Futures Arbitrage is a strategy for trading that takes advantage of the difference between an asset's or security's current price and its futures contract. This gap can be referred to as the basis. Traders can profit from it to increase profits.

Cash and Carry Arbitrage

This is a method of futures arbitrage that involves the purchase of an asset or security in a spot market and the simultaneous sale of a futures agreement equivalent to the same asset. This strategy works if the futures price is lower than the spot price of the asset or security and the proceeds from the sale are enough to cover the cost of buying the underlying asset and holding it until the contract expires.

The investor will receive $108 to purchase the underlying. This amount is equal to the original purchase price and its carrying cost. The amount of the futures contract that he has sold will be the predetermined money he receives.

Contango Trading

Contango is when futures and spot prices for an asset converge. This is due in part to higher than expected demand, or disruptions in supply.

If, for example, the spot price for oil is $50/barrel, and the futures prices for June delivery are $60, that would indicate that the market has entered contango. As the expiration of the futures contracts nears, they will begin to move closer towards the spot oil price.

This can make it profitable for investors who either want to buy a commodity at higher prices than its spot price or are willing to pay more money in order to get the same amount of the asset in the near future. Traders in contango can make use of this by purchasing or selling futures contracts and then using the funds to purchase the underlying assets.

Spot Futures Arbitrage

This is a type arbitrage where you purchase or sell futures contracts that are linked to an underlying assets in order to get an immediate profit from the sale. Spot futures, unlike the other types in futures arbitrage can be traded privately by individuals at any moment.

Traders may also be able to make money buying futures contracts that are related to an investment. Then, they can short the futures contract. Although this is risky and not suitable for all investors it can offer a way to make money.

Arbitrage can be performed on various futures contracts like oil, corn, and/or gold. This is a popular way to invest in futures markets, without the need to commit to buying or selling a specific commodity at a given time. This allows investors to diversify their portfolios while taking on minimal risk.

FAQ

What are the pros and cons of investing online?

Online investing is convenient. Online investing allows you to manage your investments anywhere with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, online investing does have its downsides. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important for online investors to be aware of all the investment options. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Some investments may also require a minimum investment or other restrictions.

Which is harder crypto or forex?

Forex and crypto both have unique levels of complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

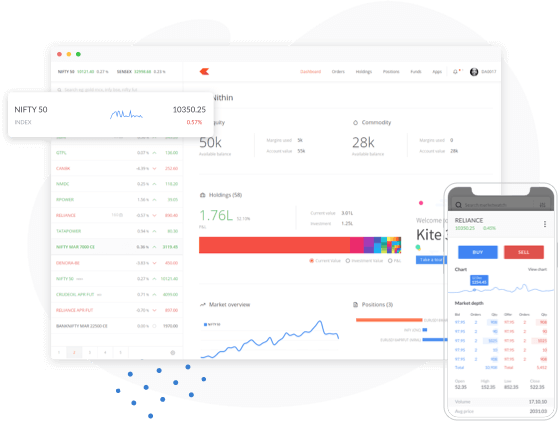

Which trading site is best for beginners?

It all depends upon your comfort level in online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers provide interactive tools to show you how trades function without risking any money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Is Cryptocurrency an Investment Worth It?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protection begins with you. You can prevent yourself from being duped by learning how to spot scams, and how fraudsters work.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Do not answer unsolicited emails and phone calls. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Keep in mind that fraudsters will try everything to get your personal details. Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

Secure online investment platforms are also essential. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.