Spreads options are an important component of any trading strategy, but they can get quite complicated. Before you decide to pursue a spread trade, it is important to evaluate how the option will fit into your overall investment strategy.

The spread of an option is the difference in strike prices between two options contracts. There are three main kinds of spreads: vertically, horizontally and diagonal.

Spread the Bull Call

Bull call spread is a simple strategy which allows you more money from option positions than by buying them outright. It involves buying a call options with a higher strike and selling one option with a lower price.

This spread offers you the opportunity to receive more premium for less outlay. Additionally, it reduces the likelihood that your underlying investment will decline in value. The strategy is not without its limitations. However, it requires that the underlying assets be expected to move in an appropriate direction.

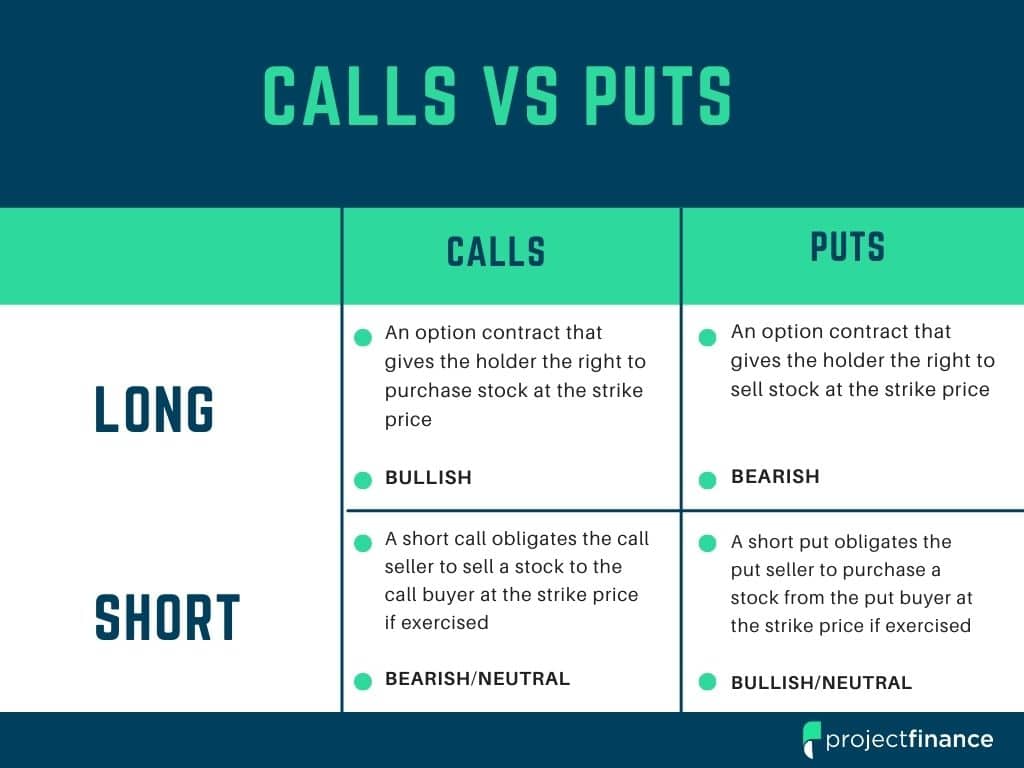

A bull call spread can be used to increase your profits, if the underlying asset is expected to rise in value over time. This strategy involves a long and short call with the same stock at a strike rate higher than the current market price.

Horizontal Spread

Horizontal spreads can be described as a variation of the calendar spread. It consists of selling and buying options at different points. This is done by using a different expiration month on each contract.

It is important to keep in mind that a horizontal spreading can be used in many different ways. If you are unsure, check with your broker.

A calendar spread can also be rolled to increase your profit. This means you can sell the front-month contracts and buy the back months.

You must place two orders to your broker in order to profit from this strategy. The first order will be to sell the front-month contract. The second will be to purchase the back-month contractual.

You must then decide whether the futures market will move in your favor. If the market moves in a negative direction, you may lose all of what you invested in the spread.

A bear call spread is similar to a bull call spread, but the underlying security will move in opposite direction from the original move. You will lose some money, but not as much as with a bull-call spread.

Remember that this spread is credit and the risk of loss cannot exceed the spread premium. The spread's width and the strike price difference will determine the maximum loss.

This strategy is good for traders who expect a decrease in security's value but don't want to risk the possibility that it will rise in price. It can be dangerous and beginners should not attempt it.

FAQ

What are the pros and cons of investing online?

Online investing has the main advantage of being convenient. Online investing allows you to manage your investments anywhere with an internet connection. Online trading is a great way to get real-time market data. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing comes with its own set of disadvantages. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

It is also important for online investors to be aware of all the investment options. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment comes with its own risks. You should research all options before you decide on the right one. There may be restrictions on investments such as minimum deposits or other requirements.

Which trading platform is the best?

Many traders can find choosing the best trading platform difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

How do I invest in Bitcoin

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You only need the right information and tools to get started.

You need to be aware that there are many investment options. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. You may choose one option or another depending on your goals and risk appetite.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

How do forex traders make their money?

Yes, forex traders are able to make money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Trading forex or Cryptocurrencies can make you rich.

You can make a fortune trading forex and crypto if you take a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Is Cryptocurrency Good for Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

Online investing requires research. Check out the company behind the opportunity and make sure they are registered with the appropriate financial authorities. Also, be aware of any restrictions or industry regulations that may apply to your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. Ask yourself if it's too good to be true and beware of claims that imply a guarantee of future results or substantial returns.

You should understand the investment risk profile and be familiar with the terms. Before you open an account, check what fees and commissions might be taxed. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.