There are many options to choose from if you're looking to invest in cryptocurrencies. It isn't as simple as it sounds to choose the right cryptocurrency for you. It is important to do your research so that you can make the best decisions for your particular situation.

Because cryptocurrency offers so many benefits over traditional investments, it's a great place to invest. It is also more cost-effective and easier to store. In addition, the cost to purchase and sell is minimal. It can also be used to pay directly. It can also serve as a portfolio asset. Cryptocurrencies are a great investment option, whether you're looking for a high-return or something to hold on to,

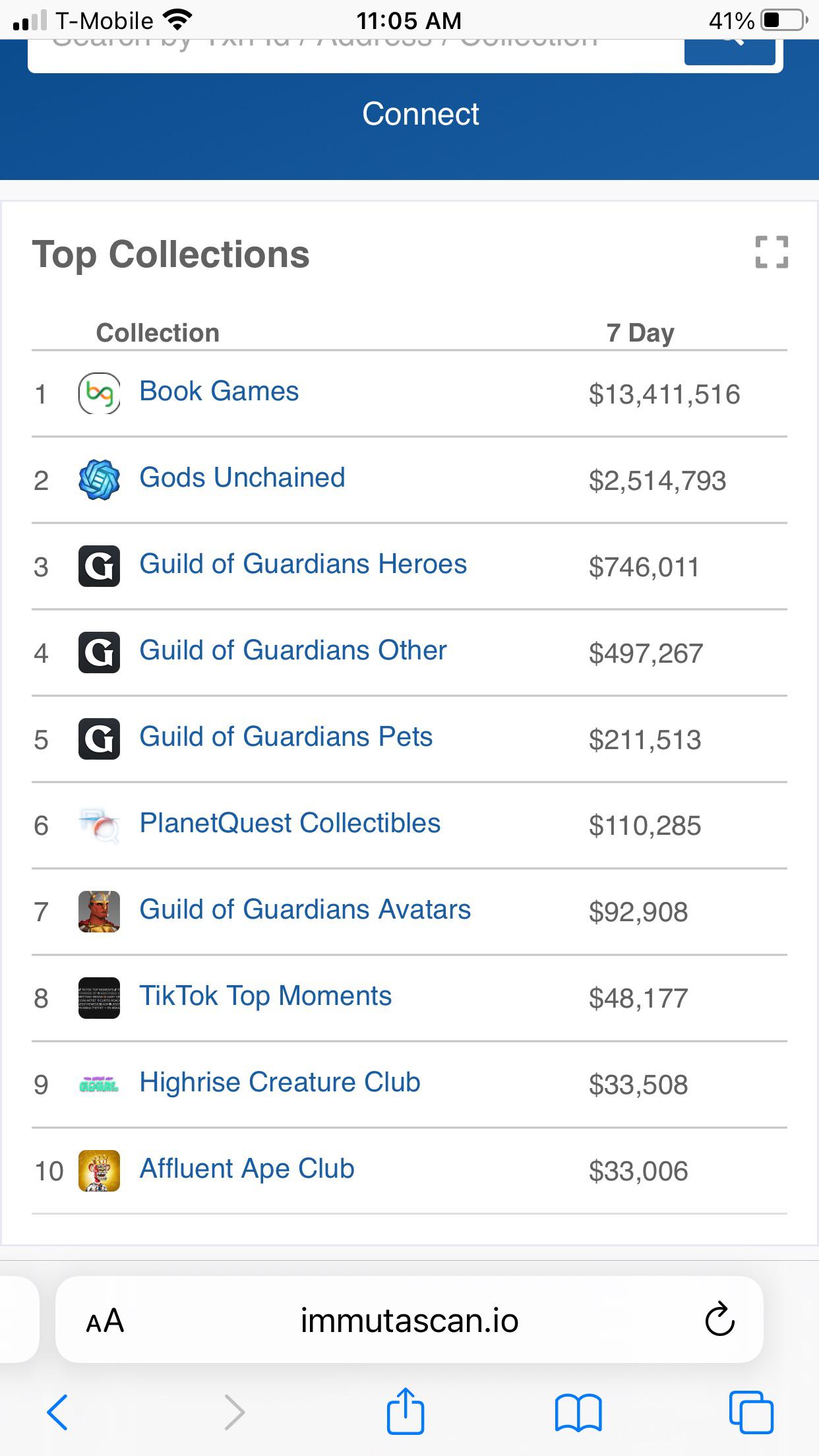

One of the most exciting things about investing with cryptocurrencies is that you can trade on more than 1000 different exchanges. There are over 10,000 different cryptocurrency options on the market, making it difficult to choose one that best suits your needs.

The best short term cryptos will be those that offer more than an attractive novelty. These digital currencies have a well-established brand and are widely used. They may also have a higher upside than their lesser known counterparts. XRP is one example. It has experienced a significant increase in value in the last few months. This is largely due to the increasing popularity of the derivatives industry.

The opportunity to collect these assets is worth it, even though the cost of one coin may not be very high. There is also a lot of risk involved. As such, it is important to only invest what you can afford.

The best crypto has a solid foundation in technology, entrepreneurship and both. It should have strong community connections and be able develop innovative products and service. Consider also the best crypto exchanges and market values of the cryptos you're interested in.

Not only is the best crypto the one that you want to purchase, but there are many options. Every investor's goals are different, so it is crucial to make the best choice for you. Here are six cryptocurrencies to consider.

Of course, no one can predict what will happen in the future. If you're willing to take the risk, your favorite crypto might have a lot of opportunities in the future. When building your portfolio, be aware of potential scams that can put you in trouble.

Another great fact is that you have the option to use a smart contract for controlling the transaction. A third interesting fact to consider is whether your cryptocurrency can be considered carbon-negative. Hedera Hashgraph is one of the few coins that claims to have zero carbon footprint.

FAQ

Do forex traders make money?

Yes, forex traders can make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading is not an easy task, but it can be done with the right knowledge. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Which trading site for beginners is the best?

It all depends on how comfortable you are with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

How can I invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You just need the right knowledge, tools, and resources to get started.

There are many options for investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. To stay on top of crypto trends, keep an eye out for market developments and news.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Cryptocurrency: Is it a good investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

What are the disadvantages and advantages of online investing?

The main advantage of online investing is convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing has its limitations. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Some investments may also require a minimum investment or other restrictions.

Which forex trading platform or crypto trading platform is the best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

Both cases require that you do extensive research before investing. Diversification of assets and managing your risk will make trading easier.

It is important to know the types of trading strategies you can use for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

Although money can seem complicated, it is also difficult to make the right decisions about where and how to store it. A strong security system is essential for your valuable assets. There are several options.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

You might also consider looking into specialist investment firms that provide secure custody services, specifically tailored to protect large asset portfolios.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?