There are many factors to consider when choosing the best crypto exchange to trade day. These factors include the platform's functions and user-friendliness as well as its ease of use. Some platforms provide traditional asset trading services while others specialize in the trading of cryptocurrency.

The best crypto exchange is the one that you like and meets your requirements. Fortunately, there are hundreds of options available online. Each platform has its unique set of features. It can be difficult to choose the best one for you, but it is worth looking at some of the top contenders.

Bitstamp is an established crypto-trading site. The app and the web interface for Bitstamp are both excellent. You can trade with more than 50 currencies on the platform. There are many features and tools available. There are also robust security features.

Gemini ActiveTrader offers high-performance trading platforms that offer a variety of order types and auctions. Its advanced functionality includes a microsecond-level execution and customizable charts, which are useful for day traders looking to hone their skills. And the platform is not just for beginners; advanced users can leverage advanced crypto derivatives, including futures.

Kraken is a well-recognized cryptocurrency trading platform. The fees are very reasonable. A $10 minimum deposit is required to open an account. Additionally, the platform supports many cryptocurrencies. There are no minimum deposit requirements and users can withdraw their funds using a variety of methods, including debit and credit cards and bank wires.

Coinbase, a digital currency platform that offers all-in-one access to hundreds cryptocurrencies and fiat currencies, is a one-stop shop. It is simple and quick to get started, and you can trade in just minutes. A feature-rich trading platform features multiple trading levels. The platform allows users to trade in native currencies or to choose from a USD spot currency. They provide strong security, as well as a dedicated mobile app for trading. They also have a San Francisco office, which makes it convenient for US traders.

eToro is another well-known platform for crypto trading. eToro offers support for dozens if crypto-cross pairs and also accepts a variety o payment methods like Neteller, PayPal, WebMoney. It offers up to $100 in USD withdrawals free of charge and allows you purchase cryptocurrencies as low as $10. Its spread-only pricing model offers some of the lowest transaction charges on the market. Users who need to sell and buy in a hurry may find the fees quite expensive.

Coinbase's liquidity is a key feature. For a modest fee of 0.1%, the exchange also allows users to trade in fiat currency pairs. Coinbase offers one the most convenient and efficient ways to trade cryptocurrency assets.

FAQ

Which is harder, forex or crypto.

Crypto and forex have their own unique levels of difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

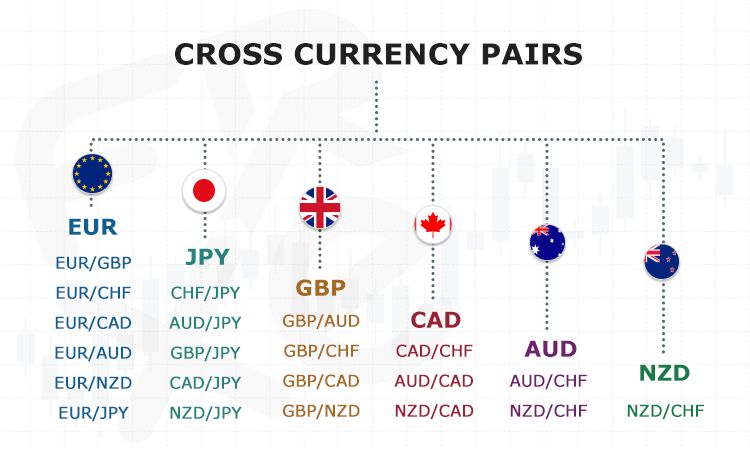

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Are forex traders able to make a living?

Forex traders can make a lot of money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which trading site is best suited for beginners?

It all depends upon your comfort level in online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

What is the best forex trading system or crypto trading system?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both instances, it is crucial to do your research prior to making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

Understanding the various trading strategies for different types of trading is important. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Where can i invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. There are other ways to make money than investing in the stock market.

One option is investing in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. If you are comfortable with the risk, you can trade online using day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

When you invest online, it is crucial to do your homework. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Before opening an account, confirm the exact fees and commissions on which you might be taxed. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.