If you're looking for a way to earn more money, options trading could be the ideal solution. Options trading, a derivative contract, gives you the option to buy and sell an asset at a specified price on a date in future. Option trading allows you to choose to sell or buy an option. In exchange for this right, you will be charged a premium. There are many benefits to this type of investment, including leverage and the ability to profit from changes in the value of an asset. You should be aware that there are risks and you need to know what your options are before you commit.

Most options traders trade in stocks or bonds. But, some also work with forex and other commodities. They should be up-to-date on market trends and understand the dynamics of the market. A skilled options trader will keep a close eye on the markets and be able to respond quickly and flexibly.

Options traders work in companies or for hedge funds. They determine when and where to buy or sell assets and make their income. Options are a kind of derivative contract which can be traded for cash in open markets. Traders are responsible to monitor the market and make sure that clients are happy. Some options traders may manage portfolios for multiple clients.

Many brokers offer free commissions for traders who are willing to use their services. Many brokers online charge no commission for option and stock trading. Firstrade does not charge commissions for these transactions.

Your abilities and experience determine the amount of money that you can make trading options. The success of traders who focus on the market and not their profits is what makes them successful. Even if you are a novice trader, it is important to be willing to spend some time learning about the markets. Just be aware that you'll lose more than you earn.

The most common misconception about options is that they are risk-free. However, they can be extremely volatile and could result in significant losses. Despite this, they can complement stock trading. By using a leveraged approach, you can control large investments with a small amount of capital.

Depending upon the strategy you use, your earnings per trade can range from 20% to 50%. It doesn't matter if you use naked calls or naked put options, the key ingredient to success is the ability to correctly time markets. If you see a stock's value dropping, you might be able to buy a call option. This option allows you to purchase stock at a certain price before it hits that level. When the stock hits that point, you can then sell it for a profit.

Even though there is some risk involved with options, many trader veterans have made a nice income with this type. The key is focusing on the market and following your trading system.

FAQ

How can I invest in Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You just need the right knowledge, tools, and resources to get started.

There are many options for investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. You may choose one option or another depending on your goals and risk appetite.

The next step is to research additional information you might need in order to be confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. Keep an eye on market developments and news to stay current with crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Most Frequently Asked Questions

What are the 4 types of investing?

Investing can be a great way to build your finances and earn long-term income. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be broken down into common stock or preferred stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

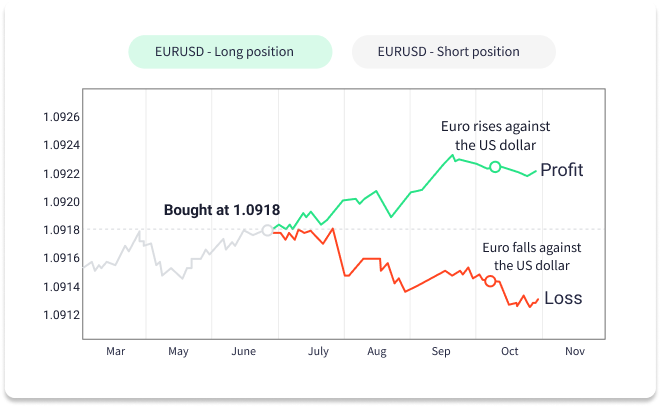

Are forex traders able to make a living?

Forex traders can make good money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

What are the pros and cons of investing online?

The main advantage of online investing is convenience. You can manage your investments online, from anywhere you have an internet connection. You can access real-time market data and make trades without having to leave your home or office. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing is not without its challenges. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important to understand the different types of investments available when considering online investing. Investors have many choices: stocks, bonds or mutual funds. Each investment comes with its own risks. You should research all options before you decide on the right one. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Where can I earn daily and invest my money?

It can be a great method to make money but it's important you understand all your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is to buy real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Diversifying your portfolio might be a good idea.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

Which is harder crypto or forex?

Both forex and crypto have their own levels of complexity and difficulty. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. A good understanding of technical indicators is essential to identify buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What are the best options for storing my investment assets online?

It is easy to lose your money, but it can also be difficult to decide where to keep it. You have several options when it comes to protecting your valuable assets.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. However, electronic breaches can occur and there are potential risks when you use a digital option.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

Other options include keeping your investments in traditional banking or investing accounts as well as self-storage facilities that allow you to safely store gold, silver, or other valuables outside of your home.

You might also consider looking into specialist investment firms that provide secure custody services, specifically tailored to protect large asset portfolios.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.