NFT-wash trading, which is a form market manipulation, has become more prevalent in the crypto space. This is a scam that traders use to artificially boost the NFTs value, and can rob innocent buyers of their hard-earned dollars.

These traders are known for using their wallets to purchase NFTs then selling them back on the exchange at a higher than what they originally bought. This is known as self-financing, and it can be a big problem for the community as a whole.

NFTs do not only have a unique identifier, but they also represent token ownership. This data is stored in a smart contract, which allows sellers and buyers to check the history of an NFT before purchasing it.

NFT Wash Trading is where sellers continuously trade a token with their wallets at a higher price and then record the activity in a smart contract. This gives the impression that the asset is in high demand, and drives up its market price, making it more attractive to buyers.

These transactions aren't expensive for sellers, as there are no gas fees. They can still make a lot of money by collecting token rewards that are worth more than the gas fees they pay.

As the cryptocurrency industry became more competitive, NFT marketplaces grew in popularity, enticing traders with token incentives. LooksRare or X2Y2 offer token incentives to entice users.

CoinGecko’s study revealed that token incentives are the key to NFT washing trading's recent growth. Blur for instance saw a triple-digit increase in wash trading after it introduced its native token $BLUR. The company also started running airdrop campaign.

The token incentive model works as follows: Each time a user trades or buys NFTs through a given platform they receive a payment in the form of a token. The trading volume of a user determines how much token they will receive.

While this can be a great way for traders to increase their token volume, it could also be used to defraud them. Avoiding this scam is easy. Make sure to store your NFTs securely in hardware wallets.

Another way to protect yourself against NFT frauds is to have multiple wallets, each with a separate address. You also need to make sure that you don't own too many NFTs. It can be difficult, especially for those new to crypto, to do this, but it is vital to protect your assets.

Although nftwash trading has been a major issue in the crypto sector, it should not go unresolved. This scam can have severe consequences for the entire community and all NFT platforms need to address it. To avoid this scam, it is essential to have strong tools to spot such transactions.

FAQ

Which is harder, forex or crypto.

Crypto and forex have their own unique levels of difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

