Trading oil futures requires a high level of skill, patience, and boldness. The rewards can be incredible, even though it does require a large financial reserve to get started.

Oil Futures Trading and Buying

You can trade oil futures online using a brokerage account managed by a professional futures broker. These markets are more volatile and risky than other commodities futures. Before you trade, be sure to exercise caution.

If you buy oil futures you are placing your bets on the rise or fall in crude oil price. This could be a position that is long or short depending on your preferences.

Crude oil is one of the world's most important and in-demand commodities. It is used in the production of a variety of products including gasoline and plastics.

There are many ways you can invest in oil. From buying ETFs to investing in shares of companies, to buying oil futures contracts. There are many ways to invest in oil, but oil futures remain the most popular.

Oil futures traders trade because they believe the price will rise over time. This belief is based upon the law of supply-demand, which says that oil demand will rise over time.

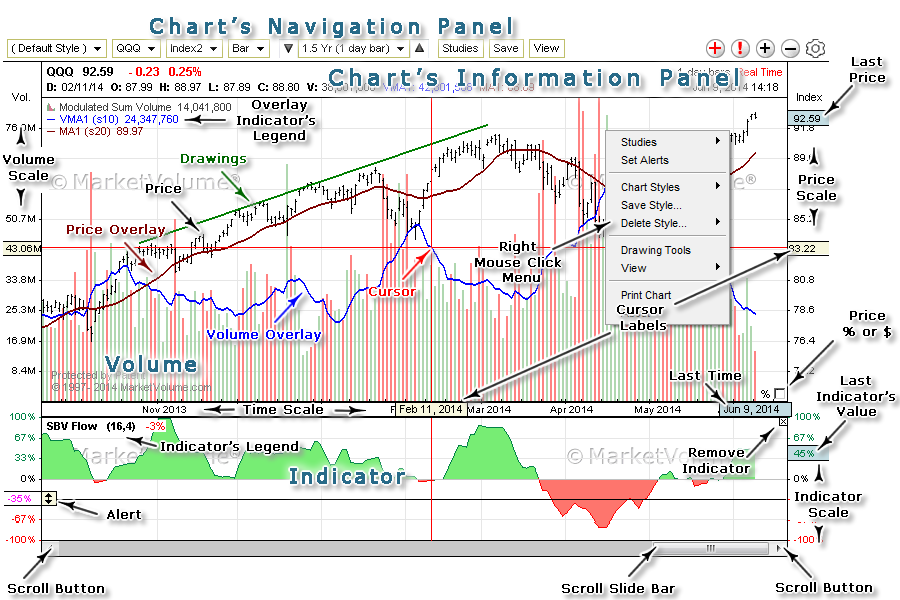

You can trade crude oil futures on the New York Mercantile Exchange (NYMEX) or the Intercontinental Exchange (ICE). Both exchanges offer electronic trading platforms so that you can trade from anywhere at any time.

The price of oil futures settles each month, which is unlike other commodities. Oil markets are highly volatile, and they tend to move rapidly.

The price of crude oil fluctuates with the world economy and political events. It is therefore important to monitor international news and events that may affect the price of oil.

You can use the price for natural gas to base your trades, in addition to the oil price. Day traders are fond of this strategy, which allows them to profit when the price fluctuates.

There are many factors that influence the price for natural gas. Traders have access to a variety of trading instruments. Options, swaps and other derivative instruments are just a few of these.

These markets give entities that have a high level of exposure to natural resources the ability to control or hedge their risk. The market gives them the option to purchase or sell a given amount of natural fuel at a time and date they choose. They can also be beneficial for investors who would like to trade in natural gases but don't want to wait on the open-market price changing.

There are many options for trading oil futures. Each one has its benefits and drawbacks. Many oil futures brokers provide a variety of tools and resources that will help you trade more efficiently. They provide oil futures quotes in real time, research, education, and other valuable insights. They offer world-class customer service and discount pricing.

FAQ

How can I invest bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need are the right tools and knowledge to get started.

The first thing to understand is that there are different ways of investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Frequently Asked Question

What are the different types of investing you can do?

Investing is a way to grow your finances while potentially earning money over the long term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into two groups: common stock and preferred stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which is more difficult, forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Which is better forex trading or crypto trading.

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

Both cases require that you do extensive research before investing. With any type or trading, it is important to manage your risk with proper diversification.

It is important to know the types of trading strategies you can use for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

Are my investments safe online? Or should I look into other options?

While money can be confusing, the decision to where it should be stored can be just as complex. There are many options to protect your valuable assets.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.