Discord is an internet social networking service that gamers can use. It is similar with Slack, Telegram, and Telegram. The platform allows users to communicate through text chats and video streams as well as phone calls. It is private and users can't sell or buy stocks via it. Nonetheless, it has become increasingly popular in the last few years. It is now valued at $15 billion, according to the latest funding round.

Discord has helped many people find success. Some of these people are professionals. Some are professionals, while others are just novices who want to get a feel for the industry. They may be able capitalize on the community. They should be cautious.

Stock discords, which are becoming more popular, are a growing problem. There are currently hundreds of them. Although there are some that are legal, others offer illegal stock tips. This is particularly true for penny stocks or alt-cryptoos. These stocks are more susceptible to manipulation.

Several experts use Discord to give their clients financial advice. Some offer free access and others charge a fee. Many discord-based stock advice forums offer education resources and live trading sessions. Whether you choose a paid or free Discord, you should read the rules carefully before joining. Violations could lead to a ban or profile strike.

Wall Street Bets is a stock discord that is well-known. Wall Street Bets is a top trading Discord, although it's not educational. With over 500,000 members, you can expect to be a part of a friendly, knowledgeable community. You can join to enjoy a number of channels including a forum and hangout as well as a live trading room.

Luxury Equities are another stock Discord. Gavin Ross (the founder) is an ambitious entrepreneur. He plans to launch a website that will be available for investors. He currently spends his entire time working on it. He has also started to develop a mobile app for the platform.

Rags to Riches (R2R) is another popular stock discord. This community is close-knit and offers many experts to answer your questions. Since its launch in April, over 18,000 members have joined. It has seen a significant increase in trade volume since then. If you are interested, you can get a 50% discount on your first month by clicking the link below.

Another Discord trader, Jeremy McMillan was a well-known trader. After being a regular player on TikTok, he decided to move to the platform. He built a large following and started a massive stock discord. He was able turn TikTok users into a global community of traders by using the platform.

Ali Saghi is a great example of a stock discord. At the moment, there are more than 50.000 members. He is also preparing to launch a hedge money. Besides teaching the basics of stocks, he also provides a comprehensive financial literacy program. His passion for education is obvious. Even as a teenager Saghi has already been able to make six-figures from trading.

FAQ

Is Cryptocurrency Good for Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Most Frequently Asked Questions

What are the 4 types of investing?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be broken down into common stock or preferred stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

What are the advantages and drawbacks to online investing?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. Online trading is a great way to get real-time market data. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing has its limitations. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

You should also be aware of the different investment options available to you when investing online. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Can forex traders make any money?

Forex traders can make a lot of money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

