The crypto industry is growing rapidly, and investors are looking for the next Coinbase. MoonPay is among many startups looking for venture capital. It's a global, B2B company that helps dozens of exchanges and wallets process transactions on all major crypto networks.

The company is funded by celebrity investors. It is focused on DeFi (NFTs), Web3 (Web3) and the metaverse. Its platform is available across 160 countries. Celebrities, companies, as well as organizations, can use it to make purchases.

Safemoon Investment

It is risky to make your first crypto investments. You'll avoid making errors and you won't be a victim to scams.

MoonPay makes it simple and secure to purchase cryptocurrency. MoonPay uses AES256 block-level encryption and a bug bounty program in order to protect customers' keys and data against hacks and identity theft.

You can purchase cryptocurrency with your debit or credit cards, or you may deposit cash to your account. Some credit cards might not work with crypto purchases. You should also check with your bank to ensure that you can withdraw your crypto balances without issue.

Selling cryptocurrencies with MoonPay is also simple. It is easy to enter the amount of crypto you are selling and the currency you would like to exchange it for. You can then select from a list of payment methods that includes bank accounts in the UK, EU, and USA. The selling process takes about three to four days.

MoonPay is a trusted, easy-to-use solution for crypto payments worldwide. It's available in 160 countries, and it supports most major crypto currencies.

The company employs a security team that works closely with law enforcement in order to prevent money laundering. Support tickets can be used to help customers with problems.

MoonPay secured a Series A funding of $555million in November 2021. The company was the most high-valued, bootstrapped startup Series A. Its valuation was $3.4 billion, placing it among the most valuable start-ups in the space.

Founded in Miami, Florida, in 2016, MoonPay was created by CEO Ivan Soto-Wright and Chief Engineer Victor Fara. They were inspired in part by PayPal and digital payment systems.

Soto Wright said that they wanted to create a digital asset portal that is simple, quick, and reliable for all users. The platform currently serves more than 160 countries, with tens of million of users.

Its core products consist of a crypto on-ramp and off ramp for dozens if exchanges, wallets or other partners. It also provides an NFT checkout tool for creators and NFT marketplaces.

Token burning must be controlled manually, according to the company. This is to make sure that tokens are not lost in circulation. The token displays a public burn tracker on its homepage to inform the community of what's happening with the token supply and burn rate.

FAQ

Which trading site for beginners is the best?

It all depends on how comfortable you are with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers provide interactive tools to show you how trades function without risking any money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

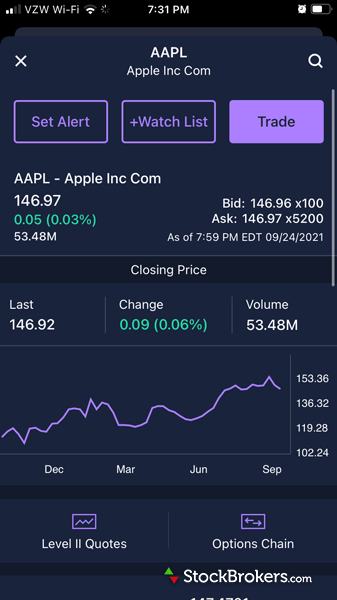

Which platform is the best for trading?

Many traders may find it challenging to choose the best trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Try out demo accounts or free trials to see if you like the idea of using virtual money.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This will help you narrow your search for the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Frequently Asked Question

Which are the 4 types that you should invest in?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two types of stock: preferred stock and common stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Trading forex or Cryptocurrencies can make you rich.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You need to be aware of the market trends so you can make the most of them.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Trading with money you can afford is a good way to reduce your risk.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Is Cryptocurrency an Investment Worth It?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Which is best forex trading or crypto trading?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

However, crypto trading can offer a very immediate return due to the volatility of prices. Also, crypto trades can be cashed out quickly due to their liquidity.

In both cases it's crucial to do your research before making any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to know the types of trading strategies you can use for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it's important to understand both the risks and the benefits.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protection begins with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Do not answer unsolicited emails and phone calls. Fake names are often used by fraudsters. Never trust anyone based solely on their name. Before making any commitments, thoroughly research investment opportunities independently.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Lastly, always remember "Scammers will try anything to get your personal information". Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

Also, it is important to invest online using secure platforms. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.