Axie Infinity, a gaming ecosystem that is decentralized and scalable, can be found here. Players can participate in turn-based battles and earn digital tokens through gameplay and contributions to the ecosystem. This game uses Ronin sidechain tech to reduce network latency and is built on Ethereum blockchain.

The AxieInfinity token, a digital asset, can be traded on major exchanges. However, there are important factors to consider before deciding to invest in the platform. These factors will assist you in making an informed decision. Here are a few.

Volatility is one of the greatest problems with cryptocurrency investing. Investors do not have any protection against losses and there is no protection for the consumer. This means that investing with cryptocurrencies is not right for every investor. Axie Infinity, while a promising investment option, may not be the best for all investors.

You should also consider inflation. The AXS Token is currently trading at $258,410,901 within the last 24 hour, with an average price around $0.10. This could rise and investors need to be aware of the potential risks involved in investing in the cryptocurrency market. It is impossible to predict the future price of the Axie Infinity coin based on historical data.

Axie Infinity's peak value could lead to gamers abandoning the platform. The platform may see a short-term rebound. The profit potential and price of Axie Infinity will decrease if there is less demand.

It is also important to understand that Axie Infinity is not the only game in the Ethereum space. Many other games offer revenue-generating possibilities. Yield Guild Games for DAO-lending Axies is an example. Players can use it to earn tokens. These are a great way for passive income.

Also, consider the time that you are willing and able to spend on the platform. While many gamers enjoy playing the game to earn tokens and it is popular, it can be challenging for beginners. Consider other options if short-term investments are what you want.

Axie Infinity is a game inspired by the Pokemon series. It is animated fantasy creatures called Axies. They can be bred and used in different battles to earn Smooth Love Potion (SLP) tokens. These tokens are available for sale at an exchange or can be traded for in game items.

AxieInfinity was a successful cryptocurrency project. But there are several downsides. Some of these include extreme volatility and a lack of historical data to determine the future value of the Axie token.

Two currencies are used to build the ecosystem of AxieInfinity: the Axie token as well as the Smooth Love Potion token. The Axie token has a lifetime value and can be traded at any time. But the SLP is essential to the game's success.

FAQ

How can I invest bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You just need the right knowledge, tools, and resources to get started.

First, you need to know that there are many ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Trading forex or Cryptocurrencies can make you rich.

Trading forex and crypto can be lucrative if you are strategic. You need to be aware of the market trends so you can make the most of them.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. It is important to trade only with money you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

What are the advantages and disadvantages of online investing?

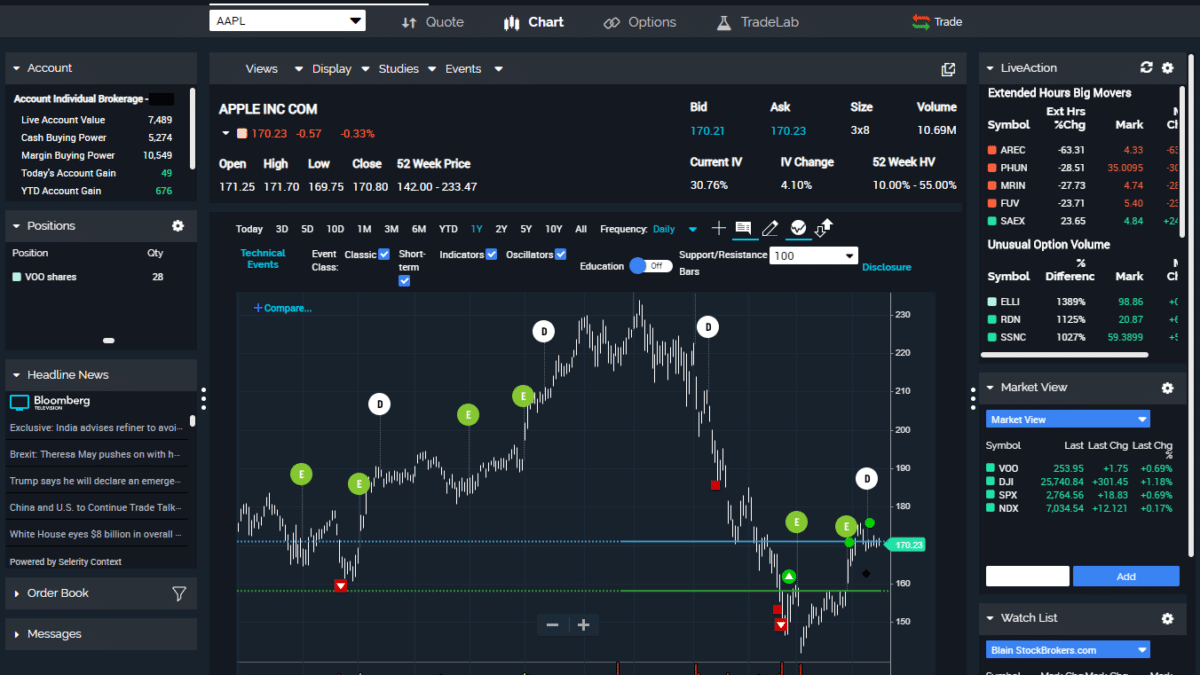

Online investing is convenient. With online investing, you can manage your investments from anywhere in the world with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing comes with its own set of disadvantages. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

When considering investing online, it is also important that you understand the types of investments available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There might be restrictions or a minimum deposit required for certain investments.

Which is harder crypto or forex?

Both forex and crypto have their own levels of complexity and difficulty. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. A good understanding of technical indicators is essential to identify buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Is Cryptocurrency a Good Investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Most Frequently Asked Questions

What are the different types of investing you can do?

Investing can be a great way to build your finances and earn long-term income. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be divided into preferred and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I ensure security for my online investment accounts?

Online investment accounts require security. Protecting your assets and data from unwanted intrusion is essential.

First, you want to make sure the platform you're using is secure. Look for encryption technology, two-factor authentication, and other security measures that will provide maximum protection against potential hackers or malicious actors. A policy should outline how personal information shared with them will be managed and monitored.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. Check your account activities regularly to be alert of any unusual activity.

Thirdly, it's important to understand the terms and conditions of your online investment platform. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourth, be sure to research the company where you plan on investing. Check out user reviews and ratings to get an idea of how the platform works and what other users have experienced. Make sure to understand the tax implications of investing online.

Follow these steps to ensure your online account is protected from potential threats.