Stock charts are an excellent tool for monitoring the market and identifying trends. You can compare the prices of different stocks or identify support and resistance levels so you can make trades.

Stock Ticker Online

Stock data can be accessed on some websites in real time. This is useful for traders who need to monitor a stock's performance throughout the day. However, a good stock ticker isn't just about prices; it also shows volume and other factors that can affect a stock's value.

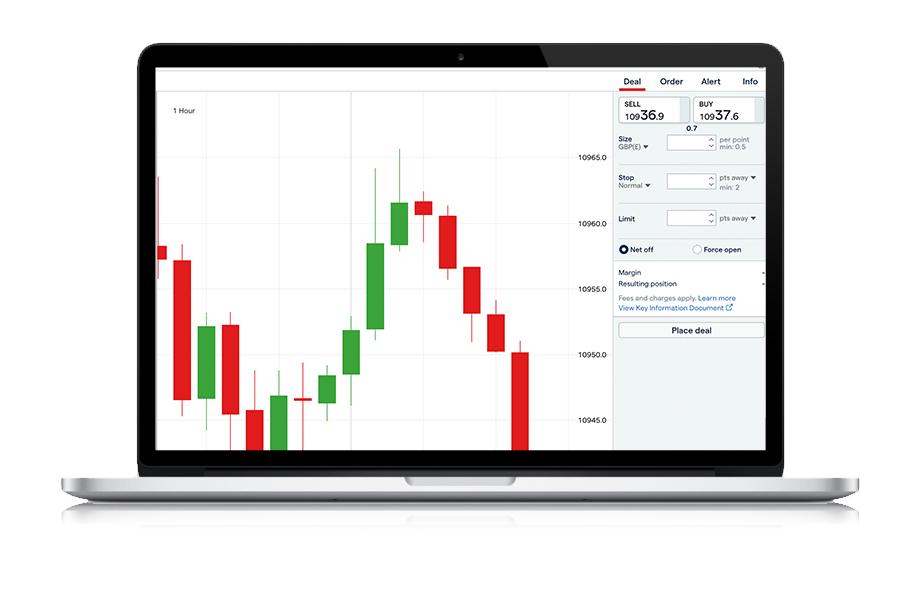

Best Online Stock Charts

Stock charts that are clear and concise give a clear view of financial data including volumes, prices, sentiment, and volume. They are customizable and simple to read.

Yahoo Finance is an excellent stock charting site for those who are interested in analyzing the markets. The website allows you to see a stock's historical price movements and draw trend lines, linear regressions, and quadrant lines on interactive charts.

Finviz is another good option for those who want to use online stock charts. It is clean and easy to use. You have enough time to see trends and patterns in the initial chart, which goes back nine months. It has a lot of technical indicators, from OBV, RSI, and Bollinger Bands to Fibonacci Fans and Andrews Pitchfork.

Best Free Stock Charting Sites

There are several different free stock charting sites that you can use, but the best ones are those that combine a variety of tools and features. You should have many options for charting and technical indicators.

TradingView

It offers an extensive range of technical indicators and drawing tools. There are also a number of chart types. The real-time charts are extremely fast and the PRO plan offers great value for advanced users.

TC2000

TC2000 allows you to trade all US stocks and options. The software lets you plot option chains as well as bid/ask numbers to show the relationship between the stock's price, and its options.

Google Finance

While the website isn't as slick as some of the others, it offers a simple interface and plenty of data for its free charts. To access intraday stock chart data, the site requires that you upgrade to a paid plan.

Google Finance, a free mobile trading app that tracks and trades US-listed securities, is also available. Because there are no commissions, this is a great way to learn how you can trade on a limited budget.

Yahoo Finance

This charting and news website may not be as advanced or as well-designed as the others, but it's still a great option for anyone interested in market analysis. You can also view the 200-day and 50-day moving averages, as well as a comparison symbol that allows you to compare other instruments.

FAQ

Which is safe crypto or forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

How can I invest bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! To get started, you only need to have the right knowledge and tools.

There are many options for investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, research any additional information you may need to feel confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Which trading site is best suited for beginners?

All depends on your comfort level with online trades. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Which trading platform is the best?

For many traders, choosing the best platform to trade on can be difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It must also be easy to use and intuitive.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down the search for the right platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

How do forex traders make their money?

Yes, forex traders can earn money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Forex and Cryptocurrencies are great investments.

If you have a strategy, it is possible to make a lot of money trading forex and crypto. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Knowing how to spot price patterns can help you predict where the market will go. It is important to trade only with money you can afford to lose.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. A solid knowledge of the conditions that affect different currencies is essential.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

When investing online, research is essential. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. You should also be alert for industry restrictions and regulations that might apply to your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Conduct due diligence checks to make sure that you're receiving what you paid for. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.