OTC stock can be used to describe a wide range of securities not listed on major stock exchanges. These investments can be risky. However, they can offer incredible returns.

OTC stock can help diversify portfolios. OTC stocks can be a great way for you to buy a small stake in a growing company at a very low price. But they have their limitations. They are vulnerable to fraud and scams because they are not properly regulated. These companies are more difficult to buy or sell because they are less liquid.

Investors love penny stocks because you can buy large quantities of shares at a low price. This is especially important for investors looking to make a quick profit. However, it could also cause big losses if the company goes under. To avoid losing money, do your research.

OTC trades are a way for businesses to avoid paying high listing fees on larger exchanges. This means that some companies might not be able to meet the listing requirements for larger exchanges. Companies may not have the capital to meet the float and volume requirements of a larger exchange. OTC markets offer lower entry barriers that can be attractive to firms that do not meet the strict requirements for mainstream exchanges.

There are several types of OTC stocks available, including penny stocks as well as mid-tier or mid-size companies and cryptocurrencies. Each OTC stock type has its own benefits and risks. A mid-tier stock can be a great choice for young and growing US companies. To make sure you are investing with a reputable and long-term company, it can be helpful to know the jargon of OTC stocks.

There are many types of OTC stock, however they are less well-known. One is the gray market, which is not an official OTC market but is a place to invest in smaller companies. Another option is the pinksheet, which allows you to sell stocks in a unique manner. These are more risky than other OTC options, even though they aren't regulated.

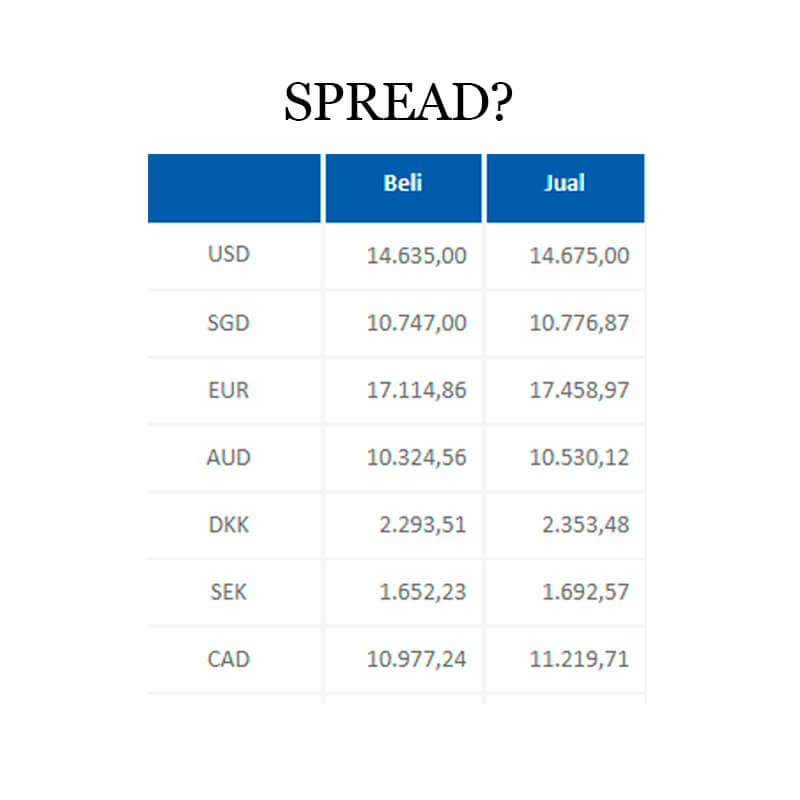

OTC stocks usually have wider bid/ask spreads, which is a departure from traditional stocks. The market size and the number of stocks that are available to trade affect the bid-ask spreads. It's easier for traders to manipulate prices when there are fewer stocks available. Stocks can be purchased at any price or you may need to wait for the stock to become available.

OTC trading is not as liquid or accessible as major stock exchanges, but it is still a viable option. It is a good way to diversify and even make a profit.

FAQ

Where can you invest and make daily income?

It can be a great method to make money but it's important you understand all your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is investing in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

What are the disadvantages and advantages of online investing?

Online investing has one major advantage: convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, there are some drawbacks to online investing. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

You should also be aware of the different investment options available to you when investing online. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

How do forex traders make their money?

Yes, forex traders can earn money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Trading forex or Cryptocurrencies can make you rich.

You can make a fortune trading forex and crypto if you take a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Which trading site for beginners is the best?

It all depends upon your comfort level in online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers provide interactive tools to show you how trades function without risking any money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Which is harder crypto or forex?

Forex and crypto both have unique levels of complexity. Crypto is more complex because it is newer and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

Money can be complex but so can the decisions about how to store it. A strong security system is essential for your valuable assets. There are several options.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. The downside is that there may be electronic thefts.

You can also keep your money in physical form like gold or cash, which is safer but requires more care and maintenance.

Another option is to keep your investments in traditional banking and investing accounts. You also have the option of self-storage facilities, which allow you to store valuables such as gold, silver or other precious metals safely outside your home.

You may also want to consider specialized investment firms offering secure custody services that are specifically designed to protect large asset portfolios.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?