Equity is the term that describes the value of money or property owned or controlled by an individual or entity. It is usually determined by the market price of the company. The equity value for a company can fluctuate throughout a trading day. Equity can be used to raise capital by investors. Investors may earn a profit if the company grows. However, equity can also be applied to other financial situations.

Equity can be defined depending on context as either a percentage of ownership or an investment. Stocks, property, and any other assets can represent equity. Add up the liabilities to get equity. A positive balance means that a business owner is able to have more assets than debt. This can be a fantastic way to grow a company.

Shareholders' equity is the portion of a company's value held by shareholders. One example is that a brother and sister own half of a bakery. Each of them have taken out loans to help start their businesses. Now the business has a net worth of around $800,000 and total assets of $120,000. Their shares can be sold for $25,000 each using this number.

Another company can be acquired by an investor using equity. A company with a greater book value than its equity value is considered a solid buy. Although equity can be hard to gauge, investors can have a valuation done to estimate its market value. A company's ownership rights can be bought and sold to raise capital.

Another popular way to measure equity, is to use the accounting equation. You add the net earnings from a company to subtract the liabilities to calculate equity. Retained earnings are an important factor when calculating shareholder equity. The retained earnings increase as a company invests its profits in its operations. These accumulated earnings eventually surpass the equity in the company. These earnings are then used to create stockholder equity.

Ownership equity is the last claim against a business's assets. Ownership equity is the money left after a business disintegrates. This is also known as risk capital. It is the last claim on a business’s property. It is not easy to raise this amount. It is possible increase ownership equity simply by increasing the number or shares. This increases ownership percentage, but it may also require more money.

Regardless of how the business owner measures the equity of a company, there are many factors that can affect the value of a company. The amount of the company's book value, its projected growth, and the corporate stage are all important in determining the equity value of a business. A company's equity value can be affected by a small trading volume.

Equity can be used for measuring the value a single piece or an entire company's stock. Equity can also be used to measure the value of inventory, the value of a single stock issued by a business, and the value of any other assets.

FAQ

Which platform is the best for trading?

Many traders can find choosing the best trading platform difficult. It can be overwhelming to pick the right platform for you when there are so many options.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Demo accounts and free trials are a great way to test virtual money before investing any real money.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. Understanding these factors will help narrow down your search for the best trading platform for your needs.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Forex traders can make money

Forex traders can make good money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is crucial to find an educated mentor before you take on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which is safe crypto or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Is Cryptocurrency a Good Investing Option?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

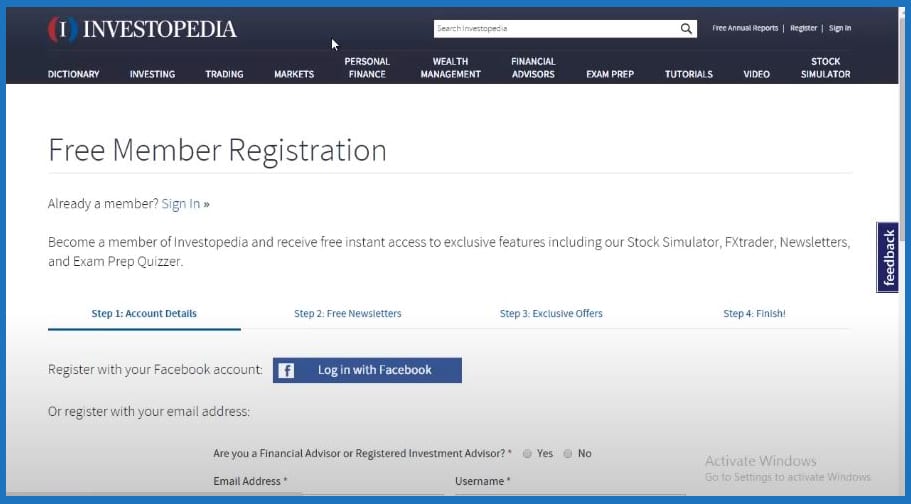

Which trading platform is the best for beginners?

It all depends upon your comfort level in online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many offer interactive tools to help you understand how trades work.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Which is harder crypto or forex?

