Bitcoin is a digital currency that is decentralized and is not supported by any central authority such as a central bank, government or financial institution. Instead, Bitcoin is built on a highly secure public ledger called the blockchain. It is kept secret by many people. This makes transactions hard to reverse and difficult to fake. The blockchain acts as a trusted account book for all transactions, since it is not centralised. It also prevents coins from being spent.

Send the amount you wish for to be transferred from your digital wallet and to another person's account to make a transfer. The network will see your transaction. If you're using an online platform like a centralized exchange or a peer-to-peer service, your transaction will be immediately completed. It will take several minutes to complete a transaction if you use a peer-to–peer service.

The current price of a single Bitcoin is approximately $30,200. The value of one bitcoin can fluctuate greatly, especially in volatile markets. A platform that allows you limit orders may be a good option. These platforms usually require you to have an ID or social security number, a bank account, and proof of income. Some of these platforms allow you to leave your investment in the account until you are ready to sell.

Transactions can be made in person or through any other communication channel. Bitcoin transactions offer greater security than other forms digital cash. Because of this, it is recommended that you store your crypto safely. You should also keep your private key separate from any other information. Multiplying your passwords will protect you account.

Although the cryptocurrency market has been volatile, some investors have placed bets on its long-term success. There are many advantages to holding a crypto, but there are also many potential risks. Experts worry that it could become a criminal instrument. Other cryptocurrencies have been linked both to fraud and other illegal activity. Many companies are worried that they could become more popular with criminals.

Experts say that it is best to only buy and hold a crypto as part of your diversified portfolio due to its volatility. Although there is some risk involved, investing crypto is more affordable than traditional assets. And, as a result, some large investors have taken to using the alternative as a way to hedge against inflation.

There is no way to withdraw your crypto. This is a major difference from traditional investments. A crypto investment can be a wise move if it's your first venture. As with any other investment, you should make sure that you understand how it works before you buy.

Bitcoin is a great starting point if your goal is to invest crypto. There is still plenty of volatility in the market, but it is growing. Beginners should be sure to find a beginner-friendly platform that helps them calculate the current rate of the crypto before making a purchase.

FAQ

Trading forex or Cryptocurrencies can make you rich.

If you have a strategy, it is possible to make a lot of money trading forex and crypto. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Understanding the different currency conditions is crucial.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

How do forex traders make their money?

Forex traders can make good money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Which platform is the best for trading?

Many traders can find choosing the best trading platform difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It must also be easy to use and intuitive.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

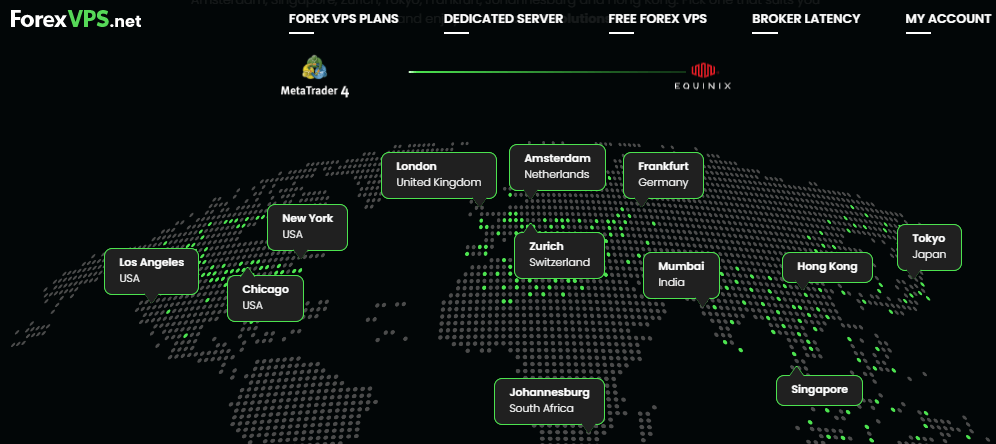

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Frequently Asked Questions

What are the four types of investing?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into preferred and common stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Which trading platform is the best for beginners?

It all depends on your level of comfort with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

You can also trade independently if your knowledge is good enough. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Where can I earn daily and invest my money?

Although investing can be a great investment, it's important that you know your options. There are many other investment options available.

One option is to buy real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Online trading is possible if you're comfortable with the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I ensure security for my online investment accounts?

Online investment accounts must be secure. It's essential to protect your data and assets from any unwanted intrusion.

You must first ensure that the platform you're using has security. Look for encryption technology, two-factor authentication, and other security measures that will provide maximum protection against potential hackers or malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Second, make sure you choose strong passwords to access your account and limit the number of sessions you log in on public networks. Avoid clicking on suspicious links and downloading unknown software. These can result in malicious downloads that could compromise your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

Thirdly, make sure you understand your investment platform's terms and conditions. Make sure you are familiar with the fees associated with investing, as well as any restrictions or limitations on how you can use your account.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. Finally, make sure you are aware of any tax implications associated with investing online.

By following these steps, you can ensure that your online investment account is secure and protected from any potential threats.