Both novice and experienced traders can find great resources on stock trading websites. They offer everything from stock market news, research, trading signals to options trades and even cryptocurrency. You can also practice with virtual trading accounts before you invest in real-money.

The best stock research sites can help you find the right stocks to invest in. These sites offer ratings and research reports as well as screening tools, which will make it easier to identify stocks that you like.

E*Trade

E*Trade is one of the oldest and most reliable stock trading sites around. It's an online brokerage that has been making trades online since 1983.

It also has a physical network of branches, which allows you to meet with financial professionals in person to discuss your goals. You do have to open an Account with them to get the most out of their services.

Although investing in stocks can seem daunting, it is possible to make a profit and have a rewarding experience. These stock trading sites are made to make it easy to get started building a portfolio and to teach beginners the basics.

WallStreetZen

This is a stock research website that has been created to make things simpler for beginner investors and those who are only part-time traders. It makes it easy to use simple screeners or charts to provide all the information needed to make informed decisions regarding a stock's performance.

There are also a number of podcasts, educational articles and other resources available to help you along your investment journey. These articles were written by experts and provide all the information that you need to better understand the stock market and make smart investment decisions.

Motley Fool

Since 1993, The Motley Fool has provided products and services for investors. You can track stocks and interact with other investors to build a portfolio.

Webull

Webull is a non-commission online stock broker. Webull provides extended hours trading, real time market quotes, customizable charts as well as multiple technical indicators. Webull can also provide analysis tools and other tools. The app on mobile makes it easy for you to place orders from anywhere and access your account.

It also has an option to deposit and withdraw money using ACH or micro-deposit verification.

Mindful Trader

You don't have to be an expert investor to trade online. This means you need to make sure that the website has accurate and current information. It also needs to keep its service updated as often is possible.

In fact, most of the research sites listed on our list of best stock trading websites provide trade alerts to their clients several times a day. This feature is important for your success in the stock markets, even though it is often forgotten by traders.

FAQ

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Also, you should only trade with money that is within your means.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Where can you invest and make daily income?

It can be a great method to make money but it's important you understand all your options. There are many other investment options available.

You can also invest in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio might be a good idea.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which trading platform is the best for beginners?

All depends on your comfort level with online trades. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

How Can I Invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need is the right knowledge and tools to get started.

First, you need to know that there are many ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. You may choose one option or another depending on your goals and risk appetite.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Frequently Asked questions

What are the 4 types?

Investing is a way for you to grow your money and possibly make more long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be broken down into common stock or preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

What is the best forex trading system or crypto trading system?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases it's crucial to do your research before making any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

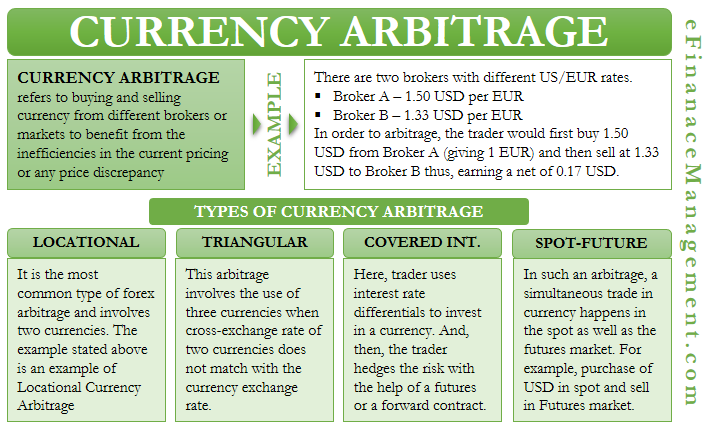

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it's important to understand both the risks and the benefits.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

When investing online, research is essential. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. Ask yourself if it's too good to be true and beware of claims that imply a guarantee of future results or substantial returns.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.