When you're investing in cryptocurrency, you have to be ready for volatility. A cryptocurrency's price can fluctuate quickly and could change significantly in just a few hours. You may not be able sell your cryptos for a profit if you are not prepared. This can result in a large loss.

Make sure you have everything in order before you start investing in cryptocurrency. You should have an emergency fund and a portfolio that is diverse. Maintaining a healthy credit rating is important. A drop in your credit scores can cause major harm.

Cryptocurrency investments can provide you with a high return, but they are extremely risky. To minimize this risk, you need to be educated. Learn more about the topic by reading white papers and articles. These will give an idea of your investment case and potential risks. Before you open an account, make sure to do your research.

Lack of regulation is one problem with crypto. While a lot of cryptocurrencies are backed by cash flow or a hard asset, there are still plenty of them that are not. You should be ready for large losses because the crypto market can be volatile.

You must understand the tax implications when investing in crypto. You will pay capital gains taxes if you are a US citizen for any profits made from crypto investments. But this is just one of the risks. There are many scams in the industry that can be dangerous.

You should also consider security before investing. You should be cautious when investing in cryptocurrency exchanges. You should verify that the exchanges you are interested in offer secure storage.

Other risks include privacy issues. Unlike stocks, cryptocurrencies cannot be regulated, so you'll need to protect your personal information. It's recommended that you use a hardware wallet, which is more secure. In addition, keep up with the developments of your cryptocurrencies.

You should also consider the possibility of falling short of your financial obligations. This could result in repossession, or even foreclosure, which can impact your credit score.

It can be a good investment to buy a new coin, but not too many. The impact of a 10% drop on the price of a coin is much greater than that of a 95% decrease. The same goes for selling coins early, which can result in a large return.

It can be a good way to diversify investments, but crypto investing is not for everyone. Particularly if you don't know much about the industry, it is important to take your time to learn more. Your first step is to find a trusted educational source.

Once you are familiar with the industry, you will be able to begin looking for a job. Make sure you do your research before you start to create a plan. Don't be afraid to talk to others, since they can give you an unbiased view of the market.

FAQ

What is the best trading platform for you?

Many traders find it difficult to choose the right trading platform. It can be overwhelming to pick the right platform for you when there are so many options.

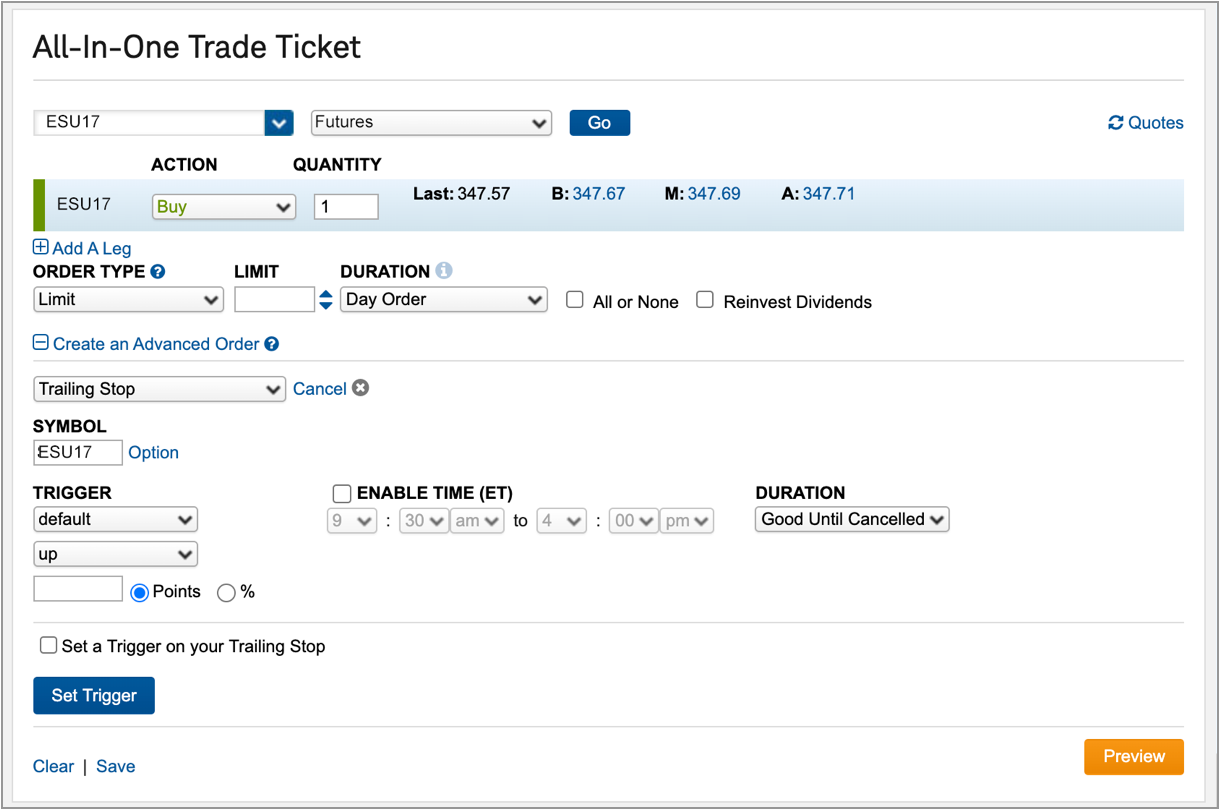

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. The interface should be intuitive and user-friendly.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down your search to find the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

What are the disadvantages and advantages of online investing?

The main advantage of online investing is convenience. You can manage your investments online, from anywhere you have an internet connection. Online trading is a great way to get real-time market data. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, there are some drawbacks to online investing. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

When considering investing online, it is also important that you understand the types of investments available. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Where can I find ways to earn daily, and invest?

Although investing can be a great investment, it's important that you know your options. There are many other investment options available.

You can also invest in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Is Cryptocurrency a Good Investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

You can also make a profit if your risk is taken and you do your research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Which trading platform is the best for beginners?

Your level of experience with online trading will determine your ability to trade. You can start by going through an experienced broker with advisors if this is your first time.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Do forex traders make money?

Forex traders can make a lot of money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading is not an easy task, but it can be done with the right knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What precautions can I take to avoid investment scams online?

Protection starts with you. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Do not answer unsolicited emails and phone calls. Fake names are often used by fraudsters. Never trust anyone based solely on their name. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Don't forget to remember that "Scammers will attempt anything to get personal information." Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

Secure online investment platforms are also essential. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before you make any investment, read and understand the terms of any website or app that you use.