American hedge fund manager Timothy Sykes is also an investor. His fortune was made trading penny stocks, which he then managed to make a fortune. He is also a philanthropist and has built a charity that provides education to underprivileged children around the world.

Tim Sykes was one of the most prominent short-biased hedge fund managers in the world during his golden years. His hedge fund was ranked number one for a few years, until it suffered a significant loss. The fund was still up by a few points even after the loss. Despite the setback, Sykes did write an autobiography, "An American Hedge Fund," which details his career.

Timothy Sykes is a well-known financial journalist who has been featured by many financial media outlets. Larry King has interviewed him. Apart from his outstanding career, he is also a philanthropic entrepreneur. He donates over a billion dollars to Pencils of Promise which provides school supplies to children living in poor countries.

During his time in the business, Sykes has been known to criticize certain businesses and celebrities. For instance, he has been a vocal opponent of so-called "pump and dump" schemes, where an investor buys a stock for a higher price and then sells it for a lower price.

His other accomplishments include donating more than a half a billion dollars to Pencils of Promise as well as his charity the Timothy Sykes Foundation. The foundation's primary goal is to educate underprivileged children. The foundation has constructed more than 1000 schools across the world using the funds it raises.

If you are interested in learning how to become a trader, a program by Timothy Sykes is worth considering. While he doesn't offer direct mentoring, Sykes does provide many educational resources to assist you. You can access a vast video library or stock alerts right away.

The best part about these services is that they are geared towards beginners. They are easy and straightforward to use. The real-time notifications can alert you to important developments such as when to enter or exit a position. They are useful for both newbies and more experienced traders.

Tim Sykes' teaching style has a lively, engaging quality. He knows how to explain the basics of trading to his students. Unlike many of his competitors, he is not afraid to let his students know his own personal take on the topic.

It is also a plus to see his transparency about his own performance. His famous "Millionaire Challenge" program is a good example. It requires students to trade with a set amount of capital and participate in multiple live webinars throughout the week. Although not everyone will reach the same level as him, it does have its benefits.

Tim's market alerts are a great way for you to keep an eye on what's going down in the market. Although they aren't as active than other chat rooms, they serve a useful purpose. It is important to plan when you will make an exit and enter.

FAQ

Which is more difficult, forex or crypto?

Forex and crypto both have unique levels of complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex is a well-established currency with a stable trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Is Cryptocurrency Good for Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

You can also make a profit if your risk is taken and you do your research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Frequently Asked questions

What are the 4 types?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

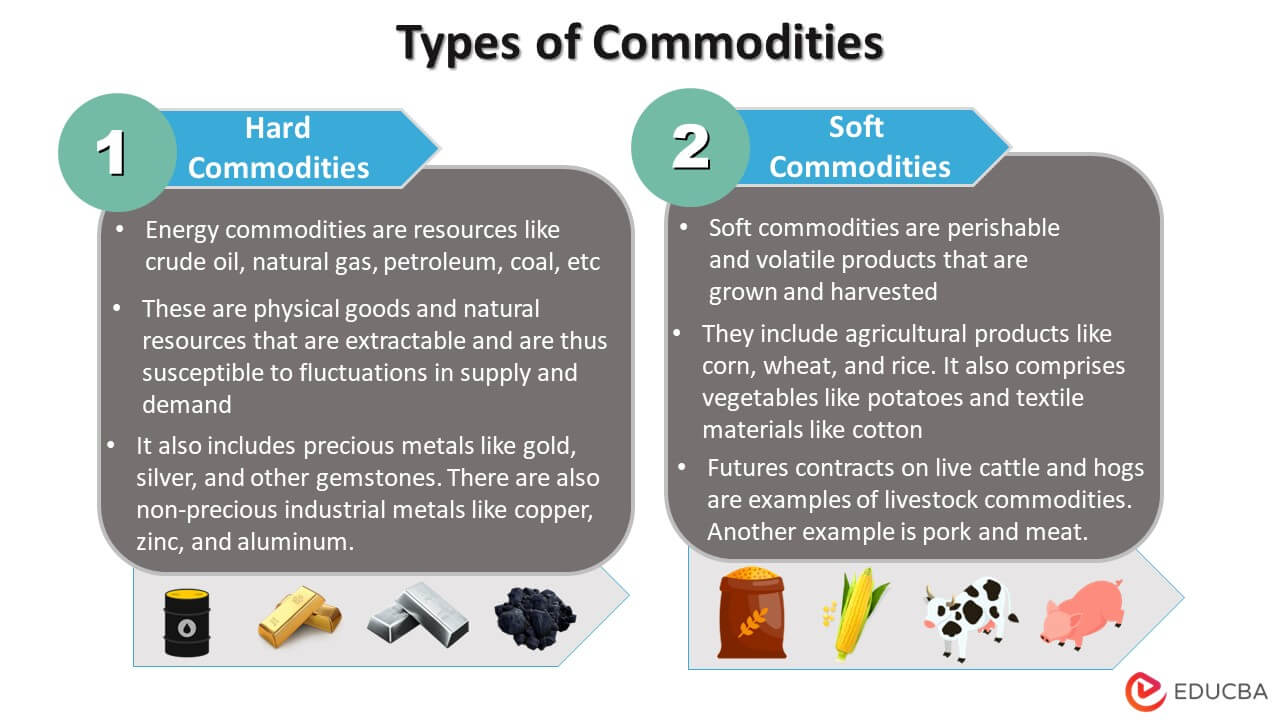

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Which forex trading platform or crypto trading platform is the best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. Any type of trading can be managed by diversifying your assets.

It is important that you understand the different trading strategies available for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Is it possible to make a lot of money trading forex and cryptocurrencies?

You can make a fortune trading forex and crypto if you take a strategic approach. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Where can I earn daily and invest my money?

It can be a great method to make money but it's important you understand all your options. There are many other investment options available.

One option is investing in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I verify the legitimacy of an online investment opportunity?

Online investing requires research. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Before you open an account, check what fees and commissions might be taxed. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.