The best Forex traders are known for their skill in identifying the most lucrative opportunities in the market and implementing their strategies accordingly. This can be done with a variety of methods, from technical analysis to simply relying on your own intuition. However, all successful Forex traders share certain common traits.

George Soros, one of the greatest forex traders ever, is an example. In 1992, he was successful in short selling the British pounds and made $1 billion. His success is due to his risk management and compounding skills, among other methods.

Paul Tudor Jones is another trader that deserves to be included in the list of Forex traders. This legendary investor is a commodities broker who began trading cotton futures at the New York Cotton Exchange when he was just 18. He fell asleep at his desk and was eventually fired.

Paul Tudor Jones was a successful futures trader and also founded Tudor Investment Corporation. This company trades a wide range of assets. He was one of history's most successful investors.

He also developed Renaissance Technologies, a money management fund. The company employs people with diverse backgrounds to implement its algorithms. It was created to help investors invest in the markets by using a variety of online tools.

Andrew Krieger is another popular name in forex trading. Although he has left his mark in the industry, he is perhaps best known for his ability to take advantage of the strong dollar during the Reagan administration.

Andrew Krieger, despite his humble beginnings, quickly rose up the corporate ladder and became a millionaire within ten years. In 1987, he placed a bet against New Zealand dollars. The gamble paid off handsomely.

Similar to Bill Lipschutz, he started trading in his spare-time with little inheritance and lots of hard work. He currently ranks as the second best forex trader worldwide. He claimed that he held a position worth nearly $300 million in Deutsch marks during his career.

Forex traders who are the best are those who can minimize losses and maximize profits. This requires patience. It is important to recognize when you are making impulsive trades and how to avoid them. You can earn decent returns on your investment by creating and following a trading strategy that suits you.

You should familiarize yourself with these five top forex traders if you haven’t already. They all have successfully managed risk and took advantage of numerous opportunities to make their fortunes. It is important to remember, however, that Forex traders who are the best have not always been the most wealthy. Even the largest names in the industry needed to learn to get to this point. One or two mistakes can quickly land you in deep financial trouble.

FAQ

Which is harder crypto or forex?

Different levels of difficulty and complexity exist for forex and crypto. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex is a well-established currency with a stable trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

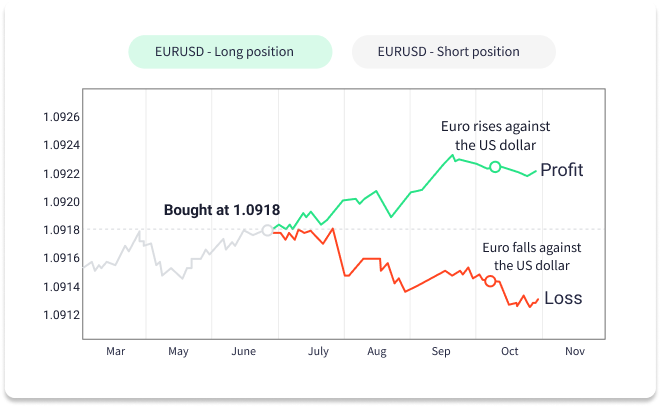

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Forex and crypto both require keen research skills and attention to ensure successful trades.

How Can I Invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. To get started, you only need to have the right knowledge and tools.

You need to be aware that there are many investment options. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. You may choose one option or another depending on your goals and risk appetite.

Next, find any additional information that may be necessary to make confident investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

What are the advantages and disadvantages of online investing?

Online investing has one major advantage: convenience. You can manage your investments online, from anywhere you have an internet connection. Online trading is a great way to get real-time market data. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing is not without its challenges. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important for online investors to be aware of all the investment options. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Where can you invest and make daily income?

Investing can be a great way to make some money, but it's important to know what your options are. You don't have to put your entire savings into the stock market - there are plenty of other options.

You can also invest in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Frequently Asked Questions

Which are the 4 types that you should invest in?

Investing can help you grow your wealth and make money long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Can forex traders make any money?

Yes, forex traders are able to make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading is not an easy task, but it can be done with the right knowledge. It is crucial to find an educated mentor before you take on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protection starts with yourself. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Don't respond to unsolicited calls or emails. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Never forget that scammers will try any means to steal your personal data. You can protect yourself against identity theft by paying attention to suspicious links and phishing emails, as well as the many types of online phishing schemes.

It is also important that you use secure online investment platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.