The rise in popularity of non-fungible tokens (NFTs) has had a major impact on the digital art and technology world. They are a type fungible crypto coin that is used for purchasing digital assets such as gaming items and digital artwork. NFTs, unlike fungible coins, are not interchangeable. Instead, they have a unique identifier. This helps ensure that the digital item is tradable and collectible. This also allows the artist the right to keep the original artwork.

The NFT has changed the way we use blockchain technology. Artists can now make money through a curated platform. These platforms are restricted to authorized artists and allow them to mint and trade digital art tokens. Many artists are now jumping on board the NFT train. Others question its security.

In addition to allowing artists to monetize their work, NFTs also create a sense of scarcity in the digital world. The asset's value is increased when there is scarcity. An example: If there is just one copy, the piece of work of art is worth more that if there are many copies. Also, if there are limited editions, that can add to the price of the NFT.

NFTs exist for a while but their popularity is rapidly increasing in the art- and gaming industries. There are many NFT trading platforms online. SuperRare (Rarible), and OpenSea (among others) are some of the most popular.

While some are skeptical of NFTs' legitimacy and validity, many artists are positive. The technology could transform the art industry, according to them. NFT could be a catalyst for a new era in art.

NFTs offer transparency to collectors. Collectors can purchase art pieces and verify their authenticity via the blockchain. That means that the artist will get paid after every sale.

Digital art has existed for many years but is undervalued. Artists are tired and frustrated at the lackluster return on their art. NFTs might be a new way to help artists grow.

Another unique NFT platform is MusicArt. Music industry executives founded the company. They wanted to create a space where musicians could sell their music and exchange digital arts. Once MusicArt goes live, it will accept various types of cryptocurrencies and provide instant royalties on resales.

NFTs make it impossible to exchange fungible tokens and allow for each item to be copied. Additionally, artwork must be approved by an independent process.

Start by looking for a trustworthy platform that sells digital art. Many artists have turned to NFTs to find an audience who is willing to invest their unique work. However, you'll also need your crypto wallet.

MetaMask is one of the best. This Chrome extension allows for you to buy or keep cryptocurrencies on your smartphone or computer. You can also purchase or hold BUSD, the Binance currency.

FAQ

Which trading website is best for beginners

All depends on your comfort level with online trades. You can start by going through an experienced broker with advisors if this is your first time.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

You can also trade independently if your knowledge is good enough. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which is harder crypto or forex?

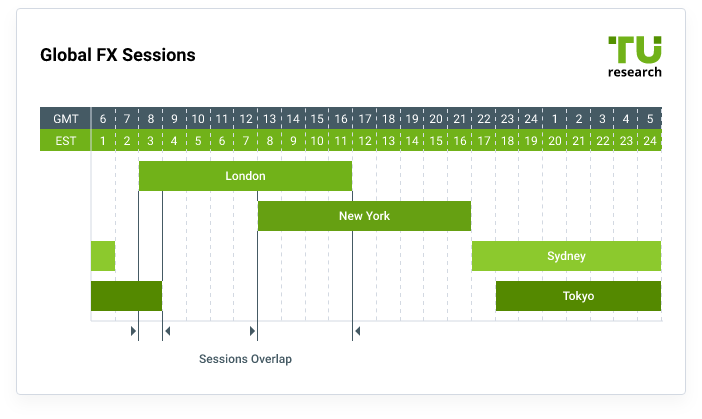

Each currency and crypto are different in their difficulty and complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

How can I invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You only need the right information and tools to get started.

First, you need to know that there are many ways to invest. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, find any additional information that may be necessary to make confident investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. Keep an eye on market developments and news to stay current with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Is Cryptocurrency a Good Investing Option?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Where can you invest and make daily income?

While investing can be a great way of making money, it is important to understand your options. There are many options.

Real estate is another option. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which is more safe, crypto or forex

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What are the best options for storing my investment assets online?

Money can be complex but so can the decisions about how to store it. Your valuable assets require a strong security system and you have a few options.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

You might also consider looking into specialist investment firms that provide secure custody services, specifically tailored to protect large asset portfolios.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.