After hours trading is a trading option that happens outside of normal trading hours. It is open both to institutional and retail investors. However, there are fewer participants than usual during regular market hours. It is therefore more volatile and less liquid. The spreads can also be wider. Traders will need to use a limit-order when entering a trade.

Even though there are risks associated with trading after hours, there are some benefits to taking advantage of these opportunities. If you are an experienced trader, you may find that this market offers opportunities you wouldn't otherwise be able to access. If a company is affected by new legislation, for example, you might be able to buy or sell stocks. These events can have a major effect on the stock price when the market opens the next day.

After-hours trading also offers the advantage of being able to examine stocks in depth even before the market closes. An earnings report may not be available until after hours trading. You might be able identify periods of consolidation. This means that you can sell shares at a higher price in the stock market than you would normally. You won't have the ability to execute your order though if there aren’t enough buyers or sellers. To limit your cash balance, you can use limit order.

No matter how you decide to trade after-hours, it is important to fully understand the risks. Investing in stocks is a time-sensitive endeavor, and it is important to be able to react to changes in the market. An inability to access liquidity after hours could result in your position being closed at a loss. Your limit order may be cancelled if you don’t have the funds to fulfill it by the deadline.

After hours trading does not allow you to lose more than the regular market. You might find it more difficult to get the price you want than in the regular market. Long-term traders may be willing settle for a lower price in order to close the position without incurring losses. But, short sellers might be unwilling to pay a price that is too high to close their position out.

Another risk is that fewer traders are trading during the after hours. While fewer buyers and sellers makes for greater volatility, this can also make it harder to get a price that suits your needs. Even if you find a good price, you can't be sure you'll be able to get it.

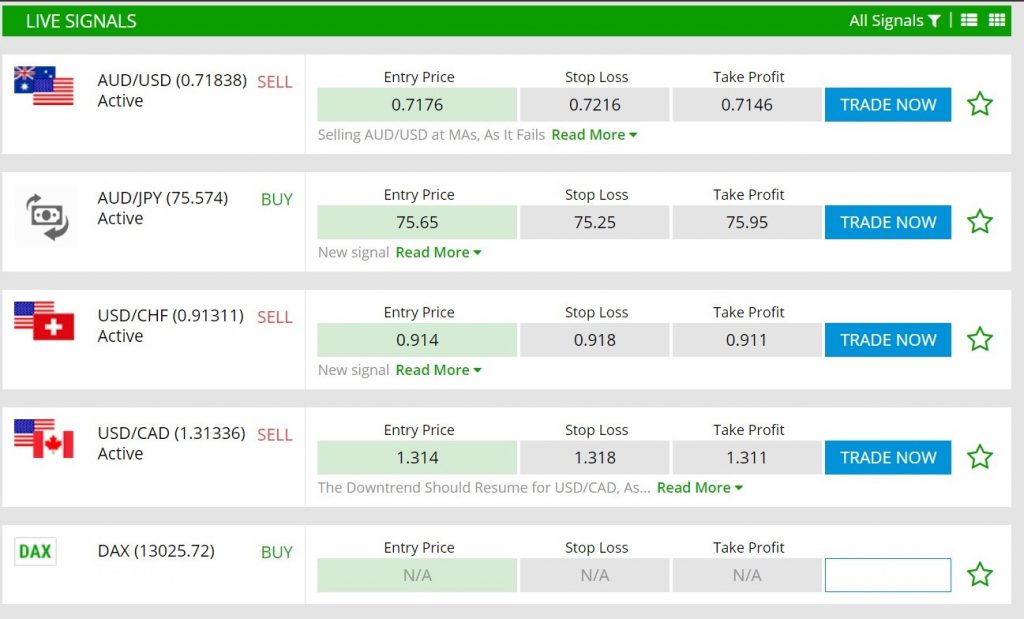

When trading in the after hours, you should keep a close eye on live graphs, news, and charting. This will allow you to identify breakouts and past performance. Stocks can move more strongly after earnings announcements. This means that you will see greater price fluctuations.

FAQ

What is the best forex trading system or crypto trading system?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. Diversification of assets and managing your risk will make trading easier.

It is important that you understand the different trading strategies available for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Where can i invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is investing in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Online trading is possible if you're comfortable with the risks.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which is more difficult forex or crypto currency?

Different levels of difficulty and complexity exist for forex and crypto. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex has been around since the beginning and has a solid trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Which trading platform is the best?

Many traders may find it challenging to choose the best trading platform. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down the search for the right platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

How Can I Invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You just need the right knowledge, tools, and resources to get started.

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. You may choose one option or another depending on your goals and risk appetite.

Next, find any additional information that may be necessary to make confident investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. Keep an eye on market developments and news to stay current with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

There are also potential gains if one is willing to risk their investment and do some research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protection starts with you. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Unsolicited email or phone calls should not be answered. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Lastly, always remember "Scammers will try anything to get your personal information". Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

Secure online investment platforms are also essential. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Secure Socket Layer is encryption technology that helps protect data sent over the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.