Tesla option prices dropped as analysts and investors reduced their estimates for Tesla's quarterly results. This cuts profit margins in the short-term and could cause shares to drop as CEO Elon Tesla reiterates his desire of closing a $44billion take-private deal for Twitter Inc. ( TWTR).

Tesla dropped pricing for most models, including its base Model S sedan, in January. The automaker said that its input costs have risen, which it expects will lead to higher vehicle prices in the short term. The cheapest listed Model S now sells for $99,990, down about $5,000, while the pricier Model X Plaid Plus model starts at $149,900, up about $10,000.

The company's Model 3 sedan and SUV, which are entry-level, is still on sale for $7500 federal tax incentive until the end. That's a huge deal for customers, as they would otherwise have to wait for delivery in the spring of 2020 to get the car at that price.

This is a positive sign for investors but it also means that the company will need to compete with established automakers such as Ford Motor Co ( F ), and General Motors Co( GM ), who offer more affordable models in this era of rising oil and gas prices. That's likely to have a negative impact on future earnings, however.

Tesla's share has fallen 40% from its July record high of more than $170. The stock has been plagued with a three to one split and plans by Twitter to buy it, which have also weighed on sentiment.

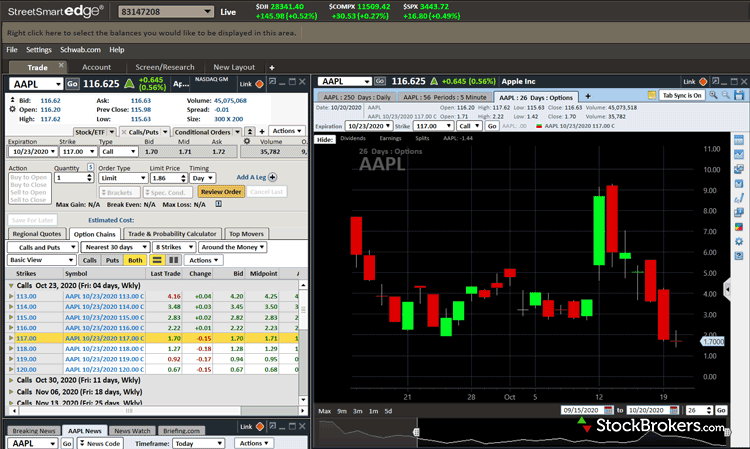

Trades in tesla options have become very popular in recent years. Speculators trade bullish call options and put options to hedge against the stock's price movements. Options traders have the potential to earn extra income by trading options. They can use any number of strategies.

1. Trade the Stock with a Strategy That's Based on the Market Trend

Tesla's shares are in decline throughout the year. Traders are hoping to capitalize on any rally as Tesla prepares to report earnings on Wednesday. This is why the market has been flooding the stock with volume, especially for bullish options which target a move after earnings.

2. Buy a Put to Lower Risk

To invest in Tesla stock, the best way is to buy put options. These options are typically sold in 100-share lots and allow the holder to sell the stock at a specific price in the future.

A put can be a great way of protecting your portfolio against future price drops and also help you to build your long-term position with the shares. However, it's important to note that buying a put can be risky, as it can cost you if you lose your money or fail to sell the stock at the desired price. You should only purchase a put if you have the funds to make a profit.

FAQ

Which is more difficult, forex or crypto?

Each currency and crypto are different in their difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

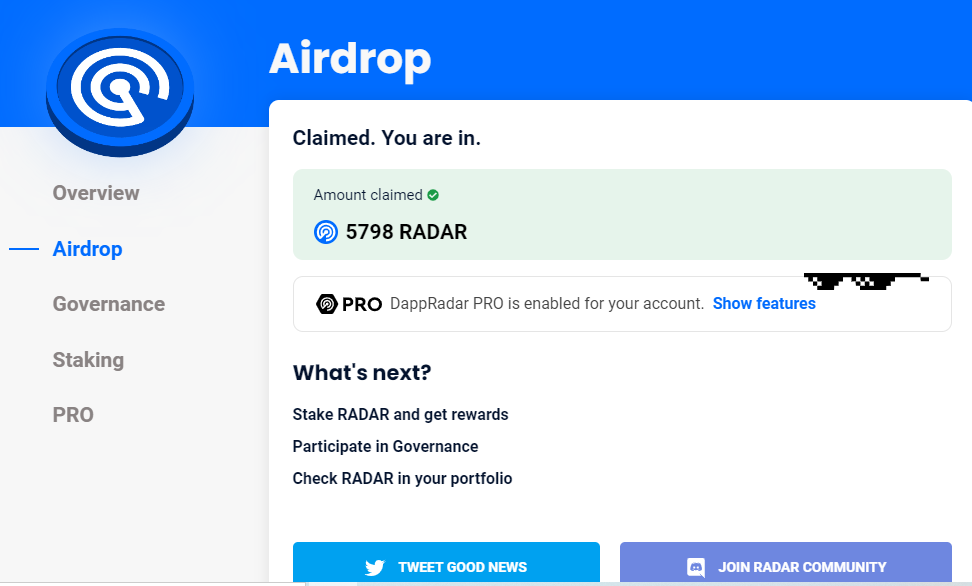

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which forex trading platform or crypto trading platform is the best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases, it's important to do your research before making any investments. Diversification of assets and managing your risk will make trading easier.

It is important that you understand the different trading strategies available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it's important to understand both the risks and the benefits.

Which trading website is best for beginners

It all depends upon your comfort level in online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

How can I invest bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. To get started, you only need to have the right knowledge and tools.

First, you need to know that there are many ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Can you make it big trading Forex or Cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. It is important to trade only with money you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How do I protect my online investment account from unauthorized access?

Online investment accounts are a matter of safety. It is vital to secure your assets and data against any unwelcome intrusions.

First, you want to make sure the platform you're using is secure. Make sure to look out for encryption technology and two-factor authentication. These security measures will give you maximum protection from hackers and malicious actors. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

It is also important to choose strong passwords that allow you to access your account. You should limit the number and time spent logging in to public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. Check your account activities regularly to be alert of any unusual activity.

Third, you need to know the terms of your online investment platform. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. Review and rate the platform and see what other users think. Finally, you should be aware of tax implications for investing online.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.