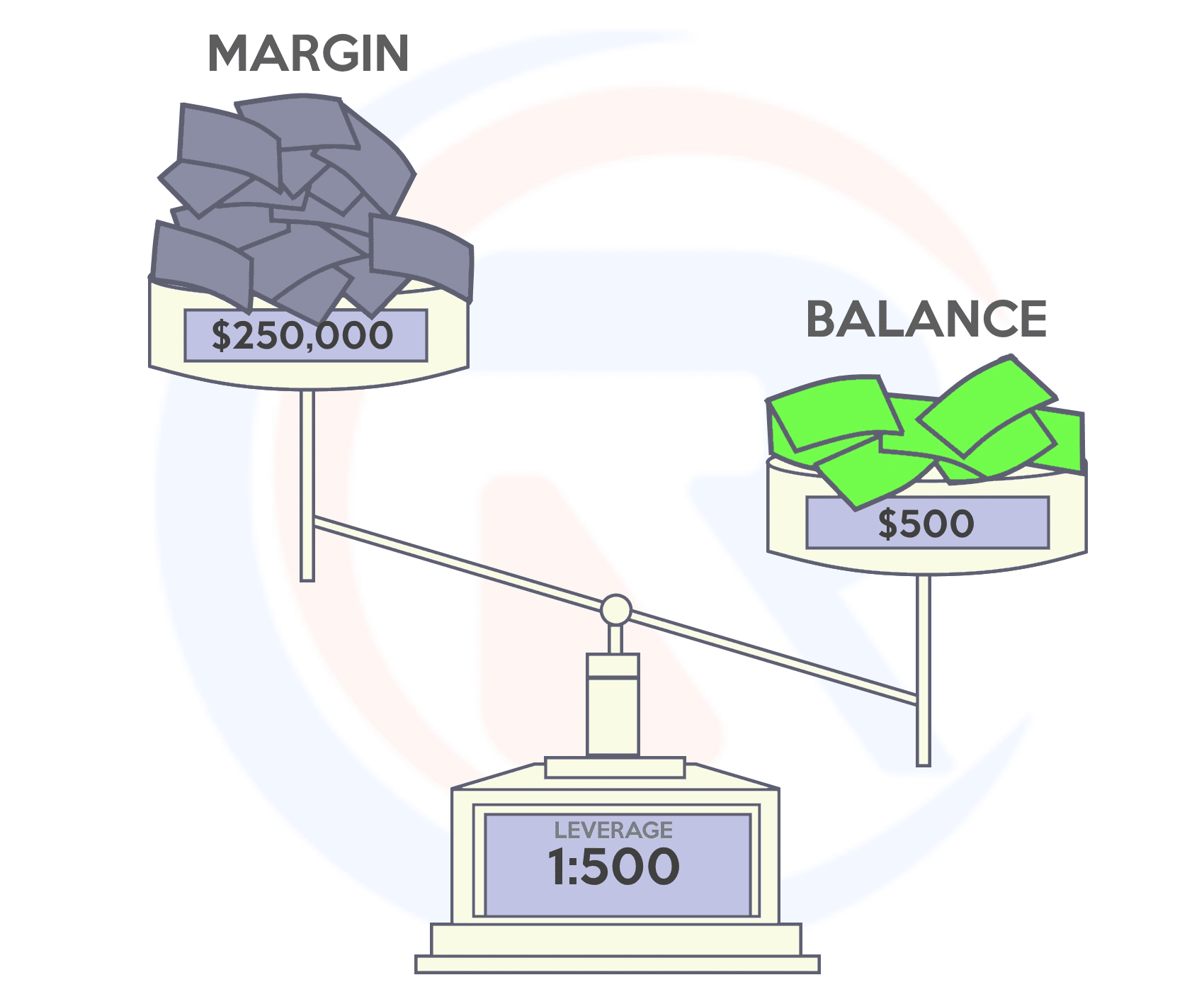

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. A good understanding of technical indicators is essential to identify buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Which trading website is best for beginners

It all depends on how comfortable you are with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which forex trading platform or crypto trading platform is the best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

Both cases require that you do extensive research before investing. Diversification of assets and managing your risk will make trading easier.

It is important to know the types of trading strategies you can use for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Is Cryptocurrency Good for Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Forex and Cryptocurrencies are great investments.

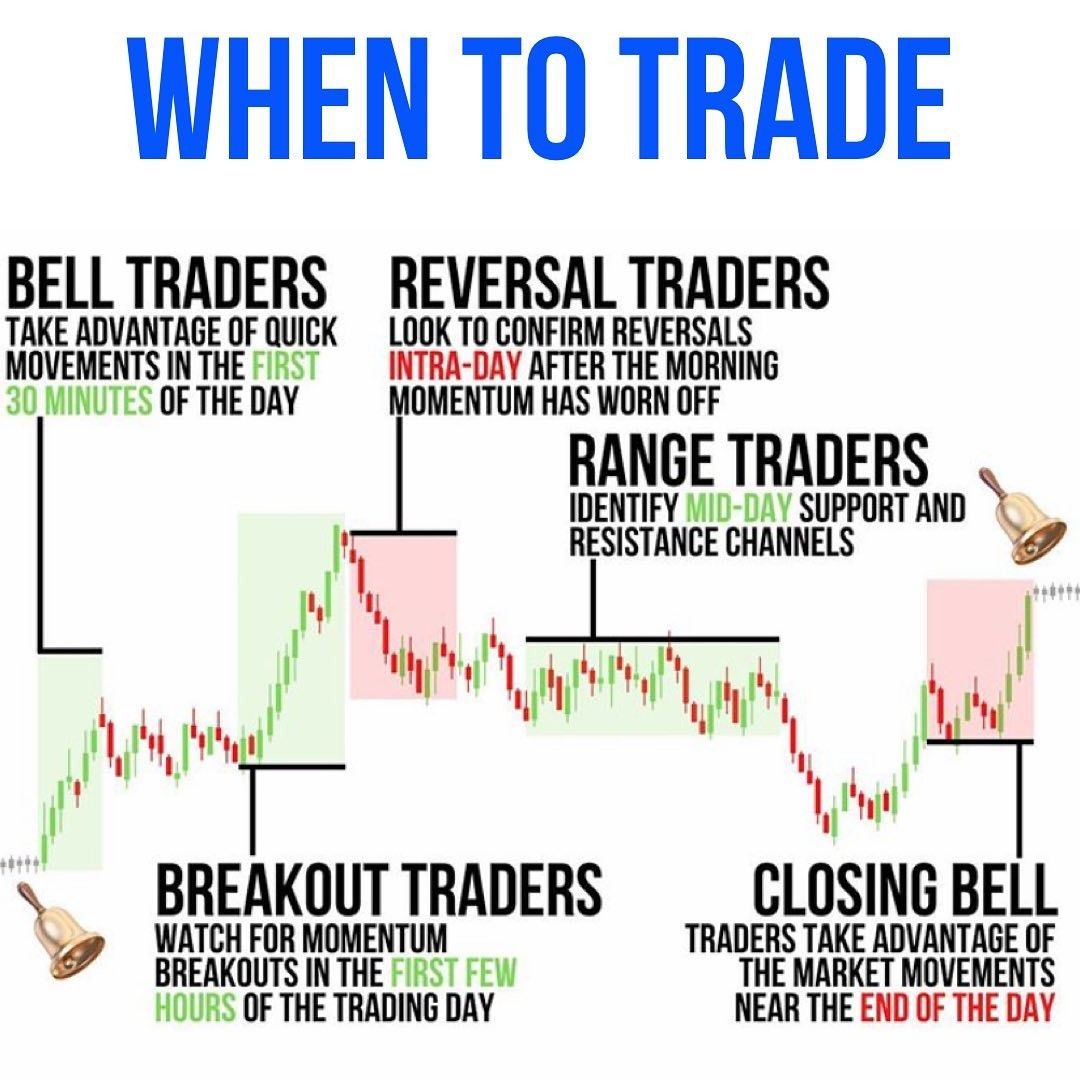

Yes, you can get rich trading crypto and forex if you use a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

It is important to do your research before investing online. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

You should understand the investment risk profile and be familiar with the terms. Before you open an account, check what fees and commissions might be taxed. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!