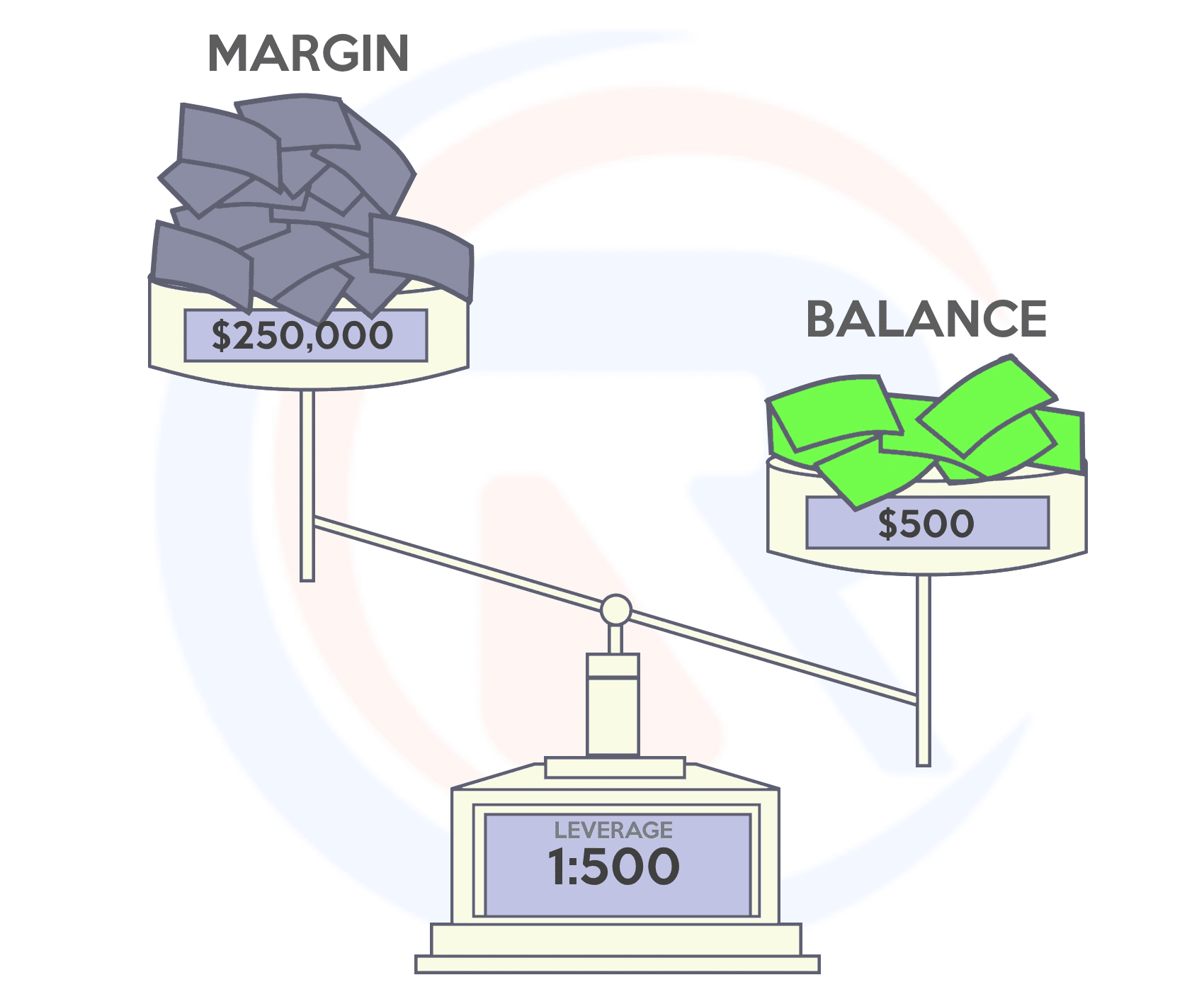

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Which trading site is best for beginners?

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

You can also trade independently if your knowledge is good enough. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

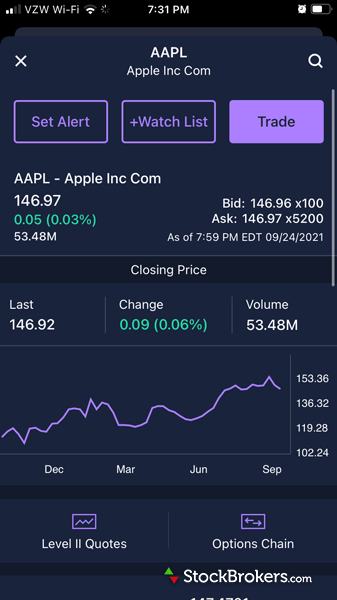

Which trading platform is best?

Many traders find it difficult to choose the right trading platform. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. These factors will help you narrow down your search to find the right trading platform.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can you protect your financial and personal information while investing online?

Security is essential when investing online. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

You must be mindful of who your investment platform or app is dealing with. Make sure you're working with a reputable company that has good customer reviews and ratings. Before you transfer funds to them or give out personal information, do your research.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. To ensure your account security, disable auto-login on all devices. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Track any account changes that could alert an ID thief, such as account closing notifications or unexpected emails asking you for additional information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. Last but not least, make sure to use VPNs when investing online. They're often free and easy!