The IG Group, an investment company, has two subsidiaries that offer CFDs and forex. While the company is most known for its trading, it also provides many research and information services to customers. IG offers a wide range of educational tools, courses, and seminars to complement its trading offerings. Its UK headquarters is a popular destination for traders, aspiring investor, and neophytes.

IG's offerings don't suit all. People looking to make a fortune in the stock market might want to consider other options. IG's US business division offers a wide variety of trading options to best suit investors. But, Ohio residents will not be able access the US division. IG has a competitive trading fee structure which encourages customers invest more. An account can be opened with a minimum deposit of $300 even if you are on a budget. IG operates an online trading platform in addition to its brick and mortar operations.

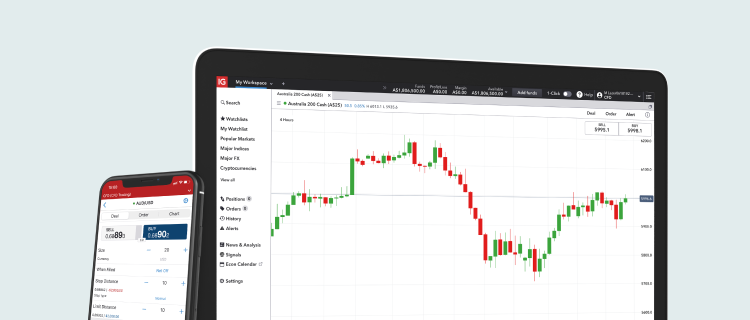

While it's not the only forex provider in town, IG's offerings are the most comprehensive. The IG application has a great selection of features, and the website offers a similarly impressive library of research and educational content for casual investors. You can count on reliable, round-the-clock customer support. IG's award-winning research team is able to uncover the market's most interesting data and trends. IG has its flaws, however. IG customers need to do their research before deciding on the right product for them. It's worth doing some research to save yourself a lot of trouble down the line. This is especially true for beginners. While IG's customer service may not be perfect, they do a good work of reassuring customers that their safety is assured.

FAQ

How do I invest in Bitcoin

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. To get started, you only need to have the right knowledge and tools.

The first thing to understand is that there are different ways of investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, gather any additional information to help you feel confident about your investment decision. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Which is more difficult forex or crypto currency?

Each currency and crypto are different in their difficulty and complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Which is more safe, crypto or forex

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which trading website is best for beginners

It all depends on how comfortable you are with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Can one get rich trading Cryptocurrencies or forex?

Trading forex and crypto can be lucrative if you are strategic. You need to be aware of the market trends so you can make the most of them.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Also, you should only trade with money that is within your means.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

What are the advantages and drawbacks to online investing?

Online investing is convenient. Online investing allows you to manage your investments anywhere with an internet connection. Online trading is a great way to get real-time market data. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing is not without its challenges. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important for online investors to be aware of all the investment options. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There might be restrictions or a minimum deposit required for certain investments.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What precautions can I take to avoid investment scams online?

Protect yourself. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Don't respond to unsolicited calls or emails. Fraudsters often use fake names, so never trust someone just based on their name alone. Before making any commitments, investigate all investment options thoroughly and independently.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Never forget that scammers will try any means to steal your personal data. Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

You should also use safe online investment platforms. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.