and cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. It is important to trade only with money you can afford to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

However, crypto trading can offer a very immediate return due to the volatility of prices. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases it's crucial to do your research before making any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important that you understand the different trading strategies available for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. It is important to understand the risks and rewards associated with each strategy before investing.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protection starts with yourself. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Never respond to unsolicited phone calls or emails. Fraudsters are known to use fake names. Do not respond to unsolicited emails or phone calls. Before making any commitments, thoroughly research investment opportunities independently.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Remember that scammers will do anything to obtain your personal information. Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

Also, it is important to invest online using secure platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.