Commodity trading involves buying and selling assets such as oil, silver, gold, copper and wheat. These commodities are consumed by a large number of people every day. It is important for traders to be able to understand and choose the right broker for each market.

A reputable organization should regulate any commodity broker you choose. This means that it must adhere to KYC (Know Your Customer). It is a good idea for a broker to offer easy-to-use trading tools. It is also important to ensure that the broker offers support during trading hours.

Many brokers offer different account types. It is important to choose the one that suits you best. They should also be able to provide you with a demo account to practice trading. Many will offer demo accounts for trading fake money.

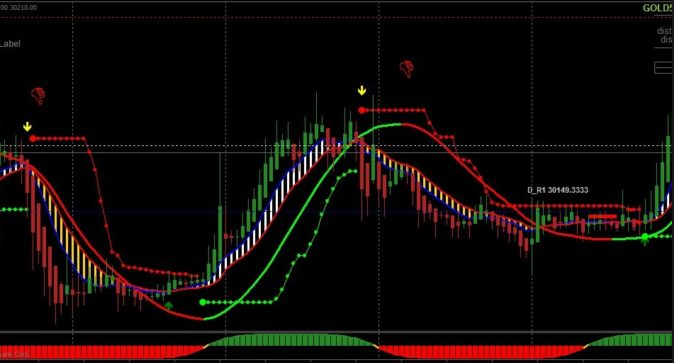

TradeStation has a reputation for being a highly respected commodity broker. It offers a powerful trading platform, a wide variety of futures contracts, and educational resources. They also offer market data free of charge, an innovative charting system, sentiment indicators, and market data. They are known for their advanced order management and order execution.

E*TRADE, on the other hand, is best known for their low commissions and intuitive platform. They also offer a number of other useful features, such as copy trading, which allows you to automatically copy the trades of professional traders. You can also access a wide network of traders to help you get more information about the market.

Another popular broker is Interactive Brokers. They offer futures options and options on commodities for a wide variety of metals, agricultural and energy commodities. You can use the platform from anywhere and you can access it through your mobile phone. Their platform also has more than thirty market locations, making it possible for traders to trade anywhere and anytime.

XM is another highly-respected commodity broker. They provide traders with a wide variety of commodity CFDs and have some of the cheapest spreads in the industry. You can also trade from your mobile device with their fully functional mobile applications.

eToro is an excellent choice for beginners. It offers an easy-to-use, beginner-friendly platform and has a robust social network. Traders have the option to copy trades made by other users, or to use the built-in tools that help them gauge the mood in the markets. They also accept checks deposits and credit/debit payments, NETELLER, PayPal and Skrill.

Many commodity brokers offer a comprehensive trading platform. It allows you place your orders and keep track of your investment's progress. It is important to make sure the platform you choose offers excellent customer support. You could miss out on important trades if you don't. Also, keep in mind that trading platforms often come with jargon that is unfamiliar to beginners. Be sure that you read the fine print before you sign up, so you don't accidentally end up with an account that doesn't suit your needs.

FAQ

Frequently Asked Question

What are the four types of investing?

Investing can help you grow your wealth and make money long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

There are two types of stock: preferred stock and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Which is better forex trading or crypto trading.

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases it's crucial to do your research before making any investment. Diversification of assets and managing your risk will make trading easier.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it's important to understand both the risks and the benefits.

How can I invest Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. All you need are the right tools and knowledge to get started.

You need to be aware that there are many investment options. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. You may choose one option or another depending on your goals and risk appetite.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Which is harder, forex or crypto.

Each currency and crypto are different in their difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Is it possible to make a lot of money trading forex and cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Knowing how to spot price patterns can help you predict where the market will go. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I ensure the security of my online investment account?

Online investment accounts should be safe. It's vital that you protect your data, assets and information from unwelcome intrusion.

You want to ensure that the platform you use is secure. Two-factor authentication and encryption technology are some of the best security options to protect against malicious hackers. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking on unknown links and downloading untested software. This can lead to malicious downloads, which could ultimately compromise your funds. Finally, review your account activities periodically so that you are aware of any changes or irregularities in order to detect potential threats quickly and take immediate action if necessary.

Third, you need to know the terms of your online investment platform. You need to be aware of all fees associated with investing as well as restrictions and limitations regarding how you can use the account.

Fourth, do your research on the company you're considering investing with. Make sure they have a solid track record in customer service. Check out user reviews and ratings to get an idea of how the platform works and what other users have experienced. You should also be aware of the tax implications when investing online.

Follow these steps to ensure your online account is protected from potential threats.