Financial derivatives called gold futures give investors leveraged access to the short-term gold price. There are many options for buying and selling gold futures. Futures contracts can be traded, which expire at a specific date. This contract allows you buy or sell an amount of certain gold at a fixed price. To open a new position, however, you must first have the minimum capital.

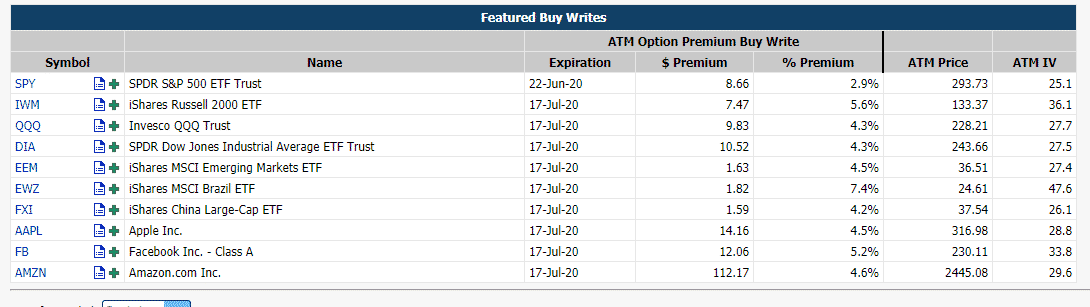

To trade gold futures you will need a broker. A broker is necessary to help you understand the market and decide when it's best to exit or enter a trade. There are a few different options available, such as Interactive Brokers, Charles Schwab and TD Ameritrade. There are also options such as ETFs, mini-gold and futures.

The Chicago Mercantile Exchange lists gold futures and they can be traded 24 hours a days, five days a semaine. E-mini futures and micro gold options can also be traded. These provide liquidity and offer a more flexible trading experience.

Trading gold futures requires a brokerage account and computing power. There is a small upfront fee to open a gold options position. Commissions are possible depending on the order size. You can also access markets through thinkorswim which is a web browser-based software suite. The platform offers custom charting, screeners, and economic indicators. It is also available via Android and iOS apps.

Speculators are a major influence on the gold short-term market. They are usually bearish on gold markets. Therefore, you should be prepared for some choppy trading action and lackluster performance. The summer months are when gold is at its weakest. These periods last from July through August.

The best hedge against inflation is gold. The global demand for the metal and the supply fluctuate the gold price. Currency inflation is something traders need to monitor in order to make an informed choice.

It's very easy to purchase and sell futures of gold. All you need is to be familiar with the rules. As with any investment, be prepared for potential catastrophic losses. You may lose all of the capital you have invested if you lose.

One point change in gold prices may be worth as much as $100. This means that you will have to have a lot of capital to make a profit on the trade. It is also important to keep an eye on the volatility of gold futures. If you are looking to hedge against risk, investing in futures markets can be an excellent option.

A profitable way to manage volatile financial conditions is to buy and sell gold futures. Be aware that defaulting is possible. The short-term gold price is influenced so heavily by speculators, that you should be prepared to make trades to maximize profits. You should also remember that gold is not a commodity you can hold for the long-term.

It does not matter if your trades are in gold futures, or any related commodity. It is crucial to keep track of market sentiment and trends. An abrupt rise in gold prices can lead to a new long-term buying frenzy. A sharp drop in gold's price can cause traders to leave the markets.

FAQ

Frequently Asked Questions

What are the four types of investing?

Investing can be a great way to build your finances and earn long-term income. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be broken down into common stock or preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Which is best forex trading or crypto trading?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading is easier than investing in foreign currencies upfront.

However, crypto trading can offer a very immediate return due to the volatility of prices. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases, it's important to do your research before making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to know the types of trading strategies you can use for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Which trading site for beginners is the best?

It all depends upon your comfort level in online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

You can also trade independently if your knowledge is good enough. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Where can I earn daily and invest my money?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

One option is to buy real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio might be a good idea.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Online trading is possible if you're comfortable with the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

How can I invest Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! All you need are the right tools and knowledge to get started.

There are many options for investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, research any additional information you may need to feel confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Which is more safe, crypto or forex

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I ensure that my financial and personal information is safe when investing online?

Online investments require security. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

Begin by paying attention to who you are dealing on investment platforms and apps. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

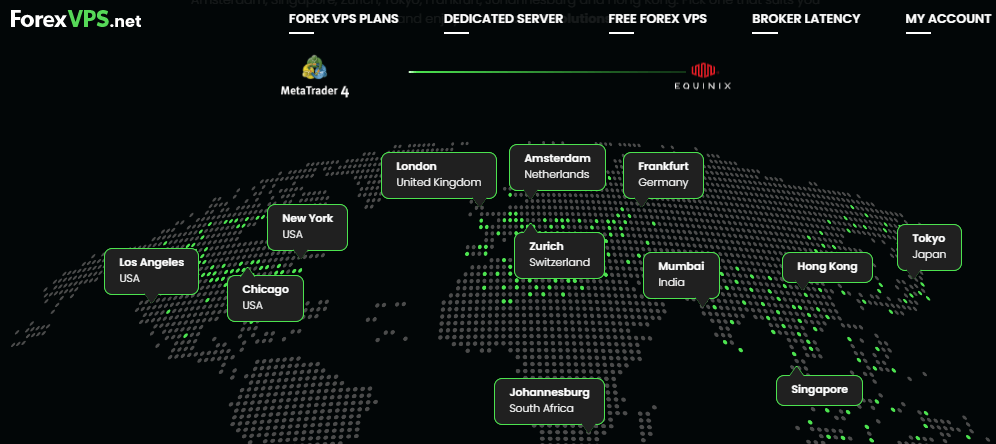

To ensure only trustworthy individuals have access to your finances, delete all bank applications from outdated devices. Also, change passwords every few months. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. Also, you should use different passwords on each account to ensure that any breach in one doesn't cause others to be compromised. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!