Both forex and crypto have their own levels of complexity and difficulty. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

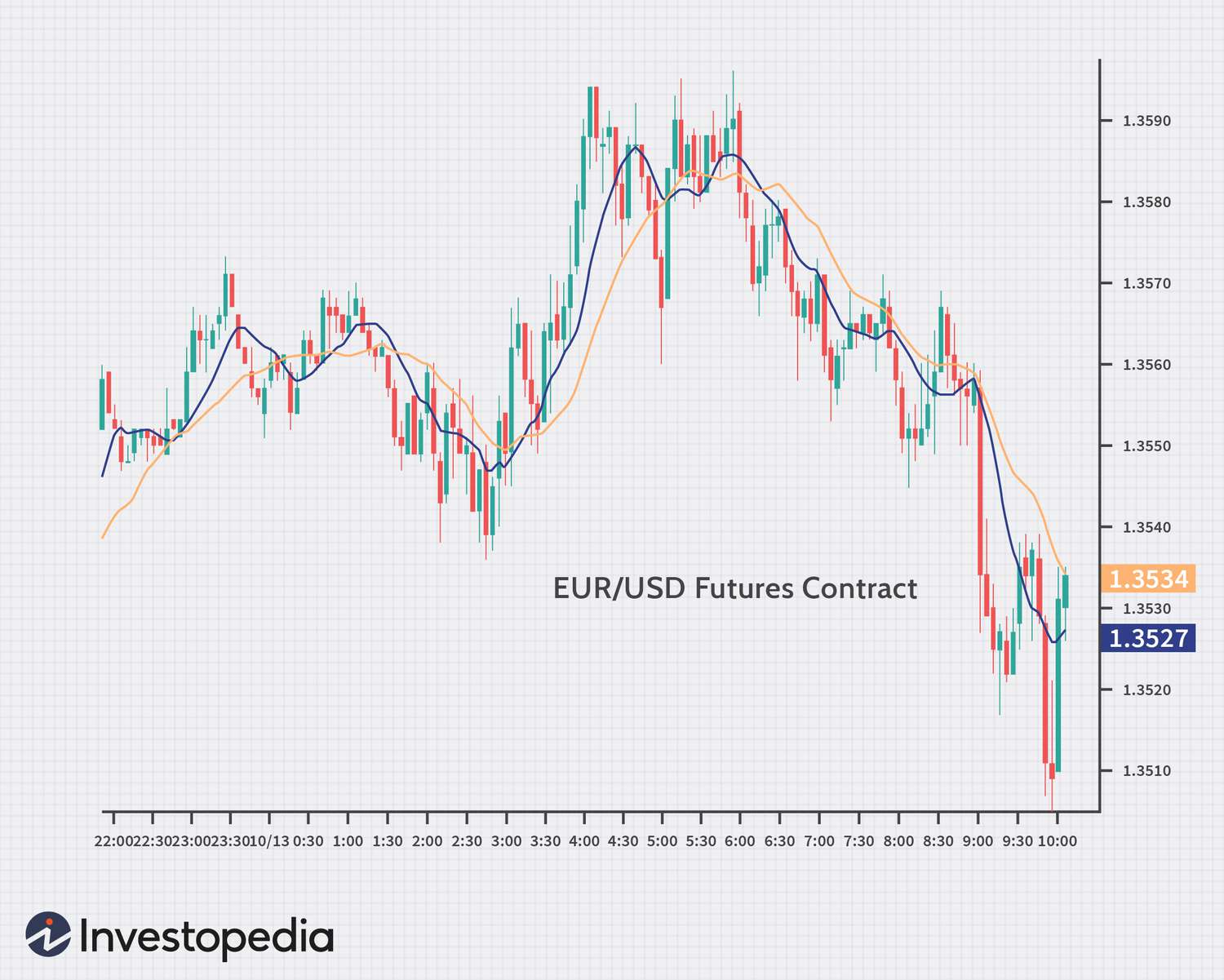

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. A good understanding of technical indicators is essential to identify buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protection starts with yourself. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Never respond to unsolicited phone calls or emails. Fraudsters are known to use fake names. Do not respond to unsolicited emails or phone calls. Before making any commitments, thoroughly research investment opportunities independently.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Never forget that scammers will try any means to steal your personal data. Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

It's also important to use secure online investment platforms. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.