Options can be used to make a profit, protect your portfolio, or simply stay out of the market. Options are great for anyone looking to make a difference, protect their portfolios, or just stay out of market.

Option buyers typically buy options within a certain timeframe. Options are not like stocks, which can only be held for a shorter time before they expire. This gives you a better idea of how long your profits will be taxed, and you can use strategies like tax-loss harvesting to minimize or offset the amount you'll owe.

Options are a great way for beginners to trade because they offer higher returns than most investment options. They can also be very risky.

Understanding what an option is and its workings is the first step. The two main types of options are calls and puts. The call type is used to believe that a stock price will rise while the put type refers to when you think it might fall in value.

Options are derivatives. Their value depends on another asset. The premium you pay to buy an option is determined by the price of its underlying stock.

The other important thing to keep in mind is that the price of the option will increase as you approach its expiration date. This is known as "premium" and is calculated based both on the value and the price of the underlying securities, as well as other factors.

How to Purchase Options

When you're ready to start trading, make sure that you have the funds needed to cover your losses if something goes wrong. A reliable broker will be able to help you navigate this maze of options.

Buy Options are an effective method of hedge

You can hedge your portfolio by purchasing a protective put on stock you own. This is a great way of avoiding a large loss in the unlikely event that the stock's price drops suddenly.

However, you need to be aware of the risks involved in choosing options. You could lose all your money. It is important to work with a knowledgeable, experienced financial advisor to help you select the right options for your situation.

How to make money with options

By buying puts and calling at the same strike, you can make a profit. This strategy, also known as a synthetic trading, is a great way for investors to profit from volatility in the stock exchange.

This strategy can be won only if you know how to construct trades correctly. This includes knowing the strike price and how much money you will need to cover losses in the event that the underlying stock falls in value. It also means understanding the time frame for holding your position. Once you understand these fundamentals, you'll soon be able generate an income stream with options.

FAQ

How can I invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need is the right knowledge and tools to get started.

You need to be aware that there are many investment options. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Is Cryptocurrency Good for Investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Frequently Asked Questions

What are the 4 types?

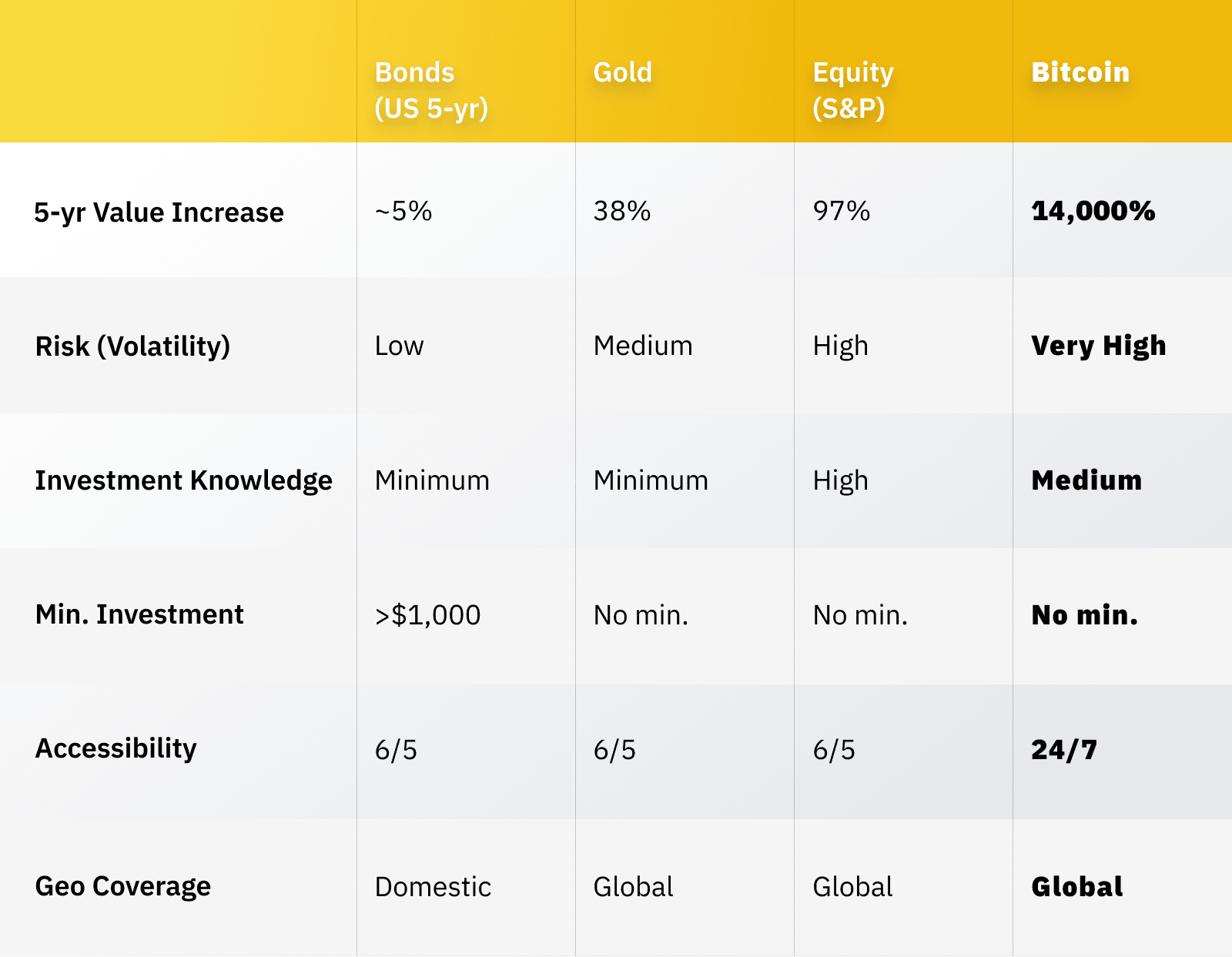

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be divided into preferred and common stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

What are the disadvantages and advantages of online investing?

Online investing is convenient. You can access your investments online from any location with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing is not without its challenges. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important for online investors to be aware of all the investment options. Investors have many choices: stocks, bonds or mutual funds. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There may be restrictions on investments such as minimum deposits or other requirements.

What is the best trading platform for you?

Many traders can find choosing the best trading platform difficult. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It must also be easy to use and intuitive.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down the search for the right platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Where can I earn daily and invest my money?

While investing can be a great way of making money, it is important to understand your options. There are many other investment options available.

You can also invest in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. Online trading is possible if you're comfortable with the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protection starts with yourself. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Never respond to unsolicited phone calls or emails. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Investigate investment opportunities thoroughly and independently, including researching the individual offering them before making any commitments.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Keep in mind that fraudsters will try everything to get your personal details. Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

It is also important that you use secure online investment platforms. Sites that are licensed by the Financial Conduct Authority and have a strong reputation should be considered. Secure Socket Layer is encryption technology that helps protect data sent over the internet. Before investing, you should read all the terms and condition of any site or app. You also need to understand any fees or other charges.