Webull is not like other brokers who limit the hours you can trade. The extended trading hours policy allows you to trade during weekends, too. This can be done via the app or on the desktop platform.

This may sound like a great convenience, but it can make trading more volatile. The bid-ask spreads are therefore usually wider. This is one reason why Webull's rules concerning trading during this period are important.

You will need to create an account before you can start trading. Once you have chosen the type you want, you will be asked to create an account. Next, you will be asked to deposit some money. After that, you will receive a verification code. If you are having difficulty following the steps, please contact customer service.

Once you create an account, you can access real-time technical charts as well as candlestick charts, line charts and fundamental analyses. You can also get analyst recommendations as well as share earnings data. Sign up to an account and you'll get a stock for free.

For those looking to buy ETFs, stocks, or cryptocurrencies, Webull offers a wide variety of options. The account does not charge commissions on the purchase or trade of these securities. You can also trade your own crypto investments with a Webull bank account. You can also withdraw your funds. To withdraw funds via domestic wire transfer, you will be charged $25

You can trade during normal market hours using the same account that you used to deposit funds. All orders must be limited. Limit orders are the best protection for investments because of the volatility that can occur during these hours.

Webull's mobile and desktop trading platforms give traders the ability to trade after hours. You can access your account from full screen mode using the desktop platform. The chart settings window will allow you to trade after-hours.

Webull's many features make it easy to see why so much people have opened accounts with us. The brokerage's interface is extremely simple and is ideal for intermediate to experienced investors. For beginners, however, the lack of customer service might pose a problem.

Customers have also reported long delays in getting answers via e-mail. Some complain that it is hard to get a reply to more complex queries. Other customers complained about slow customer service. Webull claims that they offer a 24-7 customer support.

Webull does not require a minimum deposit. You can choose to open an account with a credit card, debit card, or personal bank account. You will need to verify your identity, provide a copy or your driver's license and present a copy.

FAQ

How can I invest bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. To get started, you only need to have the right knowledge and tools.

There are many options for investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, research any additional information you may need to feel confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which is safe crypto or forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Do forex traders make money?

Forex traders can make a lot of money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Frequently Asked Question

What are the 4 types of investing?

Investing can help you grow your wealth and make money long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into preferred and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Which forex trading platform or crypto trading platform is the best?

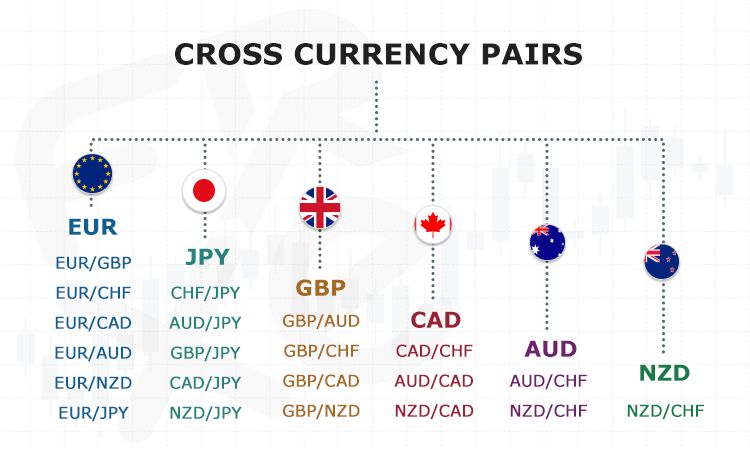

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases it's crucial to do your research before making any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important to know the types of trading strategies you can use for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it's important to understand both the risks and the benefits.

Where can I find ways to earn daily, and invest?

Although investing can be a great investment, it's important that you know your options. There are many options.

One option is to buy real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

When investing online, research is essential. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Before you open an account, check what fees and commissions might be taxed. Conduct due diligence checks to make sure that you're receiving what you paid for. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!