A virtual stock market is a virtual trading site that allows users the ability to execute hypothetical trades. It works in a similar way to an actual exchange but it is less expensive.

A virtual stock exchange is a great way to start. It is easy to buy and sell stocks. You may need to learn some things before you jump in.

Your level of investment experience is the first thing to think about. Some platforms are better suited for more experienced investors while others may be a good fit for beginners. You also need to consider your timeframe and risk tolerance. There are many different ways to invest. But how does it all work exactly?

Most virtual stock exchanges operate on a bid-ask system, in which the market maker (the seller) offers to buy and sell shares of the same company at the same price. A market maker might lose if the trend moves in one direction for an extended period of time. To avoid this, the marketmaker is willing to pay more for the stocks.

While trading stocks can seem like a snap, there is more to the process than meets the eye. Before you put your hard-earned money into a brokerage, it is important to check that both your financial plan as well as your brokerage are in sync. Research your broker's policies to make sure you don't violate any laws. Also, keep in mind that there may be times when you will need to wait for your orders to be processed.

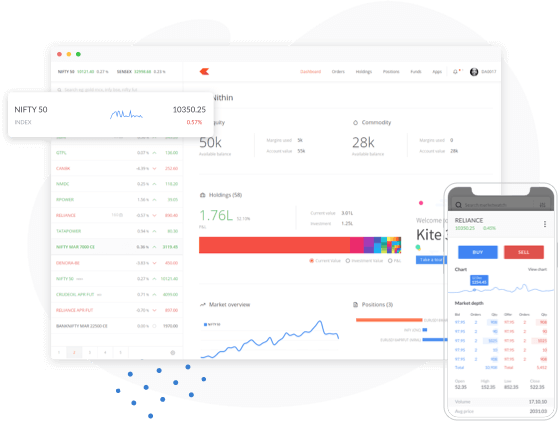

Investing in stocks is exciting and rewarding. But it can be difficult choosing the right stock. Look for a website that offers a wide selection of securities. Additionally, ensure you choose a platform that is user-friendly as well as has solid research and analysis tools.

Remember that stock markets can be of many types. You may have to be very selective in your selections. Learn about both technical and fundamental analysis. Stock analysis is essential for predicting future market trends.

You also need to examine the features available on the virtual stock trading platform. Depending on your needs, you might prefer to go with a full service platform or a site that specializes in just one or two securities. Stock trading sites, for example, might allow you to buy futures and stocks but charge you a broker commission or a commission per transaction.

Other important factors to consider are the stock selection, trading costs, as well as whether the site offers an online chat. While most platforms require a minimum deposit, others may require you to prove that you have trading experience.

An investing simulator might be a good option if time is a constraint. These virtual trading tools let you test your strategy and compete against other players. They're a great way of practicing your trading skills without taking any risk.

FAQ

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Can one get rich trading Cryptocurrencies or forex?

Trading forex and crypto can be lucrative if you are strategic. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Knowing how to spot price patterns can help you predict where the market will go. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which trading platform is the best?

For many traders, choosing the best platform to trade on can be difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. These factors will help you narrow down your search to find the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Forex traders can make money

Yes, forex traders can make money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which is more difficult forex or crypto currency?

Forex and crypto both have unique levels of complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex has been around since the beginning and has a solid trading infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Cryptocurrency: Is it a good investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

What are the best options for storing my investment assets online?

Money can be complex but so can the decisions about how to store it. There are many options to protect your valuable assets.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

Finally, you may consider looking into specialized investment firms that offer secure custody services specifically designed for protecting sizeable asset portfolios.

Ultimately the decision is yours--what works best for you and provides the security and safety necessary to protect your investments?