The number of online gambling stocks is on the rise over the last couple years. These stocks are poised to grow as more states pass legislation to legalize internet betting. They are also a great way to diversify your portfolio. It is crucial to do thorough research on the companies before you make an investment. Many factors can impact the stock's value.

Boyd Gaming is one of the most popular companies. These companies are well-positioned to benefit from the state-by-state laws. 89% of the market is controlled by the five largest operators in the United States.

DraftKings aims to be a bigger player in the online gambling market. It recently acquired Entain (a company that offers casino games) and is seeking to expand its online gambling operations. William Hill, a British-based online sportsbook operator, is another company that has been around for some time. You can make the most out of any stock by doing the right research.

While the cheapest companies to invest in are still MGM Resorts International, there are other companies to consider. Rush Street Interactive for example has seen a significant rise in revenue in the first half of 2022. This company is a great investment for long-term investors.

Flutter is another egaming company that's growing in popularity. Although it's not as big as MGM, it's a promising entrant into the online gambling market.

It's very risk-free to invest in any one stock. Do your research to get great returns. You can diversify your portfolio by investing in any of these online gambling stocks. You should only invest the right amount. A large bankroll can be leveraged to easily take control of your stake.

Some of the larger companies are starting to take notice of the online gaming market. MGM Resorts as well as Penn National Gaming are both big players in the online gambling market and plan to increase their offerings. MGM Resorts announced plans to launch online sportsbooks in several US states in 2021. William Hill, the smallest cap, has been providing online betting services internationally for many years.

It is easy to see why these companies have such great success. They are trading at a tremendous premium to their competition in terms of price-to–cash from operations ratio. Furthermore, they are enjoying the benefit of the coronavirus lockdown.

It's smart investment to make a purchase in a company which is launching a new product or service. A new company can disrupt the market and attract more customers by being innovative. Similar to traditional casinos, they can also be re-invented in order to become more lucrative.

Tribal gaming is a major problem for online gambling stocks. These casinos are often limited in their players and unable to make a large profit on table games. They can improve their brand awareness and drive more traffic to their websites by partnering with sports organizations.

FAQ

How Can I Invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need are the right tools and knowledge to get started.

The first thing to understand is that there are different ways of investing. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

How do forex traders make their money?

Forex traders can make good money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading is not an easy task, but it can be done with the right knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

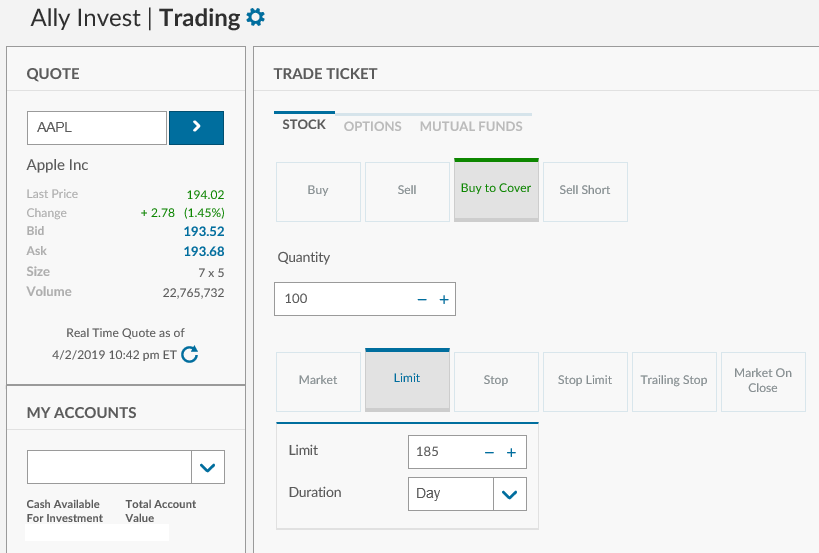

Which platform is the best for trading?

Many traders can find choosing the best trading platform difficult. It can be confusing to choose the right one, with so many options.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down the search for the right platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Which is harder crypto or forex?

Different levels of difficulty and complexity exist for forex and crypto. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Is Cryptocurrency a Good Investing Option?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I protect my financial and personal information when I invest online?

Security is essential when investing online. Protecting your financial and personal information online is essential.

Start by being mindful of who you're dealing with on any investment app or platform. Be sure to choose a reputable company with good ratings and customer reviews. Before you transfer funds to them or give out personal information, do your research.

For all accounts, use strong passwords with two-factor authentication. You should also regularly test for viruses. To ensure your account security, disable auto-login on all devices. Do not click links from unknown senders. Never download attachments from emails. Double-check the website's security certificate prior to entering sensitive information on a website form.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. You should keep track of any account changes that could alert an identity theftist such as account closure notifications and unexpected emails asking for additional information. You should also use different passwords to protect each account from being compromised. Last but not least, make sure to use VPNs when investing online. They're often free and easy!