Day trading futures is one way to profit the most from the markets. Although it may seem daunting for a beginner to day trading futures, you can easily master the techniques quickly.

Scalping is a popular option for day trading futures. It can help reduce your losses and increase your profits. This simple strategy allows you to maximize your profits and minimize the chance of losing any.

Using Spreads to Trade Futures

It's important that you consider the spread between the ask and bid prices when trading futures. This allows for you to maximize your profits, minimize losses, and avoids market volatility.

How to select the right broker

You need to choose a reliable broker before you trade. Before opening an account with them, you should read reviews and compare their ratings to other brokers on the market.

How to choose the right day trading strategy

Day trading futures is possible using many strategies. They can range from technical analysis and foundational analysis to position sizing or trend following. You need to decide which strategy is best for you, depending on your trading goals.

Automated Trading – This is one the most efficient day trading strategies. It is also a good way of saving time and preventing stress.

Charts and Patterns: By studying charts and patterns you can predict which direction price movements will take. This will allow you to decide whether to exit or enter a trade at the end.

News Alerts - News can impact futures prices, especially if they affect major industries. If a company announces significant development or earnings, it could have an impact on the market. You need to be aware of these developments in order to maximize your profits.

What to Expect From the Markets: Day traders can expect greater liquidity than individual stocks. This makes it easier for them enter and exit positions at the appropriate times. However, market volatility can make predictions difficult.

It's a good idea for newbies to begin trading futures. This will let you test the waters and determine if you are really interested before you invest any real money. You can always reach out to a professional if you have any questions.

FAQ

Are forex traders able to make a living?

Yes, forex traders can earn money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. It is crucial to find an educated mentor before you take on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which is harder forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

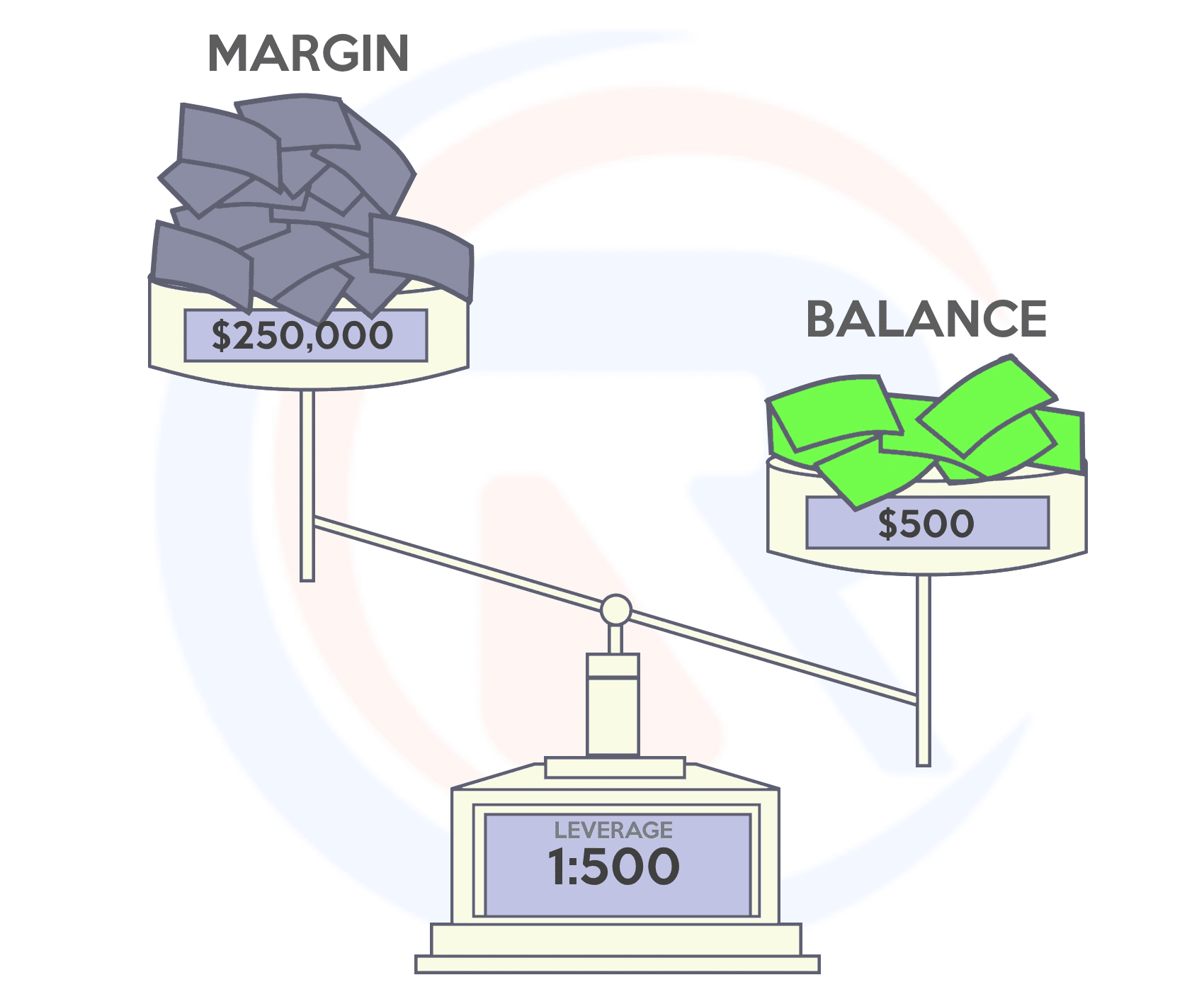

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Where can you invest and make daily income?

However, investing can be an excellent way to make money. It's important to know all of your options. There are many other investment options available.

Real estate is another option. Investing in property can provide steady returns with long-term appreciation and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you are comfortable with the risk, you can trade online using day trading strategies.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Frequently Asked Fragen

Which are the 4 types that you should invest in?

Investing is a way for you to grow your money and possibly make more long-term. There are four main types of investing: stocks, bonds and mutual funds.

There are two types of stock: preferred stock and common stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

How can I invest bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need is the right knowledge and tools to get started.

It is important to realize that there are several ways to invest. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, gather any additional information to help you feel confident about your investment decision. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. Keep an eye on market developments and news to stay current with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Which trading platform is the best?

For many traders, choosing the best platform to trade on can be difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Try out demo accounts or free trials to see if you like the idea of using virtual money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This will help you narrow your search for the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can I make sure my online investment account is secure?

Online investment accounts require security. It is crucial to safeguard your data and assets against unwelcome intrusions.

You want to ensure that the platform you use is secure. Look for encryption technology, two-factor authentication, and other security measures that will provide maximum protection against potential hackers or malicious actors. You should also have a policy that describes how your personal information will be monitored and controlled.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

Thirdly, it's important to understand the terms and conditions of your online investment platform. You must be familiar with the fees associated to investing as well any restrictions or limitations that may apply to how you use your account.

Fourth, do your research on the company you're considering investing with. Make sure they have a solid track record in customer service. Check out user reviews and ratings to get an idea of how the platform works and what other users have experienced. Finally, make sure you are aware of any tax implications associated with investing online.

These steps will help you ensure that your online investments account is safe and secure from any possible threats.