A futures exchange allows you to trade contracts for the future value of an asset such as oil, orange juice, or coffee. They can be used by investors as well as speculators to bet on fluctuations in the price for the underlying asset. These contracts are highly liquid and the market is active for them. They are used often for hedge purposes or to diversify portfolios.

It doesn't matter if your trading experience is advanced or not, you need to know what you're doing before you get started. You can do this by choosing a broker that provides a variety of educational resources and tools. Another way to do this is to choose a site where you can practice trading with paper money before you invest real dollars in the market.

Fidelity provides many educational tools that can help you understand futures trading basics. These tools include a mutual funding evaluator and an option to pair strategies. A hypothetical trading tool is also available, which can help you test an idea. You can also use a strategy evaluater to determine the best option strategy for your needs.

Etrade provides a wide variety of futures options to diversify portfolio. This includes a number of different currencies and commodities, as well as a large variety of equities and digital assets. You can trade futures via the etrade application on your smartphone!

Futures allow you to trade both short and long positions, which allows you to profit from price fluctuations in your preferred assets. Short-selling a stock means you are betting on the fall in the price of the underlying security. This can help you reduce volatility and your risk exposure.

These exchanges must be regulated. This helps ensure fair trades by participants and the integrity of the market. Clearinghouses can also be found on many exchanges, which ensure that futures contracts will always be honored.

There are many international exchanges, but all of them are managed by companies who specialize in this business. These companies must meet certain criteria.

Some of the most important aspects of a futures exchange are that they offer standardized trading, pricing information and clearing services. They offer incentives to their participants. These incentives are often based on trade volume and dollar value.

Futures trading may not be for everyone but it can provide access to many products. There are also a number of advantages to futures trading, including the ability to leverage your investments and control a relatively large contract amount with a small capital outlay. But it is also a volatile market so you need to be mindful of the risks.

FAQ

Is it possible to make a lot of money trading forex and cryptocurrencies?

Yes, you can get rich trading crypto and forex if you use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Trading with money you can afford is a good way to reduce your risk.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

What are the disadvantages and advantages of online investing?

The main advantage of online investing is convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

However, there are some drawbacks to online investing. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important to understand the different types of investments available when considering online investing. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment comes with its own risks. You should research all options before you decide on the right one. Some investments may also require a minimum investment or other restrictions.

Where can I invest and earn daily?

It can be a great method to make money but it's important you understand all your options. There are many options.

One option is investing in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Forex traders can make money

Yes, forex traders can earn money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Which trading website is best for beginners

Your level of experience with online trading will determine your ability to trade. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

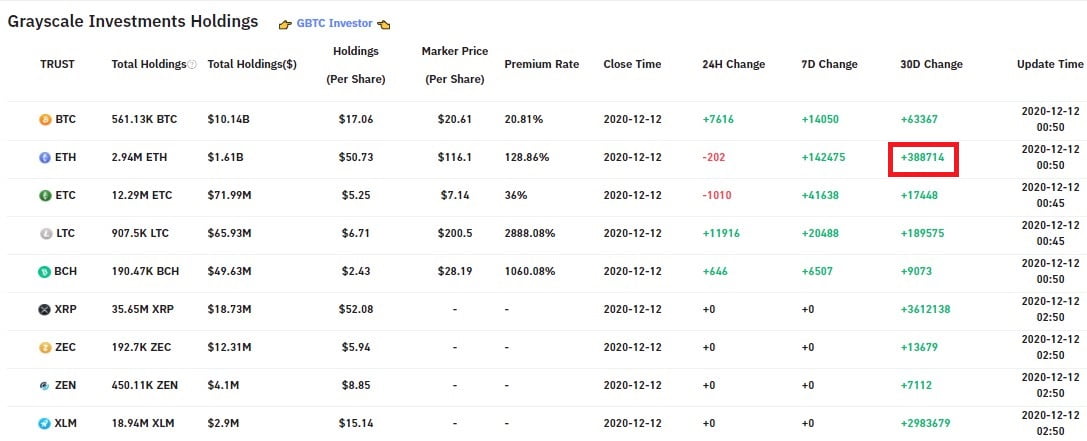

How do I invest in Bitcoin

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You just need the right knowledge, tools, and resources to get started.

It is important to realize that there are several ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Some options may be better suited than others depending on your risk tolerance and goals.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

The decision about where to store your money can be complicated. You have several options when it comes to protecting your valuable assets.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. However, electronic breaches can occur and there are potential risks when you use a digital option.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

You make the final decision.