As blockchain technology becomes more mainstream, more companies are investing in it. Banks and other institutions use blockchain technology to improve efficiency. Startups can also benefit from the blockchain technology they developed.

There are many ways you can invest into blockchain. It depends on your investment schedule, risk tolerance, and what type of company you are looking for to invest in.

Buy crypto - Cryptocurrency is the easiest way to invest in the blockchain. By buying or selling a block worth of coins, your investment is made in the underlying cryptocurrency. It is important to understand the risks involved in this type of investment. There are many software bugs and scams that could lead to large losses.

Shares in blockchain stock - investing your money in shares of companies that use blockchain technology is a great way of getting exposure and increasing your chances of making a profit over the long term. Companies that create new uses for Blockchain and develop products and/or services to exploit it are the best ones to invest in.

You can purchase blockchain stocks through an exchange or through a broker. Before you decide to invest in a company, make sure you research its business model and potential for growth.

There are several types of blockchain stocks, ranging from early-stage venture capital firms to established businesses that have been using the technology for years. The best blockchain stocks have the greatest potential to succeed and have a track record of success.

ETFs (stock indices) - These funds allow you to gain exposure in a range of companies within the blockchain sector, often for a lower cost than buying individual stocks. For example, the Nasdaq-based Blockchain Economy Index gives you access to the best companies in the industry.

IPOs (or initial coin offerings) are a way to get into a company that isn’t yet publicly traded. These investments typically come with a lot public discussion. It can be a good opportunity to buy tokens that could eventually become part of your portfolio.

In the last few months, many exchange-traded money funds focused on the Blockchain sector were launched. This allows you to have an additional way to invest and diversify your portfolio in this fast-growing area. Amplify Transformational data sharing ETF is an example of such a fund.

There are many ways to invest, but exchange-traded mutual funds are likely to be the best. These funds are licensed and allow you to easily invest in the blockchain market without having to actually buy or sell cryptocurrency. They offer diversification and are a great way for people who are interested in investing in the blockchain market.

FAQ

Is Cryptocurrency an Investment Worth It?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

However, crypto trading can offer a very immediate return due to the volatility of prices. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both instances, it is crucial to do your research prior to making any investments. With any type or trading, it is important to manage your risk with proper diversification.

Understanding the various trading strategies for different types of trading is important. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before investing, it's important to understand both the risks and the benefits.

Which trading website is best for beginners

It all depends on how comfortable you are with online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

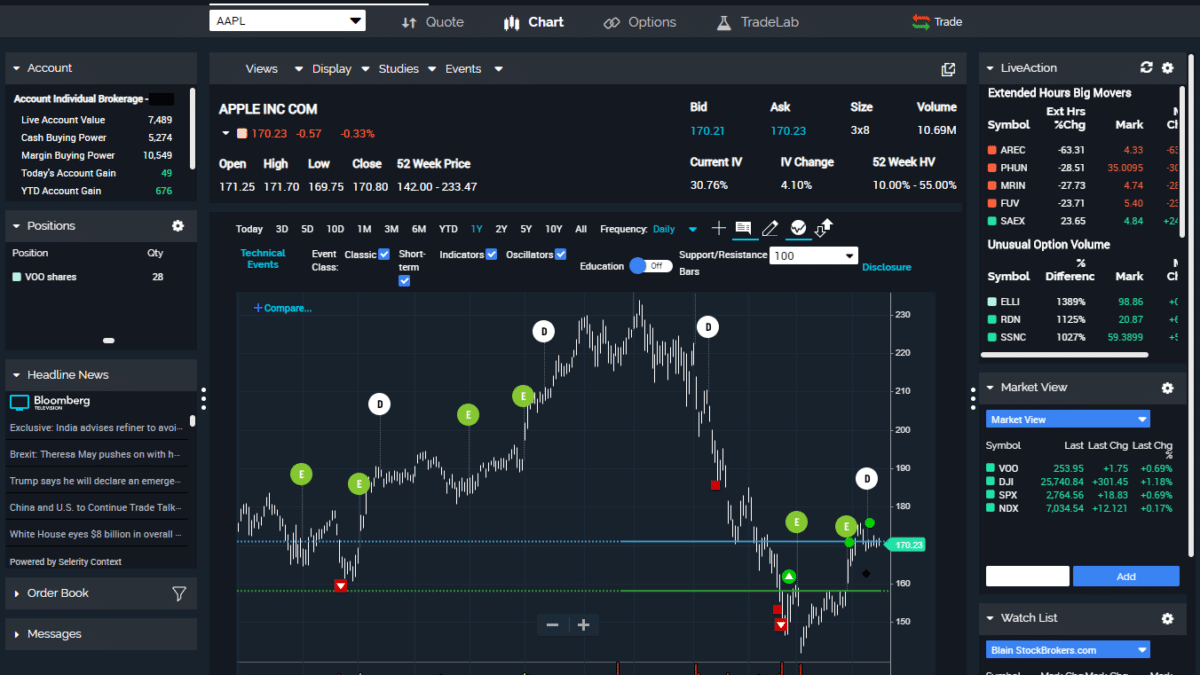

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Which platform is the best for trading?

Many traders can find choosing the best trading platform difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

How can I invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. To get started, you only need to have the right knowledge and tools.

You need to be aware that there are many investment options. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can I protect my personal and financial information when investing online?

Online investment is not without risk. Protecting your financial and personal information online is essential.

Be mindful of whom you are dealing with when using any investment app. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. Auto-login settings should be disabled on all your devices to make sure that your accounts are protected from unauthorized access. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

Make sure that only trustworthy people have access to your finances by deleting all bank applications from old devices when getting rid of them and changing passwords every few months if possible. Track any account changes that could alert an ID thief, such as account closing notifications or unexpected emails asking you for additional information. You should also use different passwords to protect each account from being compromised. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!