NFT art can be purchased on a variety of online marketplaces. This digital collectible can be traded for many cryptocurrencies. These cryptocurrencies can be used for gaming, investment, or simply as a way of buying a piece of art. NFTs are different from regular digital collectibles in that they use a non-fungible token to create a permissionless, distributed environment.

NFTs have become a growing trend in the world of digital art. More than twenty reliable platforms are available to sell NFT art. Among the most popular are SuperRare, OpenSea, and Rarible. These platforms are open to both sellers and buyers of digital art. They also support artists selling their artworks.

Each platform has their own way of creating smart contracts. Smart contracts allow you to generate payments transparently and reliably. A seller will receive a portion of the item's value through these contracts. An artist might be able to select a particular pricing model, depending on what type of artwork they are selling. There are many options: auction, fixed-price, auction with an unlimited bidding period, and auction with no limit.

OpenSea has a lot to offer in the way of NFT art markets. OpenSea not only offers an auction but also provides digital support for artists looking to sell artworks. Once users create a profile they can choose the best approach to selling their artworks. You can even make your own NFTs.

Rarible is another good NFT art marketplace. The user can pick from many different types of NFTs, and then find new pieces to enhance their collection. To do so, they need to sign up for the service. They can then use their account to purchase or sell NFT after they have registered for free. People who wish to purchase will be able select from more than 50 cryptocurrencies. This will help them access the best NFTs.

SuperRare, another NFT exchange, is also a good option. The website is home to over 16K members who are interested selling and buying non-fungible tokens. The platform offers paintings for sale, as well as a social network to artists and collectors.

With a little bit of effort and time, an artist can earn a decent income by selling their NFTs. Selling NFTs can be expensive. Fortunately, the majority of these fees can be avoided. Rarible, for example, charges $30 to $100 each time a new NFT item is added. The fee will be refunded if the artist sells a larger collection.

There are thousands of artists looking to know how to trade NFTs. There are many platforms where you can sell your artwork. It's important that you choose the right one. An artist should also be aware of the fees involved with selling their artwork on a platform.

The first step to selling NFTs involves choosing the right blockchain. Depending on the preferences of the artist, they can choose a platform that supports Ethereum, VirgoCX or Metamask. Many of these platforms offer many payment options, including bank debit cards, wire transfers, credit cards and wire transfer.

FAQ

Which trading site is best suited for beginners?

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many offer interactive tools to help you understand how trades work.

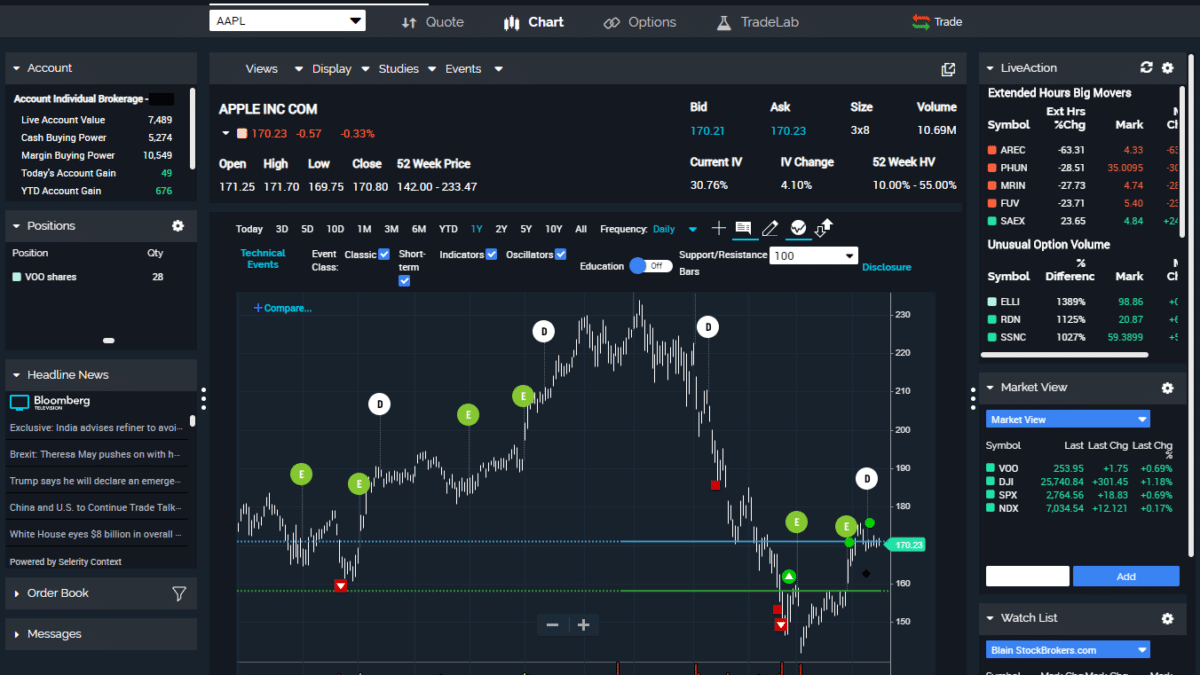

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

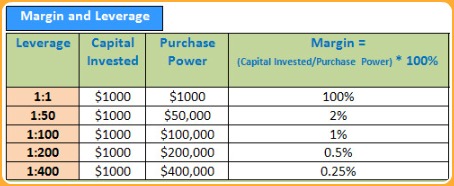

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Cryptocurrency: Is it a good investment?

It's complicated. It is complicated. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which forex trading platform or crypto trading platform is the best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading is easier than investing in foreign currencies upfront.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

It is important to research both sides of the coin before you make any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to be familiar with the various types of trading strategies that are available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it's important to understand both the risks and the benefits.

Most Frequently Asked Questions

Which are the 4 types that you should invest in?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be broken down into common stock or preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

How can I invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You only need the right information and tools to get started.

It is important to realize that there are several ways to invest. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, you should research any additional information necessary to feel confident in your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. Keep an eye on market developments and news to stay current with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can my online account be secured?

Online investment accounts should be safe. It is vital to secure your assets and data against any unwelcome intrusions.

First, make sure that your platform is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. A policy should outline how personal information shared with them will be managed and monitored.

It is also important to choose strong passwords that allow you to access your account. You should limit the number and time spent logging in to public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. Check your account activities regularly to be alert of any unusual activity.

Third, you need to know the terms of your online investment platform. Be aware of the fees involved in investing and any restrictions on how you may use your account.

Fourth, make sure you do thorough research about the company before investing. You can read user reviews and ratings about the platform to see how it works and what users have said about it. Finally, you should be aware of tax implications for investing online.

By following these steps, you can ensure that your online investment account is secure and protected from any potential